A T4 is often a source of “tax envy.” Regardless of how much or how little you made during the year, having a T4 likely means your taxes will be relatively easy.

No fumbling around with shoe boxes full of invoices and expenses, like your self-employed peers. All or most of your pre-tax income and the taxes you already paid on it are neatly captured on a single piece of paper.

READ MORE: Canada’s 2018 tax season: 6 things you need to know

A T4 is the tax form you should receive every year if you’re a salaried employee. It contains a lot of information, including how much you’ve contributed to the Canada Pension Plan (CPP) and Employment Insurance (EI), and it’s your employer who has to take care of filling it out.

READ MORE: 3 of the tax mistakes you’re most likely to make, according to the CRA

But that doesn’t mean you should pass on that slip to your accountant without a second thought, said Lisa Gittens, senior tax professional at H&R Block Canada. Even if someone else is doing your taxes, you are responsible for making sure that the information in your T4 is correct. You’ll likely be on the hook for any tax mistakes based on a wrong slip.

And if you’re filing your tax return on your own, you may miss some important tax deductions if you don’t know what each box means.

Below are some of the things you should pay attention to when you receive a new T4.

SIGN UP: For more tax season tips, sign up for Erica Alini’s new Money123 newsletter

The income you see on your T4 may be higher than your regular pay

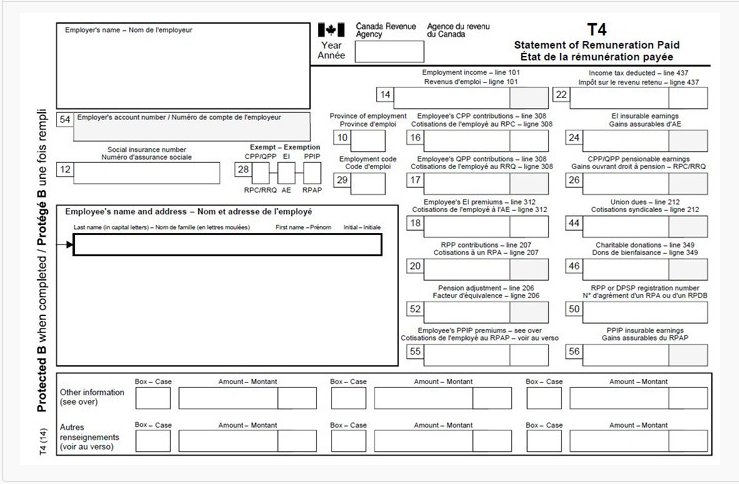

A T4 slip looks like this:

Box 14 shows the sum of your regular paycheques as well as other employment income you may have received, such as bonuses. It will also include some taxable benefits provided by your employer, such as transit passes or a membership in an offsite gym.

To figure out what’s happening, check the bottom of your tax slip, where employers report additional information with codes that relate to any number of things like employment commissions and fishers’ income. Most taxable benefits will show up under the code 40, according to H&R Block.

Get weekly money news

WATCH: These are three tax deductions Canadians often forget to claim

A lot of information on your T4 can help you lower your taxes

Know what else often appears in that bottom rectangle of the T4? Any medical insurance premiums you have been paying as part of your company plan. Your employer will record that amount with the code 85, and the good news is it counts as a tax-deductible medical expense.

Box 20 is another one that will reduce your taxable income. This is where employers report your contributions to a company pension plan, also known as Registered Pension Plan, or RPP. RPPs are set up by businesses to provide pensions to their employees. Usually, both employees and employers make contributions to the plan. However, only your employee contributions will lower your taxable income.

READ MORE: Self-employed? Here are 6 steps to get your taxes right

Total contributions to your RPP, if you’re lucky enough to have one, appear in box 52. The amount your employer paid for your pension is equal to box 52 minus box 20. RPP contributions lower the amount you can put into your own Registered Retirement Savings Plan (RRSP). Box 52, then, also reflects the amount by which your RRSP contribution room is reduced.

Box 44 shows union dues, another thing you can claim on your return. However, employers will record a number in there only if they’ve been deducting union dues through payroll deductions, said Gittens. If that’s not the case, you’ll get a tax receipt from your union or professional organization. Union dues are often tax deductible, with some caveats.

Box 46 shows any charitable donations you’ve made through payroll deductions. You won’t get a receipt for those, but you can claim the amount in box 46.

WATCH: Here are eight things you need to know to get through tax season pain-free.

Is that really your SIN?

Double-checking your T4 is always a good idea. In particular, make sure the Social Insurance Number (SIN) you see on the T4 is the same as your current SIN card. If you spot a mistake, ask your company to issue an amended T4.

READ MORE: Here’s what taxes can do to your savings if you’re not careful

Gittens she has seen SIN mishaps where fathers and sons with similar names working at the same company were issued tax slips that carried the same SIN. And newcomers to Canada should also watch out for potential mistakes. Anyone switching status from temporary worker to permanent resident will get a new SIN and should make sure both their employer and the CRA have the new number on record, said Gittens.

Did your company actually misreport your pay?

Finally, make sure your T4 reflects your actual remuneration for the year. Although errors of this kind don’t happen very often, if the CRA discovers your employer has under-reported your earnings, you’ll have to answer for it. You’ll have to pay any taxes you still owe, plus interest, said Gittens.

SIGN UP: For more tax season tips, sign up for Erica Alini’s new Money123 newsletter

Comments

Want to discuss? Please read our Commenting Policy first.