There are just under 8,500 empty or under-utilized homes in Vancouver, according to the city’s Empty Homes Tax.

The figure amounts to just under one-third the 25,495 unoccupied or non-resident occupied homes the city identified in a report to council last summer, using census data.

Another city report produced in 2016 came closer to Wednesday’s figure, finding 10,800 non-occupied housing units left empty for a year of more.

The new number comes from the City of Vancouver’s new Empty Homes Tax (EHT) department, which says it collected property declarations from 98.85 per cent of homeowners in the city by its March 5 deadline.

That deadline was extended in February after more than 7,000 people missed the original date.

On Wednesday, the city said it collected a total of 183,911 submissions, of which 177,562 were occupied. It said 6,349 were declared vacant — some with exemptions. And 2,132 were homes for which the owner did not fill out the paperwork, and thus were deemed vacant by the city.

WATCH: Census figures estimate up to 25,000 empty homes in Vancouver

Under the EHT, homeowners can apply for exemptions for a number of reasons, including renovations, title transfer, hospital stays or long term or supportive care.

Get breaking National news

The city says properties that were declared or deemed vacant will get a tax bill in mid-march, with payment due by April 16.

However we won’t know how much the program raised until next fall, when a report will go to city council.

Where are the empty homes?

According to the city, more than 60 per cent of the empty or under-used properties were condos, just over 33 per cent were detached houses and nearly six per cent were multi-family homes.

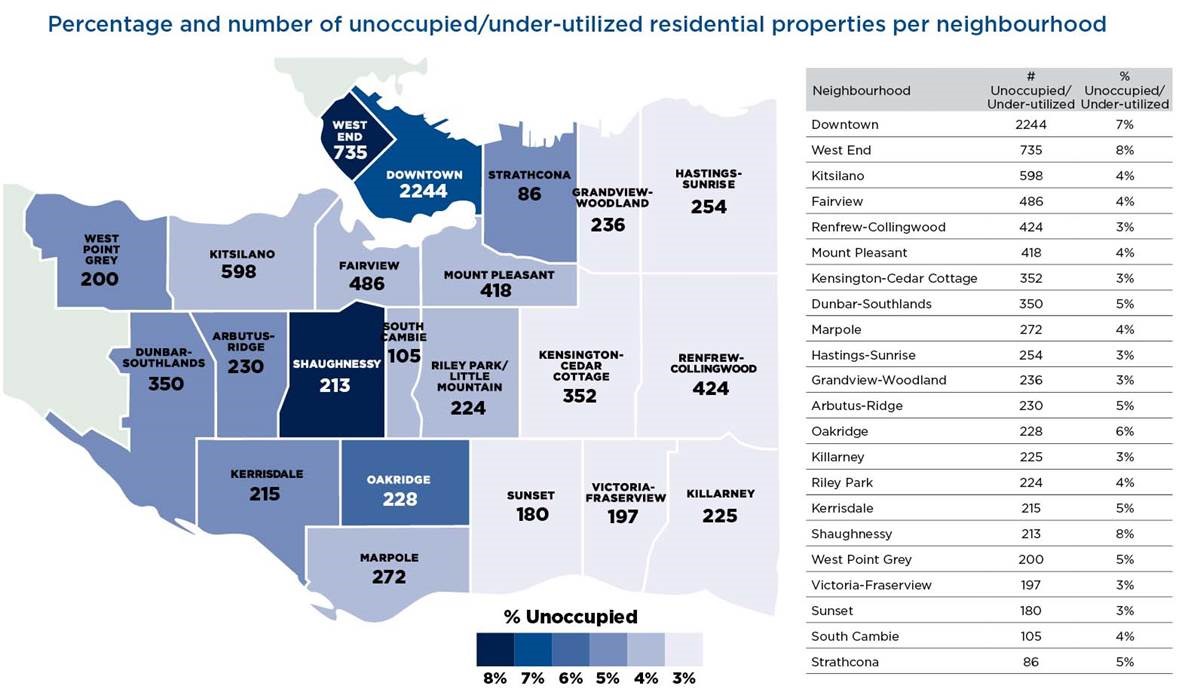

Shaughnessey and the West End had the highest percentage of taxable properties, at eight per cent each, followed by downtown (seven per cent) and Oakridge (six per cent). Vancouver’s East Side had the lowest percentage with seven neighbourhoods where the figure stood at three per cent.

The city says it is also launching an audit program which will, in part, involve random audits, to verify the status of homes that have been declared as occupied.

It has also set up an appeals process for people who feel they have been incorrectly taxed. Anyone who feels they have had the tax wrongly applied to them — which may include some of the more than 2,100 homes that didn’t file paperwork — will have to wait until after their EHT tax bill comes in the mail.

They’ll then be able to file a complaint to the city’s Vacancy Tax Review Officer.

The city introduced the EHT in November 2016 in a bid to free up rental housing stock, with the rental vacancy rate hovering around one per cent.

Under the tax, homes that are unoccupied for more than 180 days a year are subject to a tax of one per cent of their assessed property value.

The implementation of the tax has been controversial, with some critics arguing it unfairly penalizes people who own two homes.

However, at least one urban planner thinks the 1 per cent tax will send the right message.

“If you decide to park your money in Vancouver, you’re going to start paying for the maintenance of the lot,” said Andy Yan, the director of Simon Fraser University’s (SFU) City program.

“Really for where we are, it does attract a certain type of money into the city and into residential real estate.”

He said housing is a human need, and they’re going to take advantage of the money coming in to Vancouver to house Vancouverites.

- With files from Global News reporter Emily Lazatin

Comments

Want to discuss? Please read our Commenting Policy first.