Paying for car insurance can be a major hit to the bank account. But just how much is it in the GTA and surrounding regions? That’s what a local insurance data hub set out to find out.

“We wanted to see how things have changed,” says Liam Lahey with RATESDOTCA who helped gather the data. “According to our data — the average premium in December of 2020 is 1,616 dollars,” he says.

They say that’s a jump of nearly 10 per cent from 2018, and in Durham, it’s even higher.

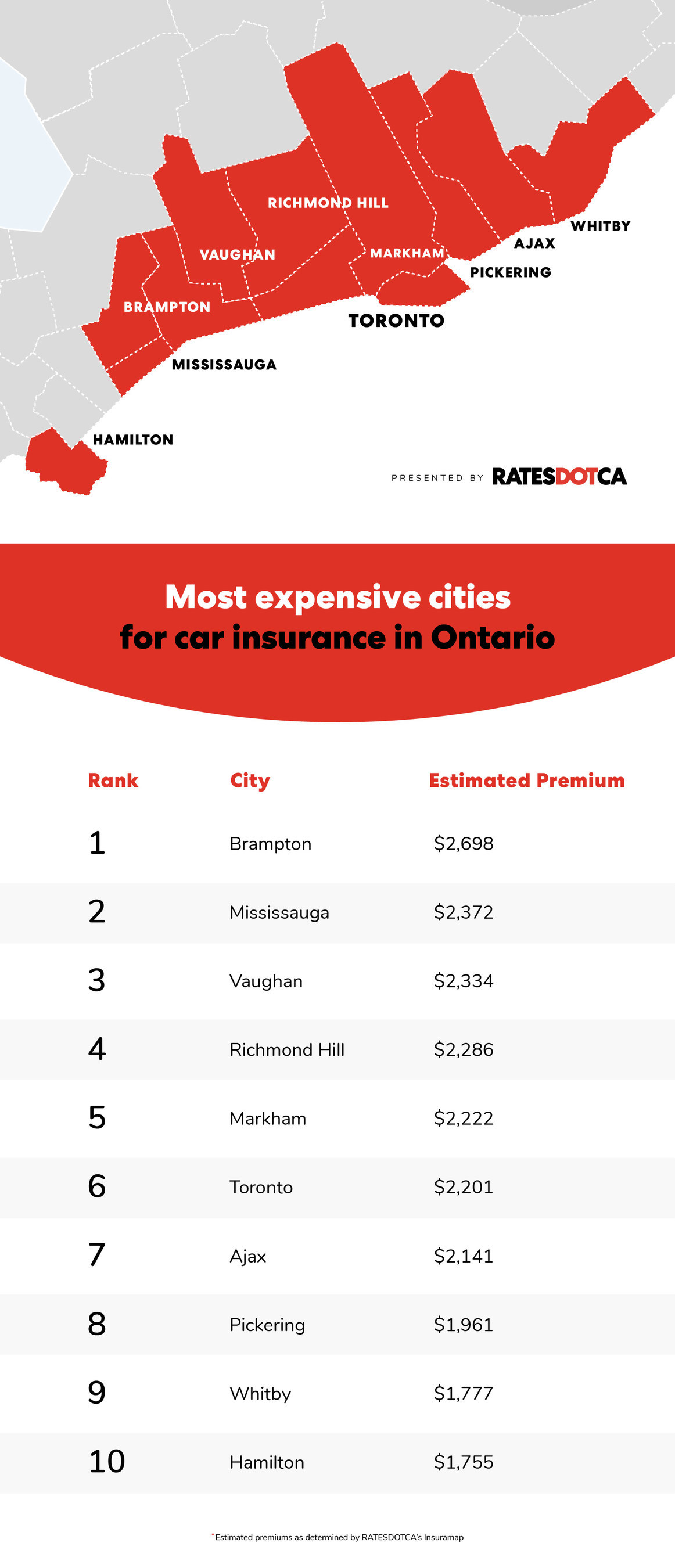

“The cost of car insurance in the Greater Toronto Area remains one of the highest in the province,” says Lahey.

“Cities such as Toronto, Ajax, Whitby, Pickering, Hamilton and Oshawa, they are all above that provincial average.”

Three Durham region cities hit the top 10 list. Whitby residents can pay nearly $1,800, while Pickering comes in at close to $2,000. But topping the list is Ajax — with a whopping $2,100 for an estimated premium.

This is according to data compiled by an insurance quote company on their insuramap. Using an example of a 35 year-old driver of a Honda Civic, the company, RATESDOTCA gathered information pertaining to postal code. The top 10 areas all fell within the GTA.

“It’s density. More cars, more potential collisions or more collisions in general,” says Lahey. “All those things affect the insurance rates that we see.”

This comes even though the industry gave more than $1B in relief for drivers on their premiums. But Lahey says just because you aren’t driving doesn’t necessarily mean you won’t be affected. It all comes down to where you live and the historical accident claims in your region.

“If the claims … or the costs of those claims trend higher in your region, whether that’s Durham Region, York Region or what have you, your premium is likely to reflect that.”

And that seems to be reflective when you look at Toronto, the largest density of course. In the GTA it’s more than $2,200 for an estimated premium. Brampton sits at nearly $2,700 and some wards in Scarborough are hitting $3,000.

The City of Kingston was among the municipalities with the lowest premiums, with drivers paying an average of $1,100. The numbers aren’t a shock to Moshe Lander, an economy professor at Concordia University.

- Train goes up in flames while rolling through London, Ont. Here’s what we know

- Budget 2024 failed to spark ‘political reboot’ for Liberals, polling suggests

- Wrong remains sent to ‘exhausted’ Canadian family after death on Cuba vacation

- Peel police chief met Sri Lankan officer a court says ‘participated’ in torture

“I think when you’re driving the … 400 series, whether it’s up in the north of the city or down in the centre of the city itself and going into the suburbs, you’re going to incur a lot of risk,” he says.

“The more people they can cover, the more they can spread the risk around of any individual accident.”

Lahey says, as always, a good thing to keep in mind is to just be a good driver.

“Drive defensively, good driving behaviour,” says Lahey. “No tickets, don’t get into accidents. That’s a big factor.”

Comments