The B.C. government is scrapping its largest oil and gas subsidy to better meet its climate action goals and bring in another $200 million a year in revenue.

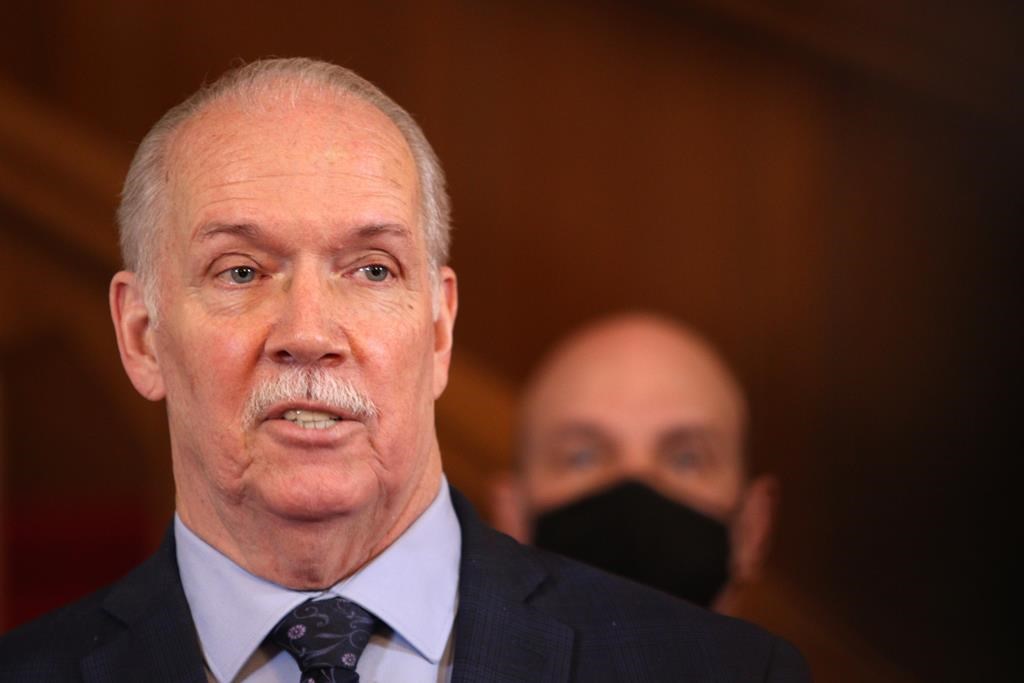

On Thursday, Premier John Horgan and Energy Minister Bruce Ralston announced a new royalty system that will eliminate the deep well program, as well as increase the minimum royalty rate from three to five per cent — similar to Alberta’s current rate.

The additional royalties — the fees the province charges companies to extract publicly owned oil and gas — will go to public services like roads and hospital, and climate action, a news release said.

Get breaking National news

The deep well program, created in 2003, was initially meant to offset higher drilling and completion costs incurred by deep wells.

Getting rid of it will mean a loss of credits between $440,000 and $2.81 million for companies, depending on the depth of the well.

The new system will apply to all new wells and be phased in over two years starting on Sept. 1.

However, Tracey Saxby, executive director of a group pushing for the end of fossil fuel subsidies called My Sea to Sky, said the move means the province is “doubling down” on subsidies for fracking and liquefied natural gas exports.

“What the Province calls royalties are actually taxpayer subsidies going directly into the pockets of global oil and gas companies doing fossil fuel extraction,” Saxby said in a release.

“It has cancelled a handful of subsidies only to replace them with a ‘revenue minus cost‘ regime that allows global gas producers to frack for natural gas without any business risk.”

– with a file from The Canadian Press

Comments