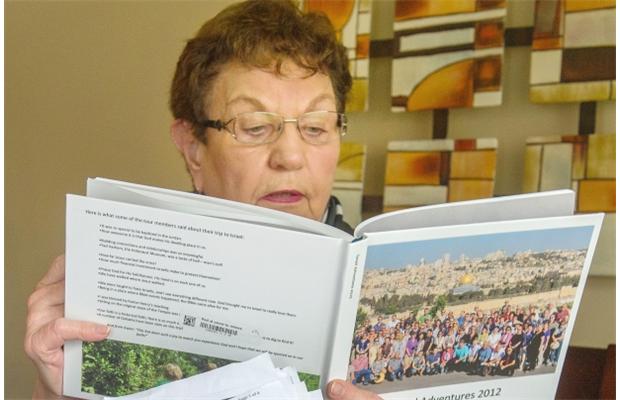

Frieda Schramm wouldn’t dream of travelling outside Canada without travel insurance.

So when she was hospitalized with internal bleeding while touring Israel last May, she wasn’t concerned about the cost of the doctors, the tests, the X-rays and the gastrointestinal scope that eventually found a large ulcer that had been bleeding.

In fact, the Abbotsford senior was tickled to be experiencing health care at a Jerusalem hospital that claimed to have a “direct line to God above.”

That changed when Schramm tried to leave.

The hospital required payment before she could check out, and her travel insurance company, which had previously assured her the bill was covered, was unable to issue payment upon learning the B.C. Medical Services Plan was the primary insurance provider.

MSP COVERS $75 A DAY

According to the B.C. Hospital Insurance Act, out-of-country hospital stays are covered for B.C. residents at a rate of $75 a day — a sum that amounts to “peanuts,” in the words of Schramm, whose hospital stay in Israel cost about $800 a day.

The 70-something senior is questioning why B.C. spent more than $9 million last year reimbursing travellers for out-of-country physician and hospital services at a rate so low it would be little help to the rare traveller who does not carry private travel insurance.

The widow believes the government should leave travel insurance to private insurers and use the savings on provincial health care — a policy that would have saved her a costly bureaucratic nightmare.

“If I didn’t have an ulcer already, I’d certainly have one now,” she says.

Because MSP was Schramm’s primary insurance provider, her private travel insurance provider — an American company recommended through her tour group — could not do anything for her until the provincial plan paid its portion.

The hospital was unable to reach MSP before she checked out, forcing her to put the $8,000-plus hospital bill on her credit card.

She was also forced to charge her hotel room and her flight home the next day.

In total, Schramm put $15,000 on her credit card — money that would not be reimbursed until November when she received a cheque from MSP for $686.68, followed by the remainder from her travel insurance provider.

OUT $1,112 IN EXCHANGE FEES

Schramm says she could have been bankrupted by the system if she didn’t have the savings to pay off her credit card bill while waiting for reimbursement. Although the money eventually arrived six months later, she’s still out $1,112 for exchange fees that aren’t covered by either plan, which would never have been incurred if MSP was not involved.

Schramm says that before her travel insurance provider realized she had MSP coverage, she was told everything would be covered immediately. The company faxed the hospital a few forms, they faxed back original receipts for the lab tests, and everything was going smoothly.

But after MSP became involved, she was left to complete the process herself at home in Abbotsford.

MSP faxed a ream of forms that needed to be completed and returned with original, translated receipts. Instead of resting, Schramm worked well into the night to finish them.

B.C. Health Minister Margaret MacDiarmid was not available for an interview, but her ministry provided a statement to The Province saying MSP will “help” to cover treatment anywhere in the world, as long as it is “medically required, rendered by a licensed physician and normally insured by MSP.”

In 2011/2012, MSP paid more than $3.5 million for out-of-country emergency physician services and $5.6 million for non-physician out-of-country hospital services.

The portability requirement of the Canada Health Act says Canadians must be covered by their provincial health plan while travelling within Canada, as well as outside the country.

However, the amount the province must pay for out-of-country care is limited. Unlike in-country health care, out-of-country services are covered at home-province rates, and federal transfer payments cannot be used.

According to the B.C. Health Ministry, when care is provided outside Canada, the province must determine how much it can afford to pay, while keeping the health care system “fiscally sustainable.”

CANADIAN AGREEMENTS TO PAY

Mike Starko, managing director of Richmond-based One World Assist, said his company has an agreement with MSP and other provincial health plans that allows the insurance company to pay for clients’ claims directly, and in full, while they are in hospital.

The client simply fills out a form that permits the insurance company to claim back the portion that MSP would pay, eliminating the need for the client to deal with the provincial plan altogether.

While many Canadian travel insurance companies have agreements with MSP, American and international companies often do not, setting into motion the arduous process experienced by Schramm.

The senior was one of scores of people who responded to The Province’s call for readers to share their stories of inefficiencies and waste in B.C.’s health-care system.

She doesn’t understand why MSP covers out-of-country expenses at all, since Canadians travelling outside the country would be wise — and, in fact, are advised by the B.C. Health Ministry — to carry travel insurance.

“The money could be used in hundreds of other needy places in the health care system and they are incurring more health costs by the nightmare this creates for people,” she says. “I had travel insurance, which was great, had MSP not ruined it and turned my entire summer — and the memory of an awesome experience in Israel and Jerusalem Hospital — into an unforgettable nightmare.”

Comments