As provinces try to reopen their economies across the country and ease into the process allowing some businesses to bring back employees to the workplace, one unintended consequence of the COVID-19 pandemic may linger on for the foreseeable future.

A vast amount of Canadians sent home to work remotely during the pandemic now prefer to continue to do so in a post-COVID-19 world, and many more businesses intend to allow them to keep doing so.

A recent poll from Accenture found that over 60 per cent of Canadians now preferred some sort of hybrid or remote work model, as many organizations plan for employees to return to their workplace.

In June, a poll from the Business Development Bank of Canada found that 74 per cent of businesses would let their employees work from home even after the COVID-19 pandemic, and that more than half of all employees would like to work remotely as much or more than they do now.

Sonia Gandhi, a partner at KPMG who heads its Global Mobility Tax Services practice, said that an increasing number of employees are now making requests to work at different locations other than their physical workplaces.

“They’re asking their employer, ‘can I work one month or more, say in Whistler or maybe Florida, Portugal or Barbados?'” said Gandhi.

“We are seeing companies across different industries now considering a ‘work from anywhere’ arrangement with their employees. Employees are asking for this flexibility and employers are seeing it as a perk to differentiate themselves in the market.“

While some employees are reveling in the added benefit of remote work, some may be asking how being hundreds or thousands of kilometres away from home will impact their taxes come spring.

Tax rates differ vastly from province to province, so what happens when a person initially employed by a business in Ontario happens to start working remotely in B.C. — all the way across the country on the West Coast.

According to Gandhi, calculating taxes from province to province may not be as complicated as it sounds. She explained that according to the current Canadian tax system, an employee will only be taxed based on which province they’re residents of.

That means if a person who lives in and is employed in Halifax decides to work remotely in Banff for several months, they would only need to pay income tax based on what the Nova Scotia government requests. The same goes for employers as well — businesses would only have to calculate the withholding tax, TPP and social security for that employee based on where their office is located.

Where it gets complicated, according to Gandhi, is when a company based in one province hires an employee living in another. The employer will need to withhold tax base on the rate specified by their province, while the employee would have to pay the rate specified by their home province.

In that situation, Gandhi said that employee will either need to pay that difference or receive a refund when they file their taxes in April.

“Remote working is actually not that complicated from province to province but where it does get a little more complicated is when the remote work is in a different country other than the location of the employer,” said Gandhi.

Many Canadians working remotely are now choosing not only to work outside of their home province but outside of the country as well.

Gandhi said that when it comes to working internationally like so, the issue extends further from that of taxes — Canadians planning to work abroad will have make sure they legally can and will have the ability to do so from an “immigration perspective.”

“Many countries have put out what I’ll call a sort of the ‘nomad visa’, where they allow people to come into the country and work remotely,” said Gandhi. “But other countries are not yet allowing that.”

When it comes to being taxed internationally, Gandhi said it would be a case-by-case basis depending on which country you work in, warning that Canadians need to be wary of facing “double taxation.”

According to her, some nations might have a “tax treaty” — an agreement between countries on how employees would be taxable — already in place to prevent a doubling up on tax payments.

“If there isn’t a tax treaty with Canada, you could end up paying taxes not only in Canada but also that remote work country. You have to be very mindful of what the ramifications could be, including a big tax compliance burden,” she said.

Ultimately, Gandhi said that those wishing to work abroad need to be very aware of what laws await them in their host country, whether it be employment or immigration laws or a lack of a tax treaty for Canadians, to avoid doubling up on their taxes.

— With files from Jon Azpiri and The Canadian Press

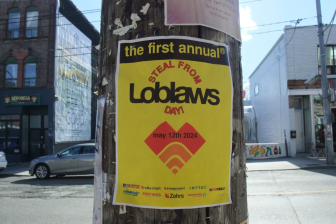

- Posters promoting ‘Steal From Loblaws Day’ are circulating. How did we get here?

- Canadian food banks are on the brink: ‘This is not a sustainable situation’

- Video shows Ontario police sharing Trudeau’s location with protester, investigation launched

- Solar eclipse eye damage: More than 160 cases reported in Ontario, Quebec

Comments