The B.C. NDP unveiled an ambitious slate of actions to tackle the province’s housing crisis in its budget on Tuesday.

They were introduced in a 30-point plan that included a speculation tax, an increased reach for the province’s foreign buyers’ tax and a registry to capture the ownership of pre-sale condos.

Coverage of the B.C. budget on Globalnews.ca:

In announcing these actions, the provincial government stressed that they would help to increase affordability by “stabilizing” prices, not necessarily lowering them.

Data analysis suggests measures like these could help to moderate prices; but lowering them for a considerable period of time could prove elusive.

Speculation tax

The speculation tax is the housing measure that’s gaining much of the attention; it’s a measure, expected to be implemented in the fall, that’s targeted at domestic and foreign homeowners who “do not pay income tax in B.C.”

- RCMP say investigation of shooting at Tumbler Ridge Secondary School completed

- B.C. 2026 budget ‘neither’ big cuts nor tax increase, minister says

- Former Conservative leader John Rustad says he’s not running for his old job

- Parts of B.C.’s South Coast set to see snow-rain mix with ‘rapidly changing’ travel conditions

It’s a property tax that would be charged at $5 for every $1,000 of assessed value this year, climbing to $20 per $1,000 of assessed value next year.

B.C. would enforce the tax by directing homeowners to an electronic tax form on the Ministry of Finance website.

There, they would be asked to provide the following:

- Social Insurance Number (SIN)

- Information on global income

- Household information

- Information on exemptions from the tax (you won’t have to pay it if your home is your principal residence, in most cases)

- Any other information that the Ministry of Finance may find useful for enforcement and auditing purposes

This information would then be sent along to the Canada Revenue Agency.

The tax is a welcome measure for Joshua Gordon, a public policy professor at Simon Fraser University (SFU).

“What that does is it addresses the crux of the dynamic in Vancouver, which is that people with foreign income and wealth have been able to buy property and enjoy the amenities of Canadian society without paying their fair share of income taxes,” he told Global News.

“The speculator tax promises to at least mitigate that dynamic.”

In the past, there were concerns that new measures introduced in an effort to calm B.C.’s soaring prices wouldn’t necessarily apply to everyone.

The 15 per cent Property Transfer Tax on foreign buyers, for example, doesn’t apply to people who have landed in the province via the Quebec Immigrant Investor Program (QIIP).

That’s one of a number of programs that provides immigrants with a path to permanent residency; as permanent residents, taxes on foreign residents don’t apply to them.

READ MORE: How over 46,000 wealthy immigrants took a back door into Vancouver and Toronto’s housing markets

Get daily National news

And research has shown investor immigrants declaring lower incomes than refugees.

The speculation tax would capture their properties, forcing them to pay as much as $5,000 on a home assessed at a value of $1 million.

“The fundamental point here is, this is a measure that helps reconnect the housing market to the local labour market by discouraging ownership by people who aren’t making income locally,” Gordon said.

“That’s been a major feature of the Vancouver housing market, and they have now tackled that.

“Because of the coordination with the CRA, it is very hard to evade, and so this is a tax that is likely to have a big impact.”

Foreign buyers’ tax

The speculation tax was only one of the demand-side measures that was promised in the budget.

The budget also unveiled changes to the foreign buyers’ tax that included raising it from 15 per cent to 20 per cent, and applying it to areas such as the Fraser Valley, Kelowna, West Kelowna and the Nanaimo and Capital Regional Districts, including Victoria.

The effectiveness of the foreign buyers’ tax has been questioned since it was first implemented in August 2016. Critics have said it has had “zero impact” on affordability.

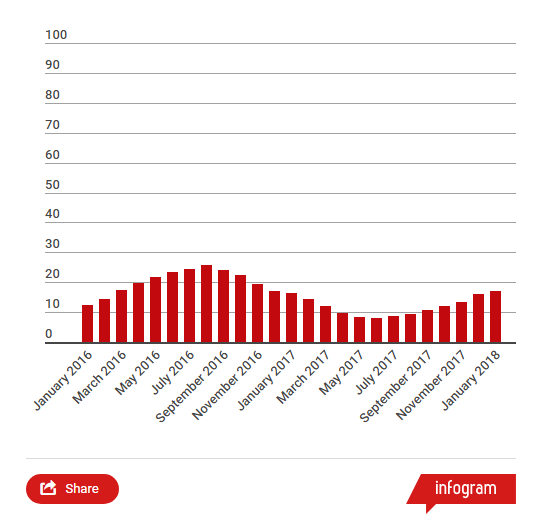

Data from the Teranet-National Bank House Price Index shows that home prices didn’t drop substantially with the tax’s introduction. But annual price increases moderated once it came into effect.

This chart shows annual home price increases in Vancouver, by percentage, from January 2016 to January 2018, using data from the Teranet-National Bank House Price Index:

Andy Yan, director of the SFU City Program, said the foreign buyers’ tax is all about “capturing value for the B.C. taxpayer.”

“People have always talked about Vancouver being a parking lot for global foreign money,” he told Global News.

“I’m always of the belief that we should also increase our parking fees, and this is a means of increasing those parking fees.”

Yan said the decision to extend the tax to areas beyond Vancouver comes in an effort to capture the “ripple effect of what’s happened.”

“Global money has now spilled over,” he said.

“It originally began in a few neighbourhoods, west side Vancouver, West Vancouver and Richmond, to really ripple out into the rest of the region.”

Affordability has steadily eroded in Victoria in the past two years, RBC noted in its Housing Affordability Report for December 2017.

RBC measures affordability by taking ownership costs as a share of household income.

By that measure, a Victoria household would have had to put 61.5 per cent of its income toward mortgage payments in order to afford a house there in the third quarter of 2017.

Gordon measured the foreign buyers’ tax’s effectiveness by looking at what it prevented.

“Just because prices didn’t fall dramatically doesn’t mean it didn’t have an impact,” he said.

“In its absence, prices might have skyrocketed, where they were at least moderately tamed.”

The latest move, to increase and extend the foreign buyers’ tax, shows that “foreign buying is going to be curtailed and the government is serious about achieving affordability,” Gordon added.

“This is now, again, a clear indication to the market that they want prices to come down.”

Pre-sales registry

The 2018 B.C. budget also had the provincial government committing to a registry that would record contract assignments in the condo pre-sale market.

When Statistics Canada released its study on non-resident ownership of Vancouver and Toronto housing in December 2017, Yan noted that the numbers didn’t account for pre-sales, which see people sell contract assignments for a condo unit before it’s finished construction.

READ MORE: Foreign buyers may not live in Vancouver, but their money sure does: StatsCan

This process can inflate prices and result in owners “not necessarily paying the appropriate tax,” the government noted.

Now, the provincial government will require developers to disclose information about pre-sale assignments so that owners pay their “fair share of taxes.”

This information will also be shared with federal and provincial tax authorities to ensure that the proper taxes are being paid.

The budget indicated that information from the database will be reported to a “designated provincial office.”

But Yan hopes it will be disclosed publicly for transparency’s sake.

“Making it available for researchers and… journalists, that would be the opportunity for who watches the watcher,” he said.

The registry, Yan said, can offer the “opportunity to understand what are the ownership dynamics.”

READ MORE: Vancouver developers want more townhomes. Critics say they’ll just be sold overseas

Gordon said the registry will allow tax authorities to match pre-sale flippers up with tax data — and in so doing, “find out who is buying in the pre-sale market.”

“I think it will discourage some of that problematic behaviour,” he said.

Comments

Want to discuss? Please read our Commenting Policy first.