The B.C. government will be exempting vacation homes from the speculation tax that comes into effect this year. Finance Minister Carole James says she has heard the concerns of British Columbians and has decided to exempt homes in remote areas and that are on smaller islands in and around the Capital Regional District.

“Ninety nine per cent of British Columbians will not pay the tax,” said James. “The speculation tax focuses on people who are treating our housing market like a stock market. So people in smaller communities, those with cottages at the lake or on the islands, will not pay this tax.”

“If there was one issue that has dominated the conversations that I, our government and all British Columbians have been having it is the issue of housing of affordability. It’s a crisis for British Columbians.”

The government announced on Monday that it will change the rate of the tax. Those living outside of Canada and not paying taxes here will pay two per cent on the assessed value of their home starting in 2019 if the property remains empty. Canadians that do not live in British Columbia will pay a tax of one per cent starting next year. British Columbians that own multiple homes, and keep them empty, will pay 0.5 per cent tax.

There will be exemptions for those who own properties in buildings that do not allow rentals.

“We are working on the specifics at temporarily grandfathering in those who live in stratas that refuse to allow rentals because, again, we recognize that there are some exemptions where people are not able to rent out their properties,” said James.

- Alberta to overhaul municipal rules to include sweeping new powers, municipal political parties

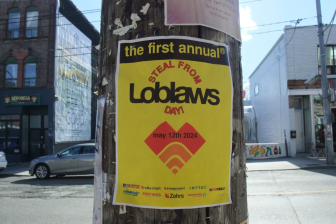

- Grocery code: How Ottawa has tried to get Loblaw, Walmart on board

- Military judges don’t have divided loyalties, Canada’s top court rules

- Norad looking to NATO to help detect threats over the Arctic, chief says

The tax will apply to Metro Vancouver, the Capital Regional District (excluding the Gulf Islands and Juan de Fuca), Kelowna, West Kelowna, Nanaimo-Lantzville, Abbotsford, Chilliwack and Mission. Nanaimo, Kelowna and West Kelowna have asked the provincial government to be exempt from the tax.

West Kelowna Mayor Doug Findlater believes the latest move will hamper development in the city, which he says has contributed to the improvement of the area’s infrastructure.

“New development expands our tax base and has been significant. We collect DCC’s, which are Devlopment Cost Charges from them, and when a new development goes in, we ask them to do all kinds of other things such as fixing up a road, and an intersection here and there.”

Findlater is hoping it’ll still be able to plead its case with the government, and will eventually be granted an exemption.

WATCH: Kelowna city council takes action against the speculation tax

James says those exemptions will not be granted.

“We have focused the geographic areas so this tax only applies in urban housing markets hardest hit by this crisis,” said James. “With so many people desperate to find good homes in these urban areas, we need to take every step we can to free up and create more housing opportunities.”

“We feel like we have an obligation to address the affordability and Kelowna and West Kelowna are two of those areas that are facing an affordability crisis.”

The exempt communities include Bowen Island, Cultus Lake, the Gulf Islands, Parksville and Qualicum Beach. Whistler was never included in the speculation tax and remains exempt as a resort community.

Starting this year the tax will be assessed at 0.5 per cent of a vacant property’s assessed value, before climbing in 2019 for everyone outside of British Columbia. The province is projecting it could bring in $200 million annually starting next year.

Starting this year the tax will be assessed at 0.5 per cent of a vacant property’s assessed value, before climbing in 2019 for everyone outside of British Columbia.

Andrew Melton is an Alberta man who has owned property in West Kelowna for 11 years. Starting in 2019, he’ll have to pay one per cent of his property’s assessed value. While he’s happy the provincial government lowered the rate for out-of-province Canadian residents from the initially proposed two per cent rate, he believes the tax is still “extremely offensive and mean-spirited.”

“What are they trying to do? Is this tax designed to make housing more affordable? If that’s the case, they’re going about it all the wrong way,” Melton said.

But the opposition does not believe that the province can hit its targets given all the exemptions. Liberal leader Andrew Wilkinson says around 48,000 homes would have to pay the tax to get to the target of $200 million calling today’s announcement “tax policy by trial and error.”

“There is no clear picture on where the money is going to come from. If the NDP is serious about chasing speculation they should do it with a traditional capital gains tax. What they are doing is saying give us part of your assets, give us part of your savings,” said Liberal leader Andrew Wilkinson.

James says her government is still working on the legislation that must be passed before the tax comes into effect. That legislation is expected to be tabled in the B.C. Legislature in the fall.

British Columbians with a vacant second home will be eligible for a non-refundable tax credit that will be applied against the speculation tax. The credit will offset a total of $2,000 in speculation tax payable. This means British Columbians will not pay tax on a second home valued up to $400,000.

Owners are also exempt if their property is rented out long-term. The province defines that as a home rented out at least six months of the year.

Comments