A new campaign is taking aim at the amount of tax Canadians pay on alcohol, and hoping to put the brakes on future increases.

Launched by the Canadian Taxpayers Federation, the “no escalator tax” campaign centres around a move by the Trudeau Liberals to hike federal liquor taxes by two per cent this year, and hike it every year after, in-line with inflation.

That annual automatic “escalator” tax has Canadian Taxpayers Federation federal director Aaron Wudrick fuming.

“What it means is that the tax on alcohol, your wine, beer, spirits, is going to go up automatically. They don’t have to come back and announce it in the budget,” said Wudrick on CKNW’s The Steele & Drex Show.

“We think it’s important that if governments want to raise taxes that they should come back to the public every year and take the heat for it, and make the case for it.”

Get daily National news

Wudrick said the government has tried to “bury” the increase, which he argued could set the precedent for automatic tax hikes in other areas.

WATCH: New B.C. liquor reforms resulting in higher prices

Canadians already pay a significant amount of tax on the liquor they buy: according to Wudrick, up to 80 per cent on spirits, 65-70 per cent on wine and 50 per cent on beer.

The actual amount of tax consumers pay varies depending on what province they live in, and is multi-layered.

Federal excise tax — the tax the campaign is targeting — is calculated using a complex formula that varies by product and alcohol percentage.

Excise taxes are paid by the producer, who usually then build it into their prices.

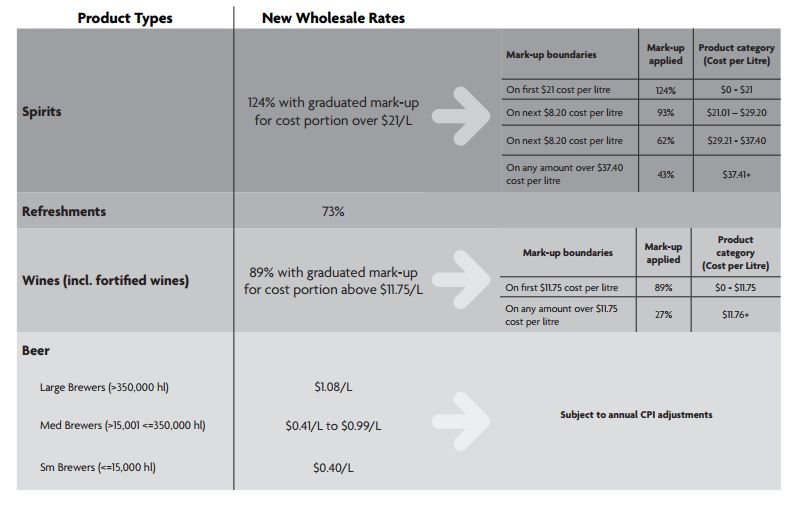

In B.C., provincial liquor taxes are applied by the Liquor Distribution Branch (BC LDB), which calls them a “mark-up.”

That tax is calculated based on several factors; for beer it depends on the size of the brewery, while wine and spirit taxes are graduated based on the cost of the product per-litre.

British Columbians also pay GST, PST, and any duties applied to imported products.

In the 2017 federal budget, the governing Liberals said the change was needed because excise taxes had not increased since the 1980s, and hence represent “a smaller and smaller proportion of the total price of alcohol products, reducing their effectiveness.”

It’s an argument Wudrick rejects.

“It’s not objective to raise taxes,” he said.

“There’s no law of the universe that says your taxes have to go up every year automatically. It’s a political choice.”

Comments