The head of Suncor Energy says the “exodus” of foreign companies from Alberta’s oilsands may not be finished yet, which could provide it with acquisition opportunities.

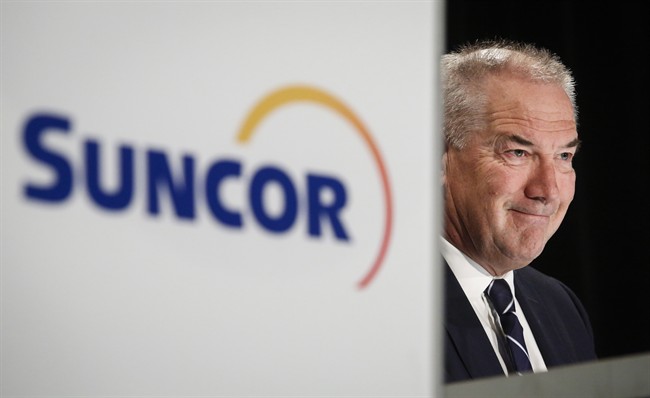

CEO Steve Williams says Suncor feels no pressure to buy, but is watching closely.

Suncor increased its ownership of Syncrude Canada last year from 12 per cent to over 53 per cent in part by buying U.S. firm Murphy Oil’s five per cent interest.

Get breaking National news

Other foreign companies selling oilsands assets in the past year have included Americans Marathon Oil and ConocoPhillips, Norway’s Statoil and British-Dutch oil giant Royal Dutch Shell.

Suncor says it will use capital freed up by completion of construction at the Fort Hills oilsands mine and the East Coast Hebron offshore project to buy back up to $2 billion worth of its shares this year.

Suncor reported earnings of $1.35 billion or 81 cents per share in the first quarter of 2017, compared with $257 million or 17 cents a year earlier, thanks to higher commodity prices and oilsands production. In early trading on the Toronto Stock Exchange, Suncor was up 98 cents or 2.3 per cent to $42.61.

Comments