The Toronto real estate market is not only overvalued, it’s the top city at risk of a housing bubble, according to a new housing report.

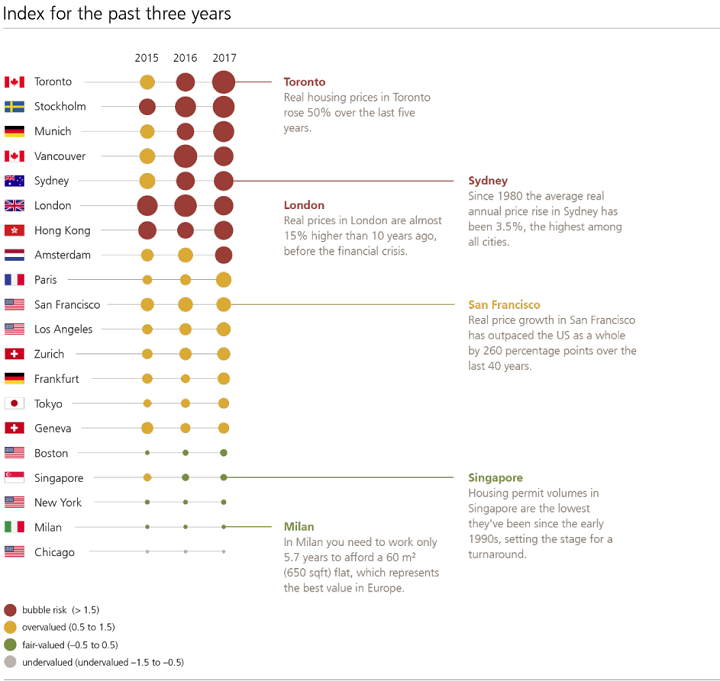

On Thursday, the UBS published its annual Global Real Estate Bubble Index, which looked at 20 major cities at risk of housing bubbles. Toronto ranked the highest and Vancouver was third on the list.

“The bubble risk seems greatest in Toronto, where it has significantly increased in the last year,” the report stated. Over the past five years, housing prices in Toronto rose 50 per cent (a majority in 2016), according to the report.

While Toronto ranked the riskiest market, Stockholm, Munich, Vancouver, Sydney, London and Hong Kong made the top six.

WATCH: New Toronto Real Estate Board numbers show housing sales are slumping

“Over the long run, Vancouver and Toronto’s house prices have moved in rough lockstep. Vancouver had the upper hand until 2008, but Toronto has been catching up rapidly in recent years,” the report stated.

What is a housing bubble?

Get breaking National news

“Everyone may have a slightly different definition of what a bubble is, but most can agree it’s when prices become dangerously detached from economic fundamentals and start rising strongly simply because people believe they will keep rising strongly, encouraging more buying,” according to Bank of Montreal chief economist Douglas Porter.

What are the reasons for the risk?

The authors attribute the risk of a housing bubble to improved world economic growth, low unemployment and low-interest rates, which push up property values in city centres.

UBS noted that Toronto and Vancouver weren’t “dragged down” by the global financial crisis, as a weaker Canadian dollar cushioned the blow. But because of “overly loose monetary policy, for too long” and “buoyant foreign demand”, the housing markets in the two cities are now in bubble risk territory.

However, this may change.

“A strengthening Canadian dollar and further interest rate hikes would end the party,” the report added.

Will the market get less risky?

The authors of the report cite Toronto at risk, but according to John Pasalis, president of Realosophy Realty, the housing bubble in the city may have already burst and now the market is starting to cool off.

“The data collected for Toronto seems like it was up to the second quarter in 2017, which means it may have not shown that the market started cooling in June,” Pasalis said.

“Since then, prices have adjusted to a (somewhat) buyers’ market.”

WATCH: Housing sales cool in the Greater Toronto Area

There are a number of reasons real estate in Toronto isn’t as high as it was in January. In April the Ontario government proposed policy changes in hopes of cooling the red-hot housing market. For example, a 15 per cent foreign buyer tax would be implemented in Toronto.

Despite the “moderate” cool down and government initiative, Pasalis, said the city’s housing is still very unaffordable. Another bubble may soon be on the way.

Comments