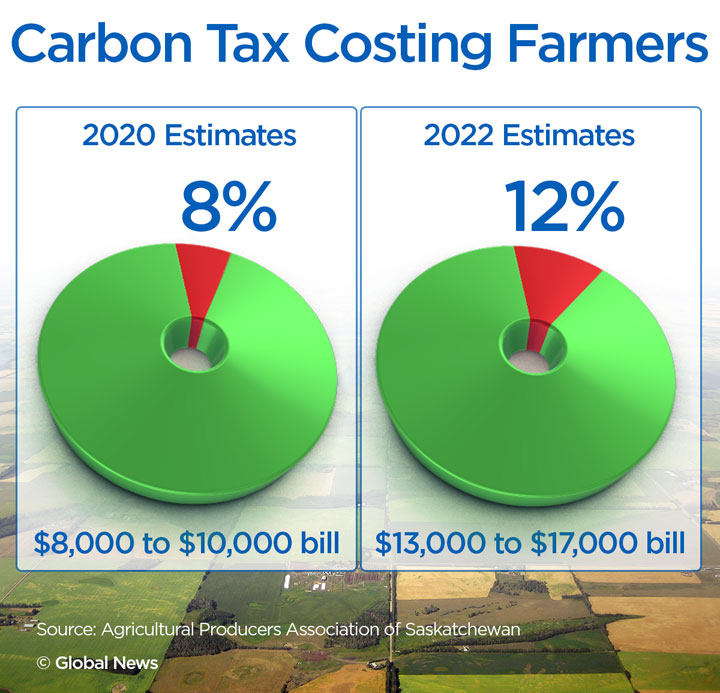

An organization representing agricultural producers in Saskatchewan says the federal carbon tax could eat up to 12 per cent of a farmer’s net income by 2022.

The Agriculture Producers Association of Saskatchewan (APAS) said Monday a review of the carbon tax shows the financial impact it will have on producers in the province.

“It’s comparable to having 12 per cent of your paycheque disappear in a year,” APAS president Todd Lewis said in a statement.

“Farmers don’t set our prices, so those increased costs are coming right off our bottom line.”

APAS pointed to rail transportation, heating and electricity, and truck hauling as major farm expenses currently not exempted from the carbon tax.

Another concern for APAS is the cost of grain drying — which is also not exempt.

“This past year was unprecedented in terms of the role grain drying played for farmers in our province,” said APAS vice-president Bill Prybylski, who farms near Willowbrook.

“Without using propane to dry our grain, the wet fall would have meant losing a huge portion of our crop.”

Lewis is calling on the federal government to exempt the carbon tax on all farm expenses.

“Federal Minister of Agriculture Marie-Claude Bibeau has asked the agriculture industry for evidence of what the carbon tax is costing Canadian farmers,” Lewis said.

“We’ve responded with estimates that are backed up by producer bills in 2019.”

APAS estimates a 5,000-acre grain operation will lose $8,000 to $10,000 in 2020 with a carbon tax of $30/tonne, rising to between $13,000 and $17,000 when the carbon tax hits $50/tonne in 2022.

Both Saskatchewan Premier Scott Moe and Saskatchewan NDP Leader Ryan Meili have called on the federal government to remove the carbon tax from farmer’s energy bills.

The Saskatchewan government is also challenging the legality of the carbon tax.

In a 3-2 decision, the Saskatchewan Court of Appeal ruled that Ottawa has the constitutional power to apply a minimum national carbon pricing.

The province is appealing the decision to the Supreme Court of Canada. It is expected to be heard on March 17 and 18.

“In the absence of an alternative, I think the (Canadian) government has to be looking at the impacts on the industry and saying, ‘OK, we’ll exempt this or we’ll exempt that’ to avoid that burden (on farmers),” said APAS general manager Duane Haave.

“Farmers sequester a lot of carbon, somewhere between nine and 11 million tons a year, which at $50 a ton is worth $550 million, so they don’t get recognition from that side. That would be probably good for the government to do as well is to take into account the management of carbon that happens on the farm.”

-With files from Thomas Piller

Comments