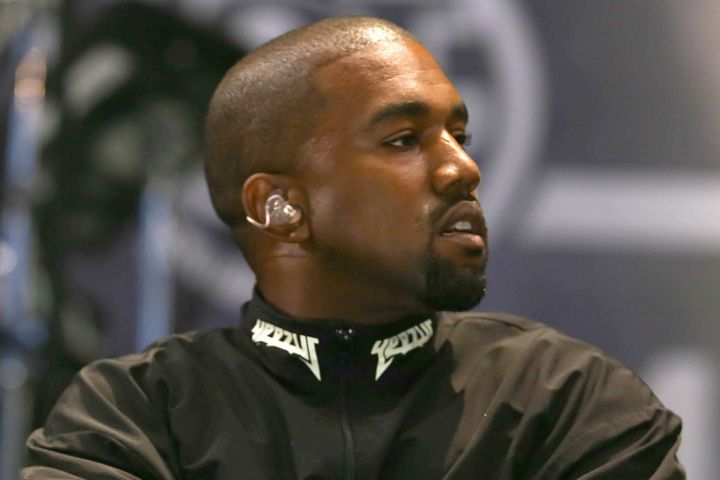

Earlier this month, Kanye West sued venerable insurance company Lloyd’s of London for $10 million over its refusal to pay out claims from his aborted “Saint Pablo” tour, which was cancelled midway through when West was hospitalized after apparently suffering a breakdown.

In his suit, West’s lawyers claim that Lloyd’s hasn’t “provided anything approaching a coherent explanation about why they have not paid, or any indication if they will ever pay or even make a coverage decision, implying that Kanye’s use of marijuana may provide them with a basis to deny the claim and retain the hundreds of thousands of dollars in insurance premiums.”

On Wednesday, Lloyd’s filed a counterclaim against West and his Very Good Touring company (VGT), with The Hollywood Reporter noting that the suit outlines “insurance policy exclusions pertaining to a pre-existing psychological condition, possession of illegal drugs, prescription drugs not taken as medically prescribed, and the consumption of alcohol rendering the insured unfit to perform.”

READ MORE: Kanye West has filed a $10M lawsuit regarding his cancelled Saint Pablo tour

In fact, the countersuit says that the company’s investigation has uncovered “substantial irregularities in Mr. West’s medical history,” adding that West’s “failure to cooperate” in the investigation is part of a larger pattern in which VGT has “delayed, hindered, stalled and or refused to provide information both relevant and necessary for Underwriters to complete their investigation of the claim.”

The Lloyd’s of London lawsuit, however, does not specify the information that was uncovered through its investigation, “in order to protect the privacy of Mr. West from public disclosure of details of his private life.”

Comments