A wave of megamergers between grocery giants this year, the growing presence of U.S. discount behemoths as well as the inexorable growth in international e-commerce are combining to cast a long shadow over the nation’s mom-and-pop shopkeepers, experts say.

But there are ways small and independent retailers can hit back.

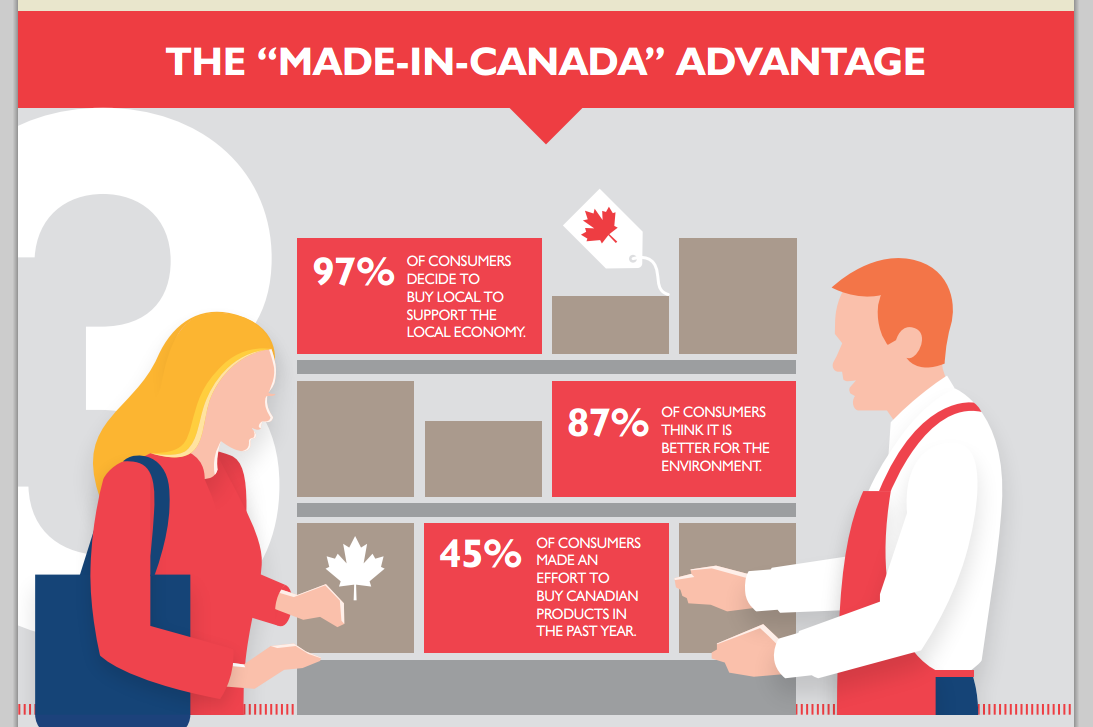

In a report released by the Business Development Bank of Canada (BDC) this week, fresh survey results show a growing appetite among many shoppers for locally-sourced goods, according to the Crown corporation’s chief economist, Pierre Cleroux.

“The consumer sees it as a good thing for creating jobs in the community. Our study shows that’s why they buy local – they have a positive impact on their community.”

Recent high-profile coverage of dismal and even deadly working conditions among those who toil to feed globalized supply chains, such as Bangladeshi textile workers producing garments for Western firms – including Canada’s Loblaw – has helped spur more shoppers to consider where a product comes from.

“This trend is stronger than before,” Cleroux said.

The BDC says 45 per cent of shoppers in the study actively sought last year to find locally-made products, a figure that has potential to grow, the report’s authors say.

Perhaps not surprisingly however, others suggest the clear determinant for most remains price above all.

Making matters more difficult for smaller competitors, consumers are being enticed by even more aggressive discounting among retail giants this year, Enenajor said, as the battle for consumers’ wallets intensifies.

Target’s entry into Canada this spring combined with Walmart’s deeper push across the country has raised the stakes for all, helping to trigger a pair of mergers between Loblaw and Shoppers Drug Mart, and Sobeys and Safeway.

And discounting is sure to ratchet up further as the holiday shopping season approaches, experts say.

Indeed, for Canadian online shoppers it’s just around the corner, with many connected consumers on this side of the border looking to take advantage of the cut-rate deals offered by U.S. retailers during the annual shopping blitz between Black Friday and Cyber Monday next month.

The BDC report says if smaller Canadian retailers are to counteract or deter domestic shoppers from spending billions online with foreign retailers, it would help if they too had an e-commerce presence. Just under a third of small retail businesses in Canada have no home on the Internet, according to Cleroux.

“You have to convince the consumer online now, that’s where the consumer is looking for information and making the decision,” the BDC economist said.

Another avenue for small shopkeepers is to join initiatives like Yellow Media’s Shop the Neighbourhood, a promotional event designed to encourage Greater Toronto Area consumers to skip the shopping trip south or that online order and instead spend at home.

“It doesn’t mean folks still aren’t going across the border to buy some stuff because there are good deals, but we’d like to support our local community and economy as well,” Doug Clarke, senior vice-president of sales, told the Canadian Press at a launch event this week.

Comments