Canadian household debt is very high by almost any measure.

One of the most common ways of looking at it is through the debt-to-income ratio, which measures people’s debt against their disposable income.

The latest numbers from Statistics Canada indicate that household debt now stands at 167.3 per cent of disposable income, a record high. This suggests that, on average, Canadians owe $1.67 for every $1 of disposable income.

The debt-to-income ratio is “likely the most quoted economic number out there,” CIBC economist Benjamin Tal said in a report last week.

But how seriously should Canadians take that measure as a cause for concern? Not very, if you ask him.

In a brief report titled, “On the Fallacy of the Debt-to-Income Ratio,” Tal wrote that the debt-to-income ratio is “probably the most useless economic indicator out there.”

READ MORE: Fuelled by mortgage growth, Canadian household debt rises to new record high

There’s little question that the measure is simple.

“But as we all know, the cost of simplicity is, at times, very high,” Tal added.

For example: a person isn’t required to pay off their mortgage in a single year, he said.

At the same time, the debt-to-income ratio measures the debt of people who owe money, relative to the earnings of people who owe it or don’t.

Get daily National news

“Again a suboptimal comparison,” Tal said.

Canada’s debt-to-income ratio has been used to fuel concerns about credit through comparisons to American debt levels before the housing crash of 2008.

Indeed, the U.S. ratio was higher than 165 per cent at the time.

The U.S. housing market, however, didn’t crash because the ratio was north of 165 per cent, Tal said.

It was because it was a “lousy 165 per cent,” he wrote, referencing the growth of subprime mortgage loans.

READ MORE: The Liberals tried to clamp down on Canadians’ debt. So far, it isn’t working.

Tal said Canada’s debt-to-income ratio has fallen only twice in the past 25 years — and that it’s normal for credit to grow faster than income in a “normally functioning economy.”

“For the ratio to fall notably you need a significant shock such as the U.S. financial crisis which led to the U.S. debt-to-income ratio falling from over 160 per cent to 140 per cent,” Tal wrote.

He doesn’t even feel that Canada’s debt-to-income ratio is growing very fast.

He said total real household debt is growing by about four per cent year-over-year, “a rate that is in line with the performance seen during the jobless recovery of the 1990s.”

“The recent rise in the debt-to-income ratio reflects a normally functioning economy,” Tal said.

But just because debt-to-income might not be the best way to look at household credit, doesn’t mean there’s nothing to worry about.

Elevated debt levels create the risk of lower consumption and sluggish GDP growth, Desjardins senior economist Benoit Durocher told Global News last month.

And they’ve been concerning enough to the federal government that the Liberals instituted new mortgage rules to tighten borrowing and slow house price growth last year.

There are conflicting reports as to whether the rules are having their intended effects.

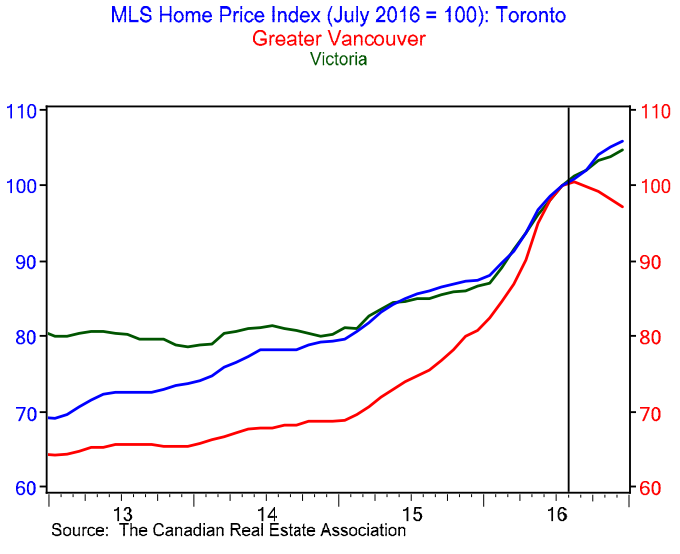

They don’t appear to have had any effect on home prices in Toronto, which have only kept growing since the rules were implemented.

Home prices have fallen in Vancouver, but that market has been subject to a 15 per cent foreign buyers tax. They haven’t fallen in Victoria, which is not subject to the tax.

But others, like RBC economist Laura Cooper, say the mortgage rules are cooling debt growth.

In a report from earlier this month, she said that mortgage loan growth has trended downward since June 2016, having fallen to a 5.6 per cent annual increase — “the slowest pace since June 2015,” she wrote.

And consumer credit, she said, has “trended sideways” since mid-2016, if you measure by year-over-year changes.

In any case, Tal argues that evaluating Canadian household debt is “too complex” to boil down to one number.

“It’s time to end the national fascination with the debt-to-income ratio,” he said.

Comments