The Tri-Cities Partnership, an organization consisting of the municipal governments of Moncton, Fredericton, and Saint John, has come out strongly against the province’s proposed solution to a property assessment freeze — and called for a stronger dialogue between municipalities and the province.

On Tuesday, New Brunswick’s minister of local government announced the province would provide financial assistance to any municipalities that face a decrease in revenues caused by the province’s decision to freeze property tax assessments.

Serge Rousselle said his department will work with each local government on a case-by-case basis.

But the three cities say that’s just not good enough.

“Due to the wide reach of assessment freeze impacts, the assistance offer should benefit all communities and not be delivered on a case-by-case basis,” the Tri-Cities Partnership wrote in an open letter.

Municipalities often rely on the figures from property tax assessments to calculate their own budgets as well as make long-term plans.

“All municipalities in New Brunswick will have to make difficult decisions during the 2018 budget process,” wrote the organization.

WATCH: New Brunswick homeowners still concerned despite promise of property tax assessment fix

The province’s Liberal government announced the freeze in June, hoping to contain a festering scandal involving what the premier said were thousands of errors that started in 2011.

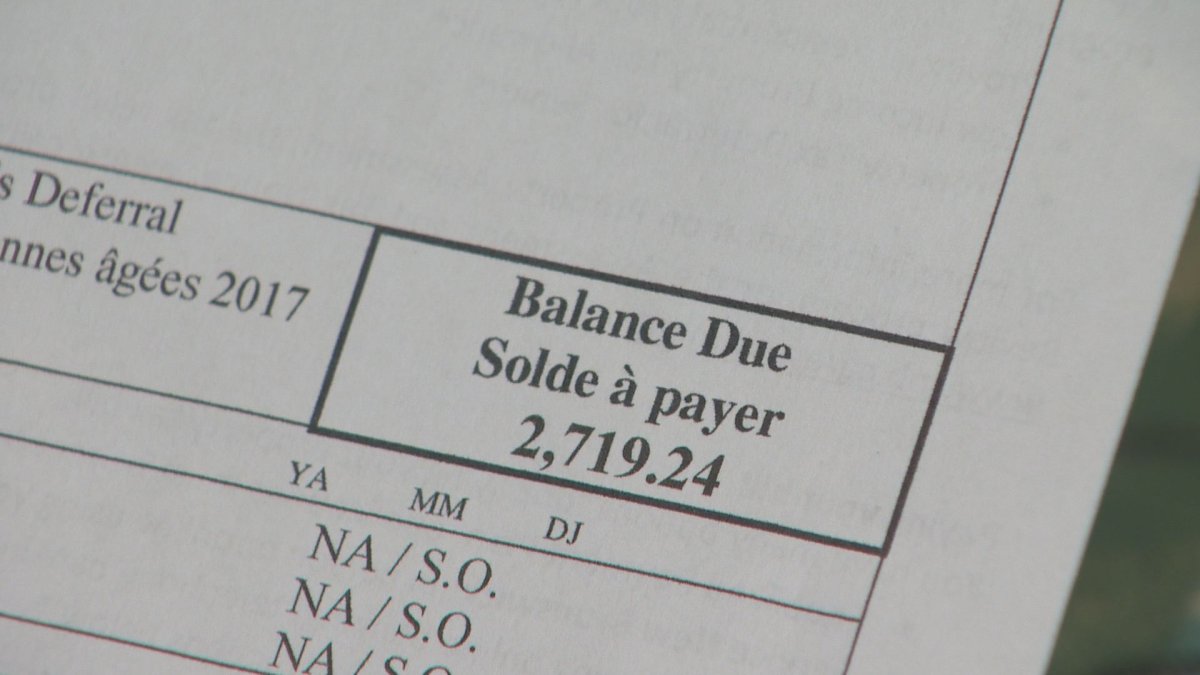

A whistleblower alleged in March that more than 2,000 property owners were given improper and inflated tax bills – some double the amount from the previous year.

Auditor general Kim MacPherson is reviewing the system and is expected to release a report later this year.

— With files from The Canadian Press

- Alberta to overhaul municipal rules to include sweeping new powers, municipal political parties

- Grocery code: How Ottawa has tried to get Loblaw, Walmart on board

- Military judges don’t have divided loyalties, Canada’s top court rules

- Canada, U.S., U.K. lay additional sanctions on Iran over attack on Israel

Comments