Equifax Canada

-

Missed credit payments higher among younger Canadians: reportAn Equifax Canada report says missed credit payments were higher among younger Canadians in the second quarter due to living costs and unemployment.ConsumerAug 27

-

Young Canadians more likely to have missed a bill payment this year: surveyEquifax Canada says young Canadians are more anxious about their personal debt and more likely to have missed a bill payment this year.CanadaOct 30, 2023

-

-

Advertisement

-

Businesses are increasing their credit usage. Why that’s a worrying trendEquifax Canada says new data suggests a major shift in credit usage among businesses in the first quarter of 2023, and that casts doubts on the stability of the Canadian economy.MoneyJun 20, 2023

![]()

-

-

Advertisement

-

Mortgage originations in Canada dipped in first quarter: reportEquifax Canada says credit demand was high in the first quarter of the year while the mortgage market saw a significant slowdown.MoneyJun 6, 2023

![]()

-

Credit card debt up 15% in Q4 with younger Canadians feeling pinch: EquifaxEquifax says Canadians' credit card debt increased by more than 15 per cent from the same period a year earlier and totalled more than $100 billion for the first time.EconomyMar 9, 2023

![]()

-

-

Canadian consumer debt climbs 7.3% to $2.36 trillion in third quarter: EquifaxEquifax Canada says an increase in borrowers helped push total consumer debt to $2.36 trillion in the third quarter, even as mortgage volumes decline.ConsumerDec 6, 2022

![]()

-

-

Canada’s housing market hotter than ever — and investors are playing a big roleThe share of home purchases by buyers who already have multiple mortgages is rising, data shows.MoneyDec 3, 2021

![]()

-

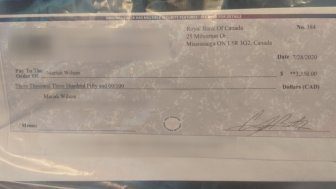

Overpayment scam making the rounds in Kelowna, RCMP warnFake cheques can be business or personal cheques, printed to look like legitimate cheques, stolen from a victim of identity fraud, or even a fake money order.CrimeOct 8, 2021

![]()

-

-

Advertisement

-

Canadian consumers are now carrying $2.1 trillion in debt, driven by mortgagesEquifax says the debt profile of Canadians has changed throughout the COVID-19 pandemic, with mortgages accounting for a larger portion of people's debt.ConsumerJun 8, 2021

![]()

-

-

Advertisement

-

Police say alleged identity thief tried to obtain credit from jewelry stores in Oakville, BurlingtonInvestigators say the woman tried to set up accounts with jewelry stores at Mapleview Mall and Oakville Place.CrimeSep 3, 2019

![]()

Trending

-

![]() ‘Alarming trend’ of more international students claiming asylum: minister5,601 Read

‘Alarming trend’ of more international students claiming asylum: minister5,601 Read -

![]() U.S. Election 2024: Questions arise over groups door-knocking for Donald Trump1,937 Read

U.S. Election 2024: Questions arise over groups door-knocking for Donald Trump1,937 Read -

![]() NBC, CBS polls show Harris gaining ground as election focus shifts to Trump1,221 Read

NBC, CBS polls show Harris gaining ground as election focus shifts to Trump1,221 Read -

![]() 4 dead, 17 wounded after being caught in crossfire in entertainment district in Birmingham, Alabama964 Read

4 dead, 17 wounded after being caught in crossfire in entertainment district in Birmingham, Alabama964 Read -

![]() Princess of Wales makes 1st public appearance after cancer treatment893 Read

Princess of Wales makes 1st public appearance after cancer treatment893 Read -

![]() B.C. Election Day 2: Conservatives, NDP stump in Metro area750 Read

B.C. Election Day 2: Conservatives, NDP stump in Metro area750 Read -

Top Videos

-

![]() Immigration Minister defends screening security30 Viewed

Immigration Minister defends screening security30 Viewed -

![]() Strike averted: Air Canada, pilots union reach tentative 4-year agreement28 Viewed

Strike averted: Air Canada, pilots union reach tentative 4-year agreement28 Viewed -

![]() Rally in Toronto calls for government action, compensation on Grassy Narrows mercury poisoning16 Viewed

Rally in Toronto calls for government action, compensation on Grassy Narrows mercury poisoning16 Viewed -

![]() U.S. election 2024: Harris accepts CNN invite to 2nd debate, Trump says it’s ‘too late’15 Viewed

U.S. election 2024: Harris accepts CNN invite to 2nd debate, Trump says it’s ‘too late’15 Viewed -

![]() Brazil shuts down access to Elon Musk’s X5 Viewed

Brazil shuts down access to Elon Musk’s X5 Viewed -

![]() Activists call on province to remove Boogie the Monkey from Ontario zoo5 Viewed

Activists call on province to remove Boogie the Monkey from Ontario zoo5 Viewed -