The City of Kelowna is looking at whether to earmark more money to purchase land for affordable housing, as the rapidly growing city grapples with housing challenges.

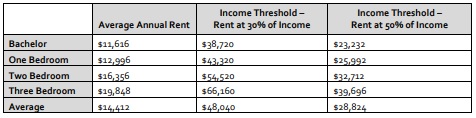

A city staff report, that will be considered by council this week, said an estimated 9,200 renter households in Kelowna, nearly 47 per cent of all renters in the city, are in “core housing need,” spending more than 30 per cent of their income on housing.

The report said a lack of land has been cited as “a key roadblock to building more affordable rental housing,” and suggests Kelowna’s city council increases the amount of money it puts in a housing reserve fund so the city is able to purchase land for one affordable housing project every four years.

Currently, $200,000 from tax revenue goes into this reserve, but city staff is suggesting that be bumped up to $400,000 next year and $600,000 per year after that.

Get daily National news

In addition to the extra funding from general taxation, the city staff report is suggesting money from Airbnb taxes also continues to go towards affordable housing initiatives.

The staff report argues, in addition to helping individuals, more affordable housing could leave people with more disposable income to spend at local businesses, create construction jobs, and possibly make it easier for businesses to recruit and retain workers.

The report acknowledges that this city spending would still “only help a small number of Kelowna residents achieve affordable housing.”

However, city staff believes it would spur investment in affordable housing from other entities including the provincial and federal governments.

The report said external funding will be necessary if Kelowna hopes to address affordability issues, as “the magnitude of total need is beyond the ability of the city to fund.”

“To address 100 per cent of the growing need for affordable housing over the next 10 years, it is projected that the city would need to provide 2,575 units, requiring 1.83 million square feet of land at an estimated total cost of $204M ($20.4M/year),” the staff report said.

In contrast, the funding strategy proposed by staff is expected to total $2.2 million from general taxation over four years.

Comments