You could buy a home, or you could rent one.

In Vancouver, the return on your investment wouldn’t be much different either way.

That’s according to an analysis that looked at three properties around Vancouver and examined how much money either a renter or buyer could make over the course of 25 years.

Coverage of rentals on Globalnews.ca:

Louie Dinh is the mind behind Quantitative Rhetoric, a respected blog that provides monthly reports tallying how much it costs to rent a place around Vancouver.

His most recent post offered up a series of “Case Studies in Renting Versus Buying.”

READ MORE: Vancouver millennials need rentals. Seniors have rooms. There may be a solution here

He was motivated to do this after hearing a popular refrain among his friends, and online: “You should buy because renting is paying someone else’s mortgage.”

- 35 court dates and no trial: Family of B.C. double homicide victims frustrated by delays

- ‘Embarrassing’: Vancouver councillor calls out mayor over drugs comment controversy

- ‘Like a spelling mistake’: B.C. teen’s DNA ‘corrected’ to cure rare disease

- ‘Ghosted’: Canadians stranded in Puerto Vallarta say they are abandoned by WestJet

“Like most unsolicited advice, it’s wrong,” Dinh wrote.

Dinh searched online for properties that were for sale, and that were being rented at the same time, and chose three in total.

One was a downtown Vancouver condo, one a townhouse near Metrotown and one a single-family home in the Dunbar area.

Then, he looked at the cost of buying them, along with all the attendant expenses, against renting each one.

Dinh chose properties that are considered “typical” across the Lower Mainland, and he found that renting or buying produced “qualitatively similar results.”

“Some people responded to my post saying the comparison’s not great because you’re buying a new build, but you’re renting this old stock thing,” Dinh told Global News.

“We’re actually comparing the exact same unit.”

Get breaking National news

He then set out an analysis in which anyone buying these properties would make a 20 per cent down payment; renters in this study would take the same amount of money and investment in a stock market index fund.

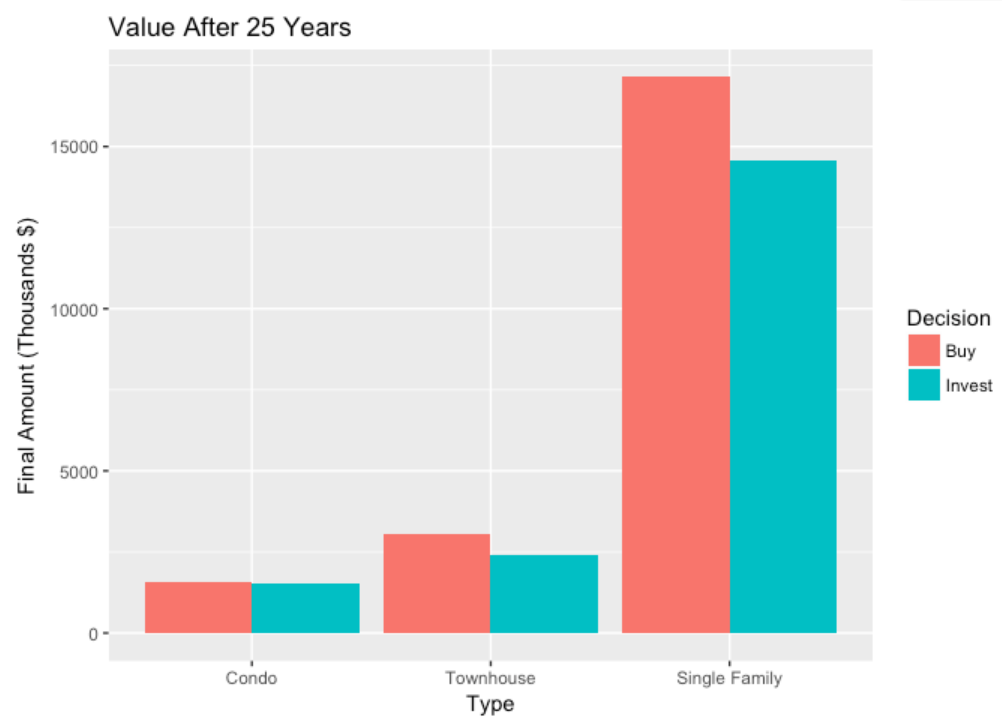

Dinh then looked at average yearly returns for condos (3.9 per cent), townhomes (4.63 per cent) and detached homes (6.69 per cent), using data from the Home Price Index for Greater Vancouver.

He also took account of average yearly returns for the stock market — eight per cent, not adjusted for inflation.

READ MORE: Rent in the city, own in small towns: Canada’s new real estate trend

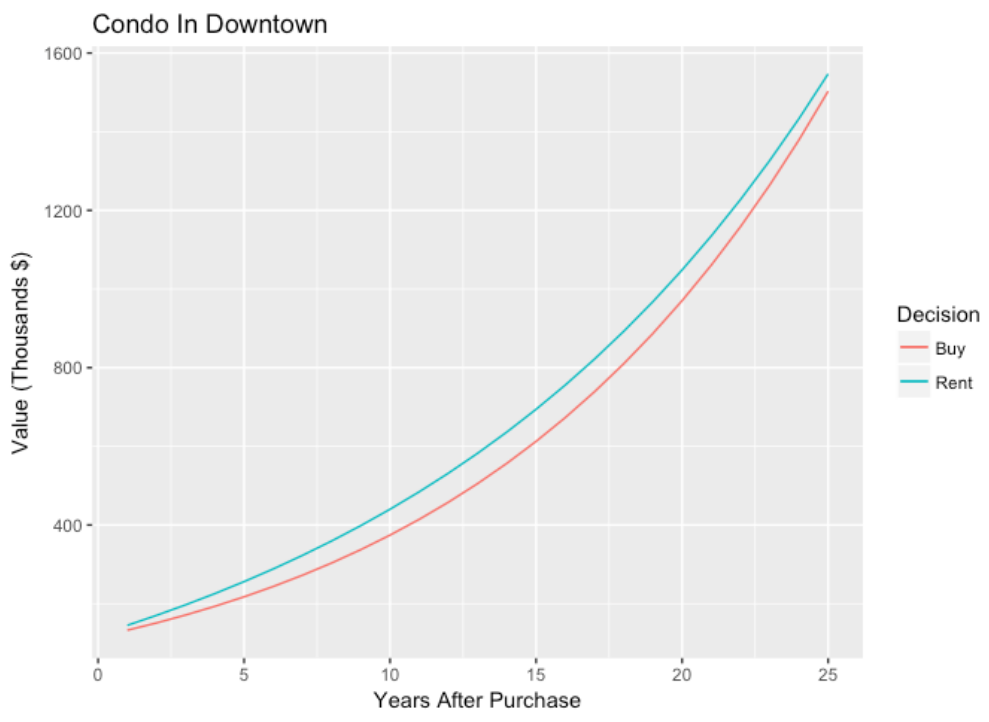

Charts produced as part of Dinh’s analysis showed the value of a renter’s or buyer’s investment over the course of 25 years.

A blue line, representing renters, indicated “what total dollar value you have in your bank account at any given time” after investing in the stock market, he said.

A red line, representing buyers, showed “how much equity you have in your house, so how much of that principal you’ve paid off,” he added.

The downtown condo that Dinh looked at was listed for sale at $600,000; it was also listed for rent at $1,600 per month.

From there, he took the amount of a 20 per cent down payment ($120,000) and charted its potential increase in value over the course of 25 years — both invested in a home, and in the stock market.

For a buyer, he took into account expenses such as property taxes and maintenance fees. Mortgage payments were kept constant.

With stock market returns growing at an average of eight per cent per year, and condo returns growing at an average of 3.9 per cent per year, there wasn’t much of a difference in value when it came to the condo at the end of the 25 years.

A condo buyer’s investment in the condo grew to $1.56 million, and a condo renter’s investment in the stock market grew to $1.55 million.

“At current price/rent levels, purchasing a condo appears to offer no benefits,” Dinh wrote.

Townhomes and detached homes were a different story.

In each case, buying such a property produced better results than renting, but it took over 15 years to realize them in Dinh’s analysis.

The person buying a townhouse near Metrotown would have seen their investment grow from $988,000 to $3.04 million, with the buyer’s returns exceeding those of the renter’s at about the 15-year mark.

The person buying the single-family home in the Dunbar area would have seen the value of their investment grow to $17.14 million over 25 years, with the buyer’s returns exceeding that of the renter’s after about two decades.

Dinh said the returns would likely differ if this analysis was carried out in different parts of the region, but he didn’t do that analysis himself.

“I haven’t looked closely at the rental numbers or the listings numbers,” he said.

“So it’s all about the ratio of how much you’re renting or buying for.”

In conducting this analysis, Dinh said he was only making projections of what these investments could look like after 25 years, and that he did so based on known figures.

But he also said, “it’s still just a best guess basis.”

Dinh’s conclusion about renting versus buying was “reasonable,” said Thomas Davidoff, a professor who focuses on housing at UBC’s Sauder School of Business.

He said there’s not much certainty around what will happen to people’s investments outside housing, as well as what home prices could look like in the future.

READ MORE: Should you rent or buy? This real estate calculator will help you decide

As for renting versus buying, Davidoff said, “one would expect that given the tax preference to owning, for a rich household, in the long run, owning would be superior.”

But with home prices where they are in the Vancouver area, “I am not surprised by the result.”

“We do not know how home prices or other investments will perform going forward,” Davidoff said.

“Roughly similar performance is not a crazy outcome, given we know that some people own and others rent.”

Comments

Want to discuss? Please read our Commenting Policy first.