New Brunswick is set to introduce legislation that will freeze property assessments for one year as the fallout of a scandal that left thousands of property owners with improper or inflated tax bills continues.

The legislation will mandate that property assessments will remain at 2017 levels for the 2018 taxation year — with a few exceptions.

READ MORE: Three major N.B. cities reject governments proposed solution to tax assessment freeze

New construction related to a building permit, new construction without a building permit, errors or omissions of property data resulting in a correction to the 2018 valuation, real estate transactions, changes in current use of the property and decrease in property value based on market forces will not receive the same valuation as 2017.

“We believe that an assessment freeze is the responsible choice that allows time to resolve issues pertaining to governance, assessment methodology, project management and quality assurance within Service New Brunswick,” said Service New Brunswick Minister Serge Rousselle.

The legislation follows last month’s announcement that the province would increase community funding by $265,000 in light of the tax assessment freeze.

That means $74.9 million in community funding and equalization grants will be doled out to municipalities, rural communities and local service districts in the coming year.

WATCH: NB government increases community funding in light of property tax assessment freeze

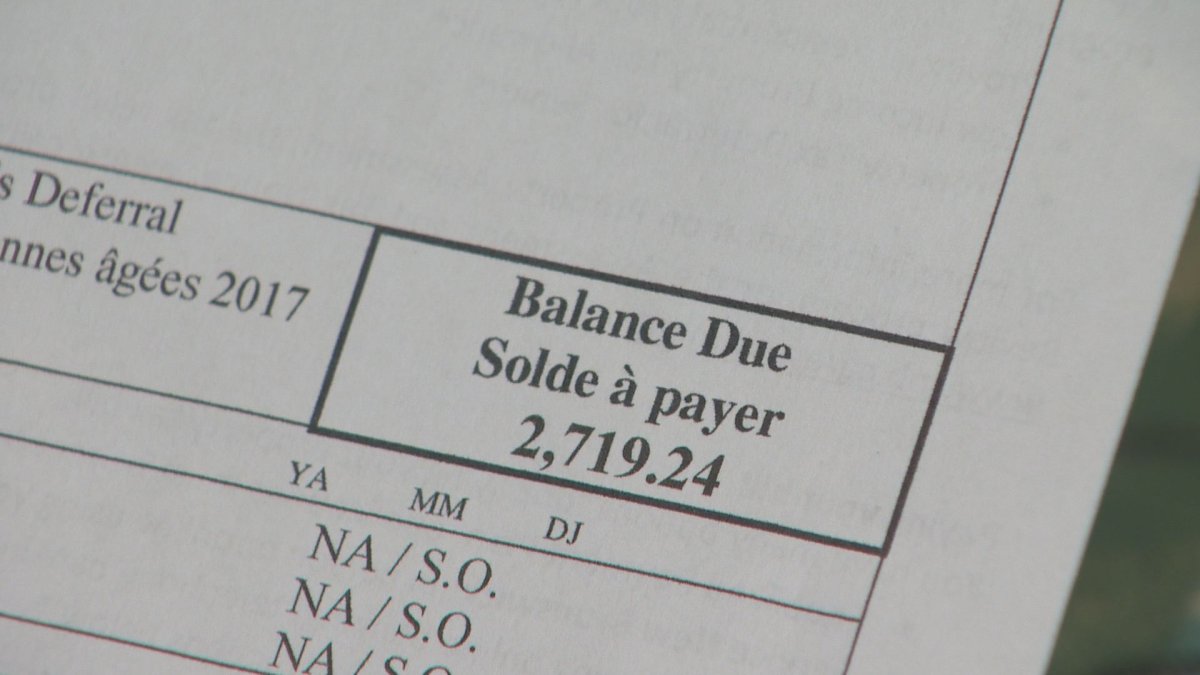

In March 2017, a whistleblower alleged that more than 2,000 property owners were given improper and inflated tax bills. In one case, a newlywed couple said they were stunned when their property’s assessed value doubled to $347,000 from about $170,000.

The province’s auditor general, Kim MacPherson, found that miscommunication played a key role in moving forward on new processes that caused thousands of assessments to unnecessarily inflate.

Comments