Lots of Canadian business owners say they’re worried about a package of tax reforms that have been introduced by the federal Liberals.

But plenty of them also say they don’t expect much of an impact from certain changes, according to a poll released by the Angus Reid Institute this week.

Coverage of the federal government’s business tax reforms on Globalnews.ca:

The Liberals have introduced tax reforms that would, among other things, limit the practice of “income sprinkling,” which involves paying income to family members, even if they don’t work for the business, so that business owners can avoid paying higher taxes.

Another reform relates to “passive income,” or money that’s been saved by a business in banks, stocks or other investments. The Liberals’ reforms include an additional tax on this income when it’s paid out as dividends.

READ MORE: Trudeau’s tax reforms: here’s how the loopholes work

The poll, which derived its results from over 850 small business owners and over 1,000 non-business owners, didn’t find too many entrepreneurs willing to say that the tax reforms would have positive impacts.

But 42 per cent of respondents said the changes would be negative, while 43 per cent said they wouldn’t have any impact at all.

Income sprinkling and passive income

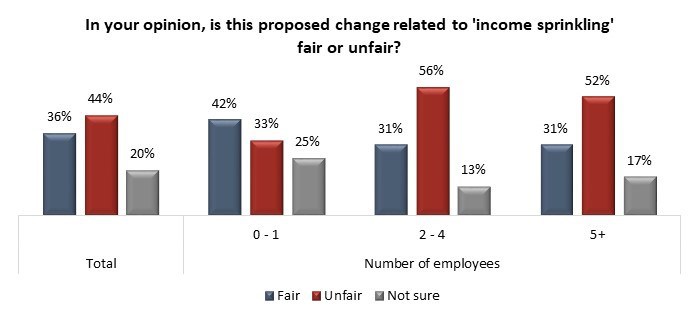

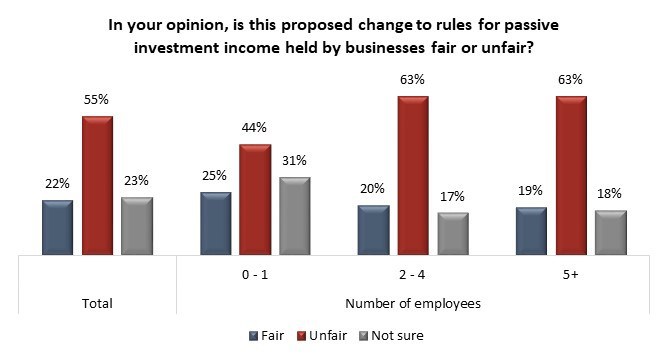

The divergence in opinion was much clearer when looking at specific reforms, however.

A majority of small business owners (63 per cent) said the changes to income sprinkling would not affect them, while 24 per cent said that change would be negative.

Get daily National news

Meanwhile, 42 per cent of them said that the changes to passive income would bring negative impacts, compared to 43 per cent who said it wouldn’t have any impacts at all.

The survey also found a relationship between the size of one’s business and their feelings about the reforms — though again, respondents felt stronger about passive investment than they did about income sprinkling.

When it came to passive income, 44 per cent of respondents who owned small businesses with no more than one employee felt the changes were unfair. That rose to 63 per cent for business owners with two to four employees, and 63 per cent of business owners with five or more employees.

That trend wasn’t as obvious when it came to income sprinkling. Out of respondents who ran businesses with up to one employee, 33 per cent said they saw changes to income sprinkling as unfair, while 42 per cent of this group said they were fair.

Meanwhile, among people who ran businesses with two to four employees, 56 per cent said the changes to income sprinkling were unfair, compared to 31 per cent who said they were fair.

Opinions about the tax reforms also varied by political affiliation.

The strongest support for the changes was found among past Conservative voters; 68 per cent of them said they would hurt investment, while 42 per cent of past Liberal voters felt this way, compared to 45 per cent of past NDP voters.

Only 32 per cent of past Conservative voters said the changes would make the tax system more fair, compared to 58 per cent of past Liberal voters and 55 per cent of past NDP voters.

READ MORE: Reality check: will closing tax loopholes for the rich really help the middle class?

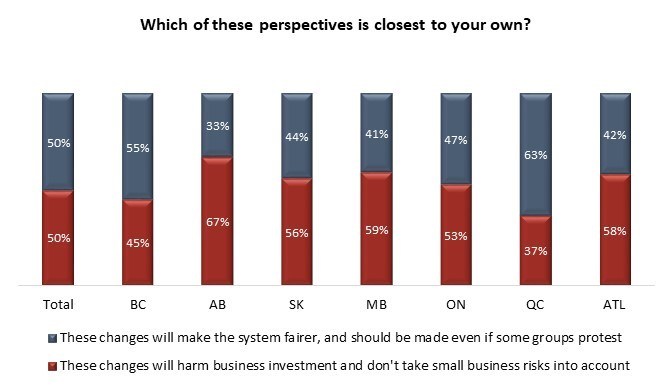

Support varied by province, too.

The strongest support for the reforms was found in B.C. and Quebec, where it was 55 per cent and 63 per cent, respectively.

In every other province, most respondents felt the changes would be harmful.

METHODOLOGY: The Angus Reid Institute partnered with MARU/Matchbox to conduct an online survey from September 13 – 18, 2017, among a representative randomized sample of 1,988 Canadian adults who are members of the Angus Reid Forum. The sample plan included a boosted sample of 852 small business owners, as well as 1,139 non-owners. For comparison purposes only, a probability sample of non-owners of this size would carry a margin of error of +/- 2.9 percentage points, and a probability sample of business owners of this size would carry a margin of error of +/- 3.4 percentage points, 19 times out of 20. Discrepancies in or between totals are due to rounding. The survey data were donated by MARU/Matchbox. Detailed tables are found at the end of this release.

Comments

Want to discuss? Please read our Commenting Policy first.