Does the Greater Toronto Area have enough space to accommodate the housing needs of its growing population?

Ontario PC Leader Doug Ford reignited that debate last week after he said the Tory government would open up the protected Greenbelt area to development as a way to generate supply in a housing market that’s become unaffordable for many.

While Ford quickly backtracked on that plan amid public pressure and criticism from his opponents, he raised an issue that’s on the minds of many voters as we head into the provincial election.

Here’s a breakdown of some of the factors driving supply issues in the region’s market, and a look at what the industry says could be part of the solution.

How we got here

In every regard, the GTA towers over the region it used to be.

Statistics Canada data shows that the Toronto Census Metropolitan Area alone, which includes Mississauga and some of the other surrounding suburbs, gained more than 1.2-million people between 2001 and 2016.

- As Canada’s tax deadline nears, what happens if you don’t file your return?

- Do you need to own a home to be wealthy in Canada? How renters can get ahead

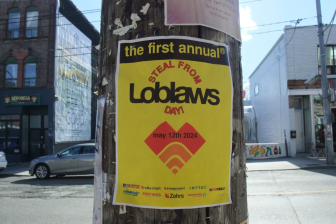

- Posters promoting ‘Steal From Loblaws Day’ are circulating. How did we get here?

- Investing tax refunds is low priority for Canadians amid high cost of living: poll

And in that time, more than half-a-million new dwellings were built.

Meanwhile, comprehensive development legislation brought in the early 2000s, including the Growth Plan for the Greater Golden Horseshoe as well as the Greenbelt, which is said to be the largest swath of environmentally protected land in the world, have put new limits on where residential development can go.

READ MORE: The data is in: Here are the winners and losers of the new mortgage rules so far

“Those two big provincial plans were designed to try to tackle some of the issues around urban sprawl and to look out for the growth of the region itself, and to recognize even though… there are 118 municipalities, you got to have some common set of rules, some ability to co-ordinate infrastructure across the entire region which is under incredible growth pressure,” explained Paddy Kennedy, a professional planner and partner at Dillon Consulting.

At the same time, those measures have taken “a lot of supply of housing-ready land out of the mix,” said Tim Hudak, CEO of the Ontario Real Estate Association.

Years of relative prosperity in the region, along with low unemployment and borrowing rates, have also contributed to the high demand for property, Hudak said.

As the market has grown and become more attractive for investors, it’s also become increasingly out of reach for families and individuals seeking a place to buy or rent.

In just a decade, the average selling price of a Toronto-area dwelling shot up by 119 per cent to $822,681 in 2017, according to Remax.

Amid warnings of an overheated market, governments took action last year, introducing tougher mortgage requirements and a non-resident buyers’ tax designed to limit speculation.

The effectiveness of those measures remains up for debate. In April, however, the number of homes sold in the GTA was down 32 per cent year over year, and prices are now slightly weaker, though the condo market remains hot.

The supply problem

Under normal conditions, high demand for housing would lend itself to an increase in the supply of units available, but that hasn’t really occurred to the extent that it could, according to the Canada Mortgage and Housing Corporation (CMHC), the country’s leading authority on housing.

In a February report on escalating house prices, the CMHC said markets in Toronto and Vancouver have responded to surging prices and a growing demand for homes with a supply that is “significantly weaker” than in other Canadian metropolitan areas.

“We do not fully know why this is the case,” the CMHC stated, adding that gaps in available data are standing in the way.

In Toronto itself, the number of dwellings completed last year was nearly 2,700 fewer than the average of the previous six years, according to CMHC data provided by the city.

Despite that, the number of units under construction in the GTA — three-quarters of which are condos — hit a record of 72,056 in February, the CMHC reported. And the number of built but unsold units is at one of the lowest levels ever recorded, at 0.98 units per 10,000 people.

Is there enough land?

With decades of growth in residential development, it would be easy to assume that further expansion of the housing supply is being stymied by a lack of space to build.

But according to a report from urban policy think-tank Neptis, that’s hardly the case. Last year, the group found that there are 50,810 hectares of unbuilt land in the Greater Toronto-Hamilton Area, for a total of 125,560 hectares in the Greater Golden Horseshoe.

“Most of that land is in the Designated Greenfield Area contiguous to existing built-up urban areas, where full municipal water and wastewater servicing is available or planned,” Neptis stated in the report.

WATCH: Ontario’s greenbelt not the cause of GTA housing crunch: Minister

Which portions of this land can or should be built upon is an entirely different question. The urban sprawl phenomenon has been linked to increased greenhouse gas emissions, loss of agricultural land and even negative impacts on public health related to commuting.

As a result, increasing so-called “intensification” and population density along transit corridors is a guiding principle of the province’s growth strategy for the region. The government projects that by 2041, the Greater Golden Horseshoe area population could swell to 13.5-million people.

That growth plan was updated last year with new targets for building up urban areas, but Dave Wilkes, CEO of the Building Industry and Land Development Association, said levels of government need to do a better job of communicating with each other.

“When we go to municipalities to get the community to build higher density products, condos or stacked townhouses or things like that, the official plans aren’t updated to reflect the policy,” he said.

“The province is saying one thing, the municipalities are saying another thing, and the homebuyer is stuck in the middle because the product can’t come to market,” he added.

WATCH: Greater Toronto area real estate sales down

Hudak, of the Ontario Real Estate Association, said he believes “there is enough land to meet housing demand, however, governments have done a lousy job of matching up infrastructure investments with housing-ready land.”

Hudak, who spent decades as an MPP and led the Progressive Conservative Party of Ontario from 2009 to 2014, said governments could encourage housing growth and intensification by directing funds budgeted for infrastructure to municipalities that have housing-ready land available.

Kennedy, an urban planner, argues that even if the land is serviced with water and sewer, it still may not be a good choice for development because of a lack of employment or transit nearby.

“There’s a lot of land there,” he said of the Greater Golden Horseshoe. “It doesn’t mean there’s not supply issues. Some of this land is not in the right place from a market perspective.”

WATCH: Canada housing market: What millennials can afford across the country

The real estate and development industry is also calling for municipalities and other levels of government to streamline regulatory and permit processes in order to help speed up building activity.

“There are so many different ministries, departments, agencies and governments involved in housing that it can take up to 10 years to get a new subdivision approved,” Hudak said.

Kennedy, whose work mostly involves consulting for municipalities, said that because of the legislative changes, there’s “no question” that it takes longer for a developer to get permits and approvals.

“Particularly for stuff that’s outside an urban boundary,” he said.”If they’re wanting to get new urban land designated, that’s a lengthy process. If you have land in an urban boundary, it can be relatively predictable.”

WATCH: Bitcoin creeps into the GTA real estate market

Unlike single-family residential homes, condo projects and other developments within urban areas can be approved faster due to there being fewer unknowns, Kennedy added.

“I think the lesson there is that, if we can find ways to do things faster for condos and infill, we need to find ways to maybe do them a little faster on the fringe,” he said.

Hudak said increasing the supply of so-called “missing middle” homes — townhouses, low-rise buildings and other forms of housing between condos and single-detached homes — can help address some of the supply problems in the market.

“Missing middle is very attractive because it tends to be very affordable for first-time homebuyers, and also very attractive for empty-nesters. Many want to stay close to the grandkids, they want to stay in the Greater Toronto Area in the cities,” he said.

Permits issued outpace completed builds in Toronto

While the industry points a finger at governments, in the city of Toronto at least, the number of planning approvals issued has been greater than the number of housing completions for a number of years.

Between 2012 and 2016, 104,769 residential units were greenlit, but only 82,762 were finished, according to stats provided by the city.

Last year, Jennifer Keesmaat, who was then Toronto’s chief planner, suggested on Twitter that it’s builders, not governments, who are controlling new supply.

In an interview with Reuters earlier this year, CMHC president Evan Siddal also pointed to the building side of the equation. He said that in addition to the red tape factor, companies are adding to the supply problem by stalling on development in the hopes that prices will increase.

He told the outlet that supply in the Toronto housing market is concerning.

“We’re replacing houses in Toronto at a much lower rate than we were five or six years ago,” he said.

*With files from The Canadian Press

Comments