Canada’s big banks are on a roll, with expectations-beating earnings and dividend hikes for shareholders. But there isn’t much in it for the lowly everyday banking customer, who is still spending $200 a year on average in banking fees.

So why not take the opportunity to trim some of your monthly expenses by reducing or eliminating your banking fees?

WATCH: TD Canada Trust adding new banking fees, increasing withdrawal fee at ATMs

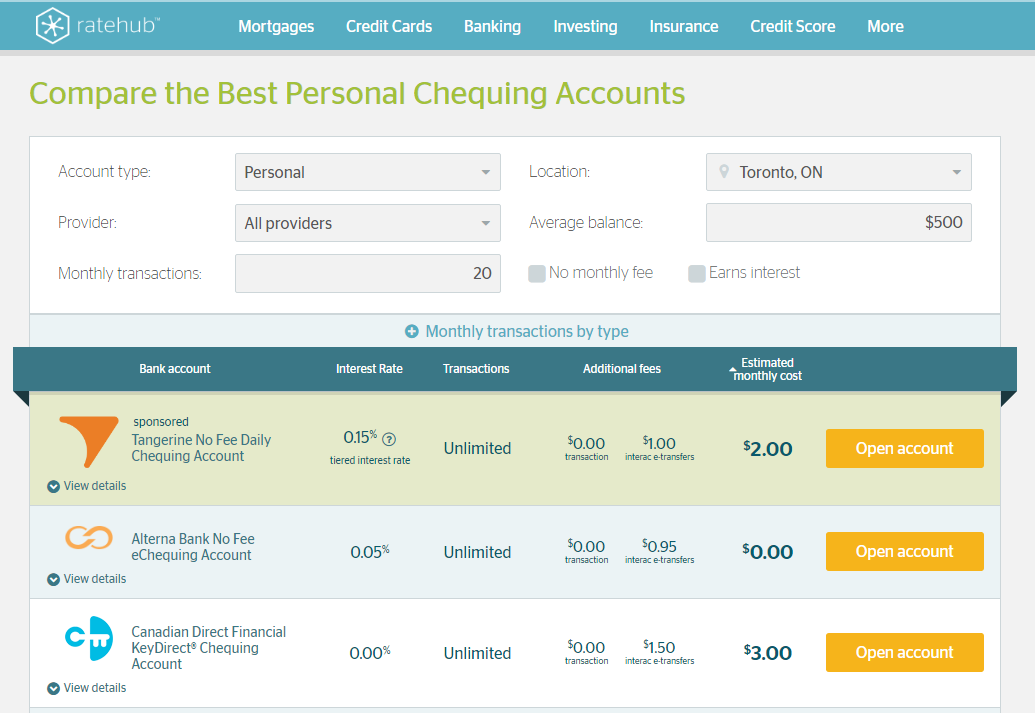

Toronto fintech startup Ratehub just joined rates-comparisons website RateSupermarket and the Financial Consumer Agency of Canada as one of the few online options available to Canadians to compare chequing accounts from different financial institutions.

But while RateSupermaket ranks chequing accounts — as well as a slew of other banking accounts — by interest rate, Ratehub orders them by fees.

The website’s new tool ranks 71 accounts from 15 providers, tailoring the results to the users’ location as well as the volume and type of monthly transactions they typically need. You can also narrow down the results to look up only no-fee accounts or accounts that earn interest.

READ MORE: Sick of banking fees? Here are some alternatives.

If you’re looking for a no-fee chequing account, there are four options according to Ratehub: PC Financial, the banking service provided by Loblaw Companies; Tangerine, which is owned by the Bank of Nova Scotia (Scotiabank); Alterna Bank, part of the homonymous Ottawa-based credit union; and Canadian Direct Financial, part of Edmonton-based Canadian Western Bank.

Get weekly money news

READ MORE: Canadians becoming less dependent on banks: online survey

None of them have proper banking branches (part of the reason why they’re able to avoid charging a fee). However, PC Financial has “pavilions,” a stripped-down version of a branch usually housed in a Loblaws or no Frills supermarket, where customers can meet with bank representatives face to face.

Base fees for chequing accounts from other financial providers go from $3.95 to $30 a month, according to Ratehub.

WATCH: Banking through Facebook Messenger? Alberta bank offers new service

Though it’s possible to get some of those fees waived or entirely refunded, that generally requires either maintaining a minimum chequing account balance or buying into multiple financial products at the same bank.

The minimum balance requirements to skip monthly fees range from $1,000 to as high as $6,000 for premium accounts, according to RateHub.

READ MORE: 5 way to avoid banking fees right now

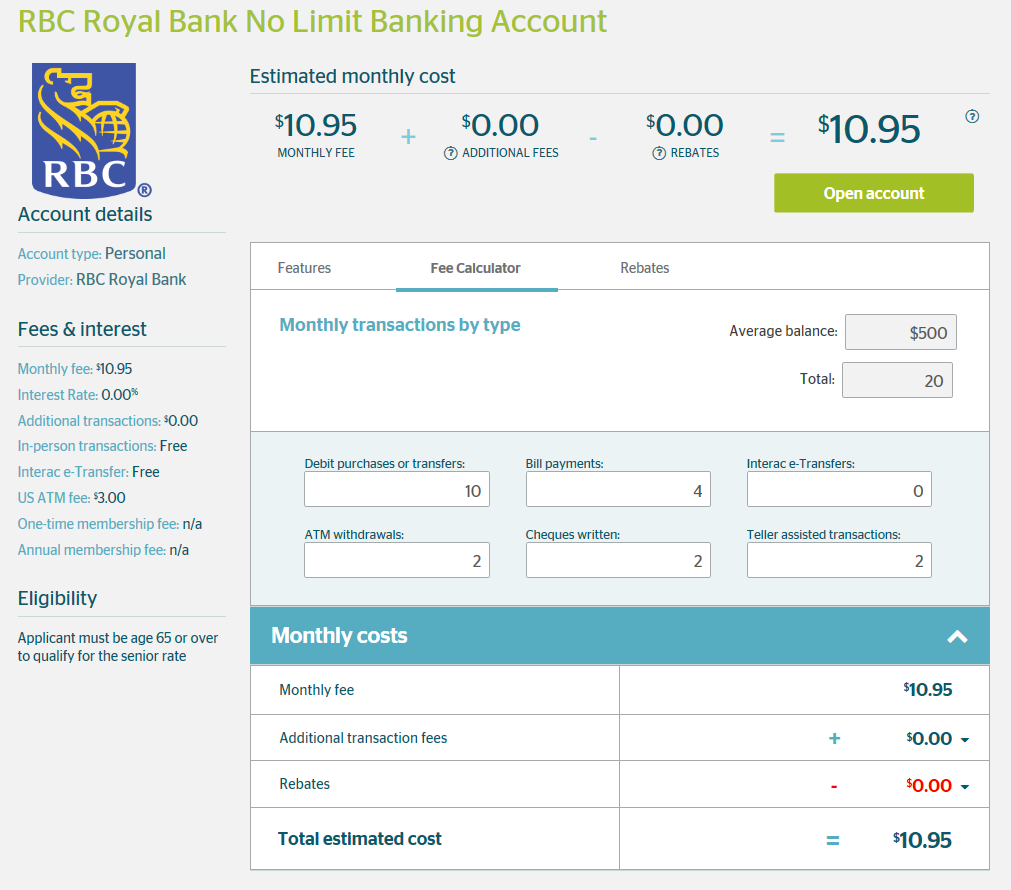

Admittedly, the company’s comparison tool doesn’t account for fee waivers and partial rebates for buying into a bank bundle, an option available at Royal Bank of Canada and Canadian Imperial Bank of Commerce, among others. But Ratehub includes that information in a handy table that summarizes the fine print tied to each account and that users can look up by clicking on “account details.”

That page also includes a calculator (see below) that allows users to come up with more personalized estimates of total monthly fee costs by inputting information such as the number of debit purchases, ATM withdrawals, Interac e-Transfers, and teller-assisted transactions they need.

For now, Ratehub doesn’t include most credit unions, which might provide an additional low-cost option for savvy Canadians. The company is planning to “continue to add local providers to the platform,” it said in a statement to Global News.

The FCAC online comparisons tool does feature a variety of credit unions. But the website is a bit clunky, requiring customers to select financial providers to compare, rather than offering a comprehensive, instant ranking.

RateSupermarket offers a slick user experience but is a little scant on details when it comes to looking up the fine print attached to each account.

WATCH: Why Canadian banks are hiking mortgage rates

Comments