Are bogus numbers being thrown around in the contentious debate over B.C.’s new school tax on homes valued over $3 million?

Data scientist Jens von Bergmann, owner of MountainMath Software and Analytics, thinks so, and has created a new online calculator to try and get everyone on the same page.

The NDP’s measure adds a tax of 0.2 per cent on the value of a home that exceeds $3 million, and a tax of 0.4 per cent on the value of a home that exceeds $4 million.

“Ever since the announcement of the tax, I notice that a lot of people have difficulty understanding what it actually means, how much tax will be owed, how does the deferral process work, how do all of these numbers work out,” von Bergmann said.

WATCH: Point Grey homeowners grill David Eby over school tax

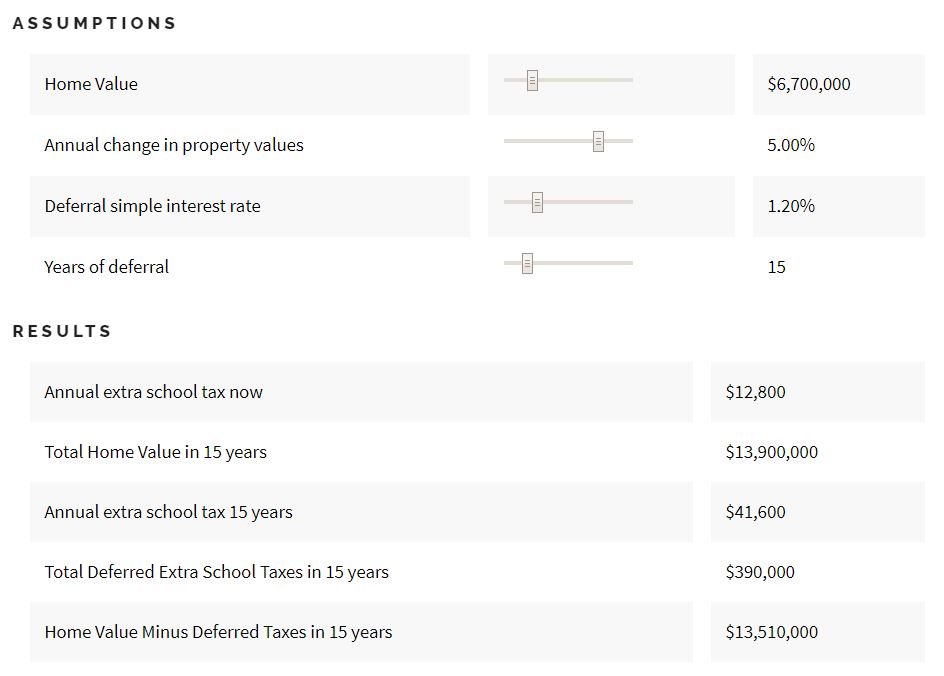

The calculator lets people toggle home values, changes in property values, interest rates on tax deferral and a time horizon for tax deferral.

Under B.C.’s property tax deferral program, people over the age of 55 can defer taxes at an interest rate of 1.2 per cent per year.

“You can just set that up, and, for example, you want to defer your taxes for maybe 20 years and it will tell you how much money you will owe at the end of it and how much equity is left in your home,” he said.

Get breaking National news

From von Bergmann’s perspective, most homeowners will come out well ahead in the equation.

In a blog post von Bergmann admitted was “snarky,” he used the tool to assess the case of retired economics professor David Tha, which was laid out in a Vancouver Courier article.

“One thing the extra school tax debate has brought to light is how challenging 8th-grade math is for people, especially those living in homes valued over $3M,” wrote von Bergmann.

The 72-year-old Tha told The Courier he bought his home in 1987 for $370,000, and that it is now worth $6.75 million. He said that if the home increased in value by five per cent a year and he passed it on to his daughter in 15 years, she’d be on the hook for a $67,000 tax bill she couldn’t afford.

Von Bergmann ran the example through the calculator, and came to a different conclusion.

“We see that in 15 years Tha’s daughter will be in the very uncomfortable position of inheriting a $14M home owing $390k in deferred extra school tax, a net value of over $13.5M,” he wrote.

“At that point in time the annual extra school tax amounts to $42k and she will have to make up her mind if she wants to keep deferring taxes … or sell her home for around $14M.”

Von Bergmann said he hopes the tool adds perspective to the debate by ensuring everyone is working with the same numbers.

And he said it could even help reveal situations where people are facing legitimate hardship because of the new tax.

WATCH: Seniors fight back against NDP’s new luxury home tax

“I’m hoping that it might be able to cool down things a little bit. And I’m sure there are actually some cases where people do get hit pretty hard and might be struggling,” he said.

“This might help refine things a little bit so we can refine the ones that maybe try to inflate the numbers a little bit to make it look bad from those that might actually have some real concerns.”

The new school tax was introduced by the NDP in its 2018 budget, which projected it would net about $250 million over the next three fiscal years, money that will go into general revenues.

Owners of valuable homes, particularly in Vancouver’s Point Grey neighbourhood, have called the measure an unfair tax grab that targets unrealized capital gains.

On Sunday, opponents of the tax packed a town hall hosted by Vancouver-Point Grey MLA and Attorney General David Eby. He is slated to hold another town hall on the matter next month.

Comments

Want to discuss? Please read our Commenting Policy first.