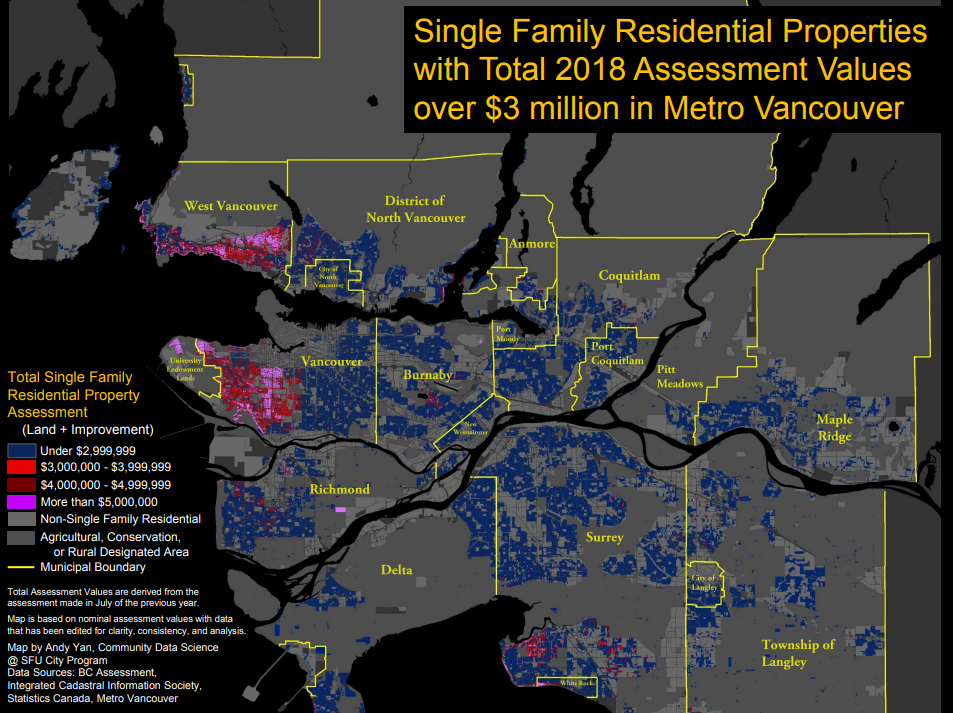

B.C.’s new taxes on properties worth $3-million or more could lean hard on West Vancouver and Vancouver’s west side, traditionally some of the region’s richest areas.

That’s according to maps produced by Andy Yan, director of the SFU City Program.

Coverage of B.C. housing affordability on Globalnews.ca:

They show that there’s a $3-million line where another boundary once divided Vancouver between areas with single-detached homes worth $1-million or less.

And now, that new line marks out which properties could be hit with a pair of new taxes that were introduced with the 2018 provincial budget.

The taxes

The governing BC NDP introduced two measures that could affect homes valued at $3 million or more.

One is an increase to the Property Transfer Tax (PTT) levelled on homes that are valued at that level, from three per cent to five per cent.

The measure will see a further tax of two per cent applied to the fair market value of a property transaction that exceeds $3-million. And that’s on top of an existing three per cent tax on the fair market value of a transaction above $2-million.

That move alone is expected to bring in $81-million in each of the next three fiscal years.

READ MORE: In this 2018 map, Metro Vancouver turns red with single-family homes worth $1M or more

Then, there’s increased school taxes on homes valued at over $3-million. The province will level a tax of 0.2 per cent on the assessed value of a home that exceeds $3-million, but doesn’t exceed $4 million.

A tax rate of 0.4 per cent will also apply to the portion of a residential property’s assessed value over $4-million.

This measure is projected to bring in revenues of $250-million over the next three fiscal years.

If Yan’s maps of Vancouver single-detached homes are any indication, much of that taxation will happen in West Vancouver and on Vancouver’s west side.

The maps show heavy concentrations of single-detached homes worth $3-million or more in those two areas, as well as in South Surrey.

READ MORE: In Vancouver, you’re competing with non-residents for condos worth as little at $600K

That doesn’t necessarily mean that most of the taxation will be concentrated in this areas — the maps don’t account for condos or townhomes worth that much — but they do show that the provincial government is taking action to tax wealth, Yan told Global News.

“We’re finally increasing the parking and club fees of the hedge city,” he said.

Yan said the NDP’s new housing taxes may be a “policy innovation towards progressive wealth taxation.”

He suggested the taxes are a way of dealing with a “globalizing economy,” when foreign income has proven very difficult to trace and tax.

“We’ve based our immigration policy on wealth and turned around to expect taxation by income,” Yan said.

READ MORE: Foreign buyers may not live in Vancouver, but their money sure does: StatsCan

In 2015, Yan released a study showing that two-thirds of homes bought in a six-month period on Vancouver’s west side may have been purchased by people from overseas.

And with the BC NDP’s new taxes, he hasn’t noticed much of a backlash, either.

“There’s no Boston Tea Party in Coal Harbour,” Yan said, referencing a 1773 protest by Samuel Adams and the Sons of Liberty, who threw 342 chests of tea into Boston’s harbour to strike back against new taxes levelled by the British Parliament at the time.

Yan has seen nothing of the sort in Vancouver.

“It’s the fact that it’s a taxation on a population with no need for representation,” he said.

“It actually doesn’t really necessarily care about representation, and it’s arguably a gift to those in government who can take advantage of this behaviour.

“The political consequence of increasing the taxes in this situation is none, or it’s limited.”

But new property transfer and school taxes aren’t the only ones that could be levelled in these areas.

If their owners don’t make income in B.C., those same properties could face a new speculation tax that would be charged at $5 for every $1,000 of assessed value this year, and $20 per $1,000 of assessed value next year.

The speculation tax is expected to come into effect in the fall.

Comments