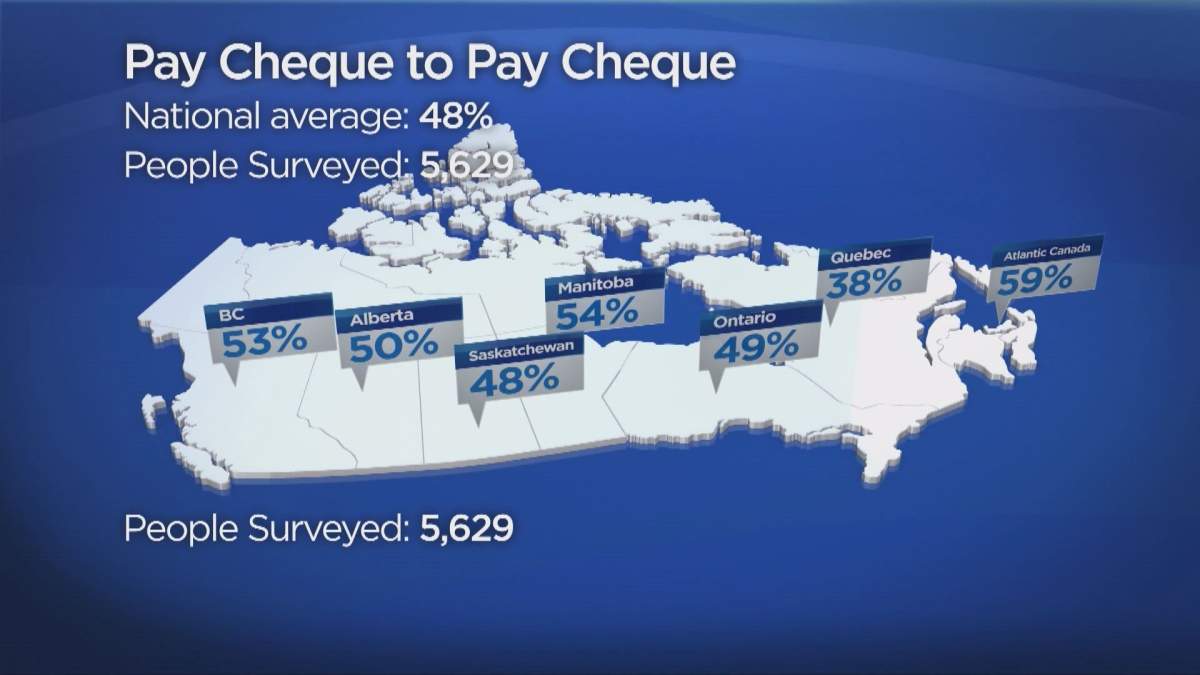

A Regina credit counselor offers money management tips in wake of recent survey showing nearly half of Canadians live paycheck to paycheque.

According to the Canadian Payroll Association’s eighth annual research survey 47 per cent of people would find it difficult to fulfill financial obligations if their paycheque was delayed by a single week.

In Saskatchewan 48 percent of people reported living paycheque to paycheque and another 35 percent of Canadians reported feeling overwhelmed by debt.

Taniel Ell with the Credit Counselling Society offers some tips to help manage your finances.

Money management tips

Be mindful of small costs:

Get breaking National news

Grabbing a coffee on the way for work or going out for lunches – you don’t think about it because it’s maybe $2 here and $5 there, but over the course of the month I’ve seen people spend $100-$300 on that stuff.

Monitor your credit: People will use it having full intention of paying it off but once high interest rates take effect on those debts, than the minimum payments are just going to interest. So, not only are they making their regular living expenses and household expenses but now they have a debt expense as well that they didn’t quite think of.

Budget fun money: Live within your means. Track what your spending and don’t spend more than you earn.

Make sure you put money away to have fun because we don’t work to just pay our bills.

Comments