Data from a new Angus Reid Institute poll demonstrates how concerned Canadians are becoming about increasing prices from rising inflation.

The poll shows that 53 per cent of participants agree they cannot keep up with financial demands, while 44 per cent say they have yet to feel that level of pressure.

In addition, 51 per cent felt they would be unable to pay for an unexpected $1,000 expense, including one in seven people who said they could not handle a surprise bill of any amount since their budget is already stretched as far as possible.

Child-care costs have also weighed heavy on some Canadians. Two in five, or 39 per cent, of homes with kids in child care say it is “tough” or “difficult” to pay for it. Approximately 46 per cent describe it as “manageable.”

However, those pressures are being felt more by residents on the prairies, according to the results.

About 36 per cent of respondents say they are carrying too much debt. When comparing that finding among the provinces, the institute found that figure is highest on the Prairies, with 51 per cent in Saskatchewan, 46 per cent in Manitoba and 45 per cent in Alberta.

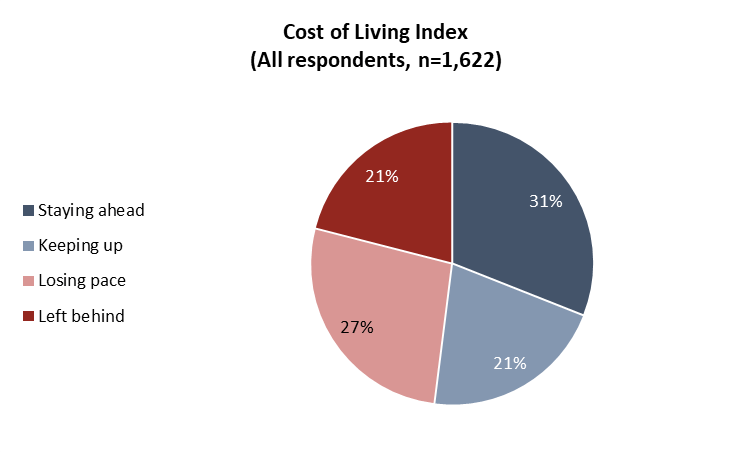

As part of the study, the Angus Reid Institute says it developed a cost of living index to better understand how household budgets are coping with the country’s rising living costs. This includes expenses such as housing, grocery bills and child care, and how much is left in a household’s monthly budget.

The organization split the results into four groups: staying ahead of increasing costs of living, keeping up with them, losing pace and feeling left behind.

Thirty-one per cent of respondents report that they feel they are staying ahead, while 27 per cent are on the other side and say they are losing pace to the increase in bills. The left behind and keeping up categories tallied 21 per cent each.

Get weekly money news

According to the institute, Saskatchewan and Atlantic Canada are the regions struggling the most. Sixty-five per cent of those in Saskatchewan are categorized into the more challenged half of the Angus Reid index, while 57 per cent of those in the Maritimes are.

Moreover, Saskatchewanians say they are most likely to be unable to afford any expenses outside of their budget. Only 39 per cent of respondents from Atlantic Canada and Saskatchewan residents would likely be capable of managing an expense over $1,000. The next lowest was Manitoba at 44 per cent.

Fifty-nine per cent of Saskatchewan, Alberta and Atlantic Canada citizens say they cannot keep up with the cost of living — the highest figure out of all the provinces.

Participants felt most concerned about potential job loss in Western Canada as well. At least two out of five people in the three prairie provinces admit they are worried someone in their home could lose a job due to the economy.

In Saskatchewan, 41 per cent agree they could lose their job because of the economy — the third-highest percentage out of the provinces.

When it comes to saving money over the past few months, more than half of Canadians, 53 per cent, are cutting back on discretionary spending. Forty-one per cent say they are delaying a purchase, 31 per cent are driving less, 29 per cent are cancelling or scaling back travel plans and 22 per cent are deferring or not making a contribution to an RRSP or TFSA.

Forty per cent of people in Saskatchewan are saving money by driving less, according to results from the poll. It’s one of the highest figures next to Atlantic Canada at 46 per cent. Meanwhile, 36 per cent say they have cancelled or pushed back travel — the largest percentage among the provinces along with British Columbia.

In January, inflation as measured by the Consumer Price Index surpassed five per cent for the first time since 1991.

Comments

Want to discuss? Please read our Commenting Policy first.