Saskatchewan Energy and Resource Minister Bronwyn Eyre introduced The Energy Export Act on the afternoon of Monday April 23. This legislation would make it so oil and gas companies would have to obtain permits to ship their product. The intent is to block oil exports to B.C. due to ongoing delays of Kinder Morgan’s Trans Mountain pipeline expansion.

Alberta recently introduced similar legislation.

This is the latest chapter in the ongoing feud primarily between B.C. Premier John Horgan and Alberta Premier Rachel Notley over delays to the federally approved Trans Mountain pipeline expansion.

READ MORE: Saskatchewan premier says legislation is coming to block energy exports to B.C.

B.C. is seeking a legal ruling into whether the province can restrict increased amounts of oil entering Canada’s most western province. There is strong opposition to the pipeline in parts of B.C., due to concern over the economic and environmental impact of an oil spill in the Pacific Ocean.

The concern among opponents is the increased amount of oil that would be carried by Kinder Morgan’s $7.4 billion pipeline expansion. If completed, the Trans Mountain pipeline would triple its capacity.

READ MORE: B.C. still not ready with reference question for courts on Trans Mountain pipeline

Last week, Premier Moe said that Saskatchewan would only take action if Alberta did first. Moe added he stands by Notley’s support of the pipeline — and if Alberta turns off the taps, Saskatchewan won’t be there to backfill B.C.’s energy demands.

“This is a situation we don’t want to find ourselves in, but in the light of the broader good of the economy and defending the economy and the sector we simply have to go down this road,” Eyre said.

Get breaking National news

Once passed, this legislation will carry fines of up to $10 million per day for corporations found violating the permit and up to $1 million per day for individuals, much like Alberta’s legislation.

Unlike Alberta’s proposed legislation, Saskatchewan’s bill contains a sunset clause. This means the export permit rules will end on January 31, 2019 unless the government extends the time frame.

Opposition Leader Ryan Meili said his party will be closely reading this bill looking for unintended consequences. These consequences could include reducing the business opportunities for oil and gas companies looking to move their product.

The Canadian Fuels Association put out a statement voicing similar concerns about Alberta’s legislation on April 18.

Meili added that the Saskatchewan NDP will have to review the bill before deciding whether or not to support it. Premier Moe is hopeful the opposition will support the bill so it can be passed quickly.

Economic impact

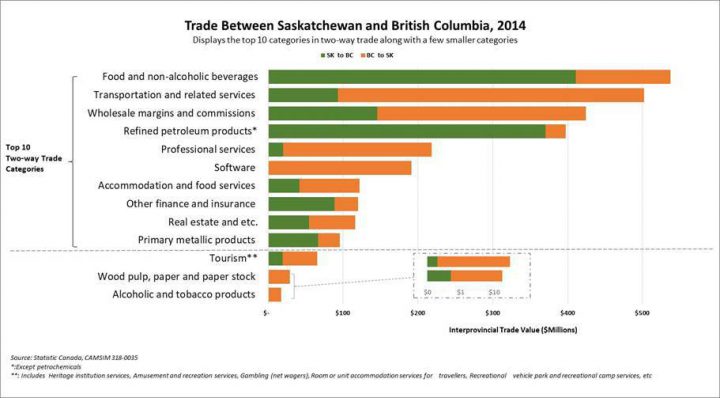

In 2014, trade of refined petroleum products such as gasoline was the fourth biggest market between Saskatchewan and B.C. Saskatchewan shipped out more than $350 million worth of product to the coastal province.

Saskatchewan estimates that in 2018, these exports are worth closer to $400 million.

If Saskatchewan does begin to issue export permits to block oil products from reaching B.C., Gas Buddy’s senior petroleum analyst Dan McTeague says consumers will likely notice a drop in gas prices in Saskatchewan.

However, McTeague says that short-term gain comes at a heavy price. He says this pipeline’s delay reduces the price of Canadian oil, and therefore the Canadian dollar. A tough spot to be in as fuel is valued on the American dollar.

“If you see Canadian oil dropping in value, it also takes with it the value of the Canadian dollar, which in turn leads to higher prices at the pumps because we price all our fuel in U.S. terms. Put another way, if the Canadian dollar was trading at the exact same level as the U.S. Greenback today you’d be saving 15 cents per litre,” McTeague said.

Based on estimates from the University of Calgary School of Public Policy, the lack of coastal access due to limitations of existing infrastructure costs Saskatchewan $150 million in resource royalties annually — which translates to an estimated loss of $1.8 billion in revenue potential for oil producers according to the province.

READ MORE: Mixed results in poll over Trans Mountain pipeline debate

However, due to market limitations reducing the coast of Canadian crude Saskatchewan estimates, this revenue loss is even greater.

On April 23, the price-per-barrel for American oil was $68.36 based on WTI Crude. The Canadian Crude Index was $49.28.

With this price difference, Saskatchewan says lost resource revenue is $210 million, and the Saskatchewan oil industry cost is $2.6 billion in uncaptured value annually.

Comments

Want to discuss? Please read our Commenting Policy first.