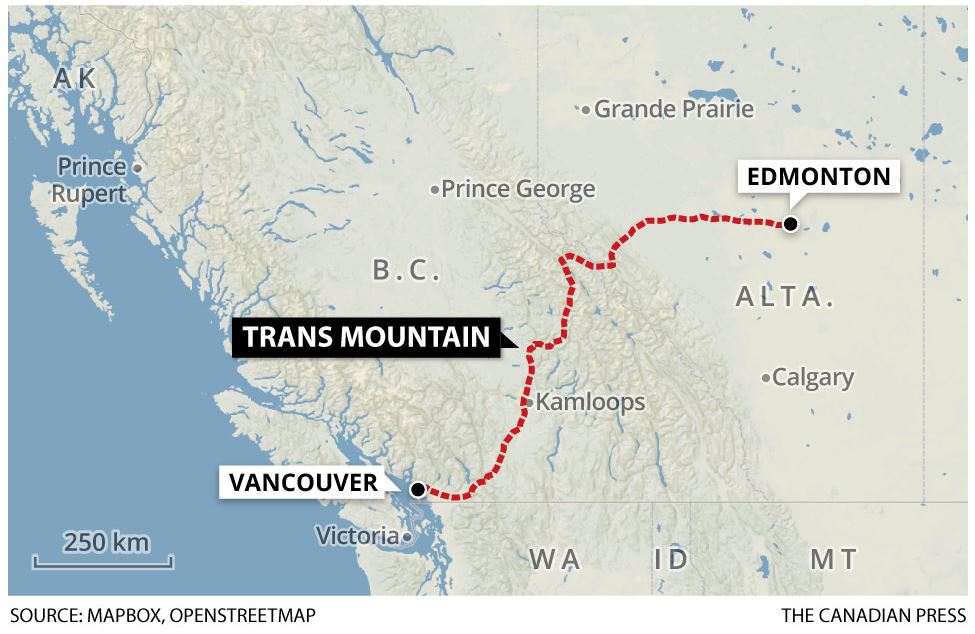

Observers on the front lines of Western Canada’s oil and gas sector are looking forward to what’s widely expected to be approval of the Trans Mountain pipeline expansion on Tuesday.

But they acknowledge the expected decision by the Liberal cabinet in Ottawa won’t solve all their problems.

“It’s going to be a big deal. We are gridlocked here with our oil,” said CEO Clayton Byrt of Pimee Well Servicing LP, a service rig company owned by six northern Alberta First Nations.

“It’s going to take some time to get that line built but that should open up world markets for us as opposed to selling our oil at a discount to the U.S.”

READ MORE: Canada set to approve Trans Mountain pipeline expansion, Trudeau unlikely to benefit

Pimee went from about 140 employees to 80 after an oil price crash in 2014 started the current oilpatch downturn and has gradually built back to the original level, Byrt said.

“We’re trying to keep Indigenous people working on our rigs, we’re about 98 per cent Indigenous,” he said.

Watch below (June 17): A huge decision for Alberta’s economy is expected to be made Tuesday. It’s the deadline for Ottawa to decide if and how the Trans Mountain pipeline proceeds. Fletcher Kent has more.

“Market conditions dictate how many people we can have working for us — that has a huge affect on the First Nation ownership group if their people aren’t working.”

Get breaking National news

READ MORE: 5 things to know about the Trans Mountain pipeline expansion project

The company counts Imperial Oil Ltd. and Cenovus Energy Inc. among its customers, both of which have delayed building or completing steam-driven oilsands projects because of uncertainty over how they will get the oil to market.

With drilling rig activity at the second-lowest level in 20 years this winter, Calgary-based CWC Energy Services Corp. packed up two of its nine Canadian drilling rigs and moved them to the United States.

Whether the pipeline is approved or not, the company plans to move two more rigs south of the border before year-end, said CEO Duncan Au on Monday.

“Bills C-69 and C-48 concern us and so we will continue to look for opportunities down south where the regulatory system, the cost system and their desire for drilling rigs continue to be stronger than in Canada,” he said.

Watch below (June 17): The Trans Mountain pipeline expansion first got the green light in 2016. Since then, the project has seen a lot of ups and downs. Jennifer Crosby walks us through them.

The two bills being pursued by the federal government are designed to revamp the way large resource projects are approved and impose an oil tanker ban on the northern B.C. coast.

Pipeline approval will boost the industry but isn’t expected to immediately benefit the oilfield pressure vessel-making business at Cape Manufacturing Ltd., said president Thomas Chadwick on Monday.

“It should mean that we’ll see some more activity but it won’t be any time soon. I mean, tomorrow is not like a light switch,” he said.

“If the thing gets approved, it will take a year or two or more than that before we see any change in activity.”

He said he worries that pipeline construction work may lead to a tighter labour market for the welders he employs at his shop near the small central Alberta village of Halkirk.

The project to triple capacity of the existing Trans Mountain pipeline will help with market access when it comes on stream but that likely won’t happen until 2022 and could be held up by more legal challenges, said analyst Samir Kayande, a director with RS Energy Group.

“Even though (the decision) is positive and it’s important, the impact on the investment climate will probably be a little bit muted at least until you can actually start construction,” said Kayande.

“It really depends on what the next round of legal challenges looks like.”

READ MORE: B.C.-Alberta trade worth $30B annually, with economies most intertwined in Canada: report

The pipeline isn’t big enough to fix Western Canada’s oil transportation woes on its own, he said.

RS Energy figures it will take Enbridge Inc.’s Line 3 replacement pipeline project plus completion of either the Trans Mountain expansion or the Keystone XL pipeline to relieve the glut of oil in the West that led to steeper-than-usual discounts on Canadian crude oil last fall, and allow for some production gains.

New pipelines won’t help Canada deal with a general downturn in energy investing throughout North America, nor can it make up for the lower quality of Canada’s energy resources compared to premier U.S. oil and gas basins, Kayande said.

Comments