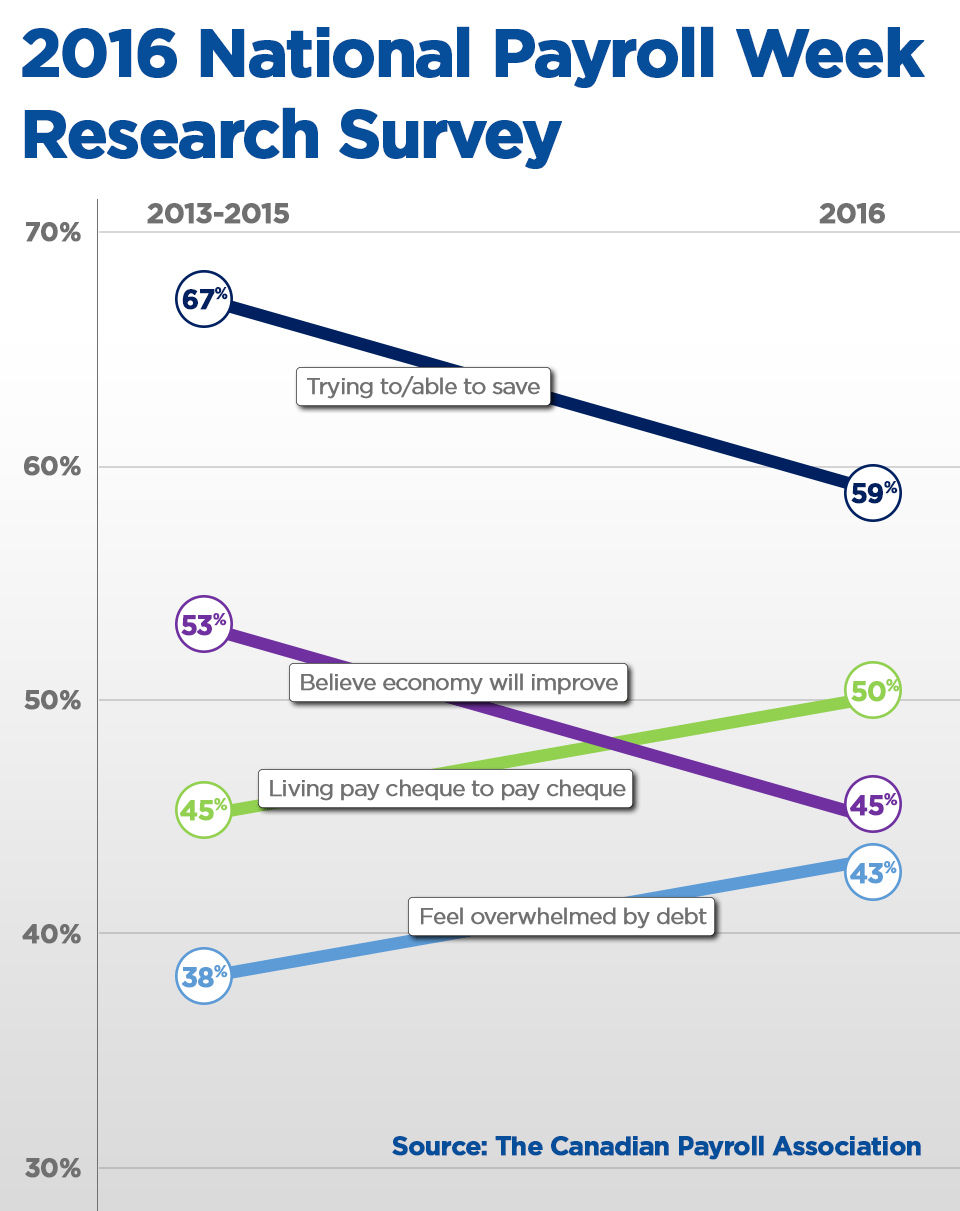

Close to half of Saskatchewan residents are living paycheque to paycheque, according to a new survey from the Canadian Payroll Association.

The Canadian Payroll Association (CPA) released its eighth annual Research Survey of Employed Canadians on Wednesday, ahead of National Payroll Week.

The survey of roughly 5,600 Canadians reveals that in Saskatchewan and across the country, 48 per cent of people report it would be difficult to their financial obligations if their paycheque was delayed by a single week.

READ MORE: Half of working Canadians living paycheque to paycheque: poll

Peter Gilmer, a Regina Anti-Poverty Ministry advocate, said the numbers point to a high level of economic instability, adding that a social safety net should be strengthened.

“We also, in the meantime I think, want to make sure that we are moving toward living wages for workers, that we’ve got plans in place to make sure that housing and childcare is more affordable for families,” Gilmer said.

“So they are in a position to put a contingency fund away, to put some benefits toward retirement away and that they can have greater security.”

Fifty-nine per cent of Canadians surveyed also think they will need to save at least $1 million for retirement. However, 74 per cent in Saskatchewan say they have saved less than 25 per cent of what they feel they will need.

In Saskatchewan, 35 per cent of people surveyed said they feel overwhelmed by debt and 35 per cent also said their debt level has increased this year.

Throughout Canada and in Saskatchewan, 40 per cent of people spend all their net pay and nine per cent believe they will never get out of debt.

Gilmer, who helps people in lower economic brackets, said he understands the frustration, as he also lives paycheque to paycheque and would have a hard time if the ministry lost funding.

“If we were to not be able to support our employees, it would make for a very difficult economic situation,” Gilmer said.

The Payroll Association said, for now, the best thing people can do is critically look at their finances.

“Take control of your financial wellbeing,” Patti Jordan, manager of communications and marketing with the Canadian Payroll Association, said.

“Do what you can to save for retirement, to save 10 per cent of your pay. Certainly it’s not easy. We all know that, but do what you can. Make a commitment.”

Even at 48 per cent, Saskatchewan still has the second-lowest rate of people living paycheque to paycheque.

“In terms of household incomes, we were very very high for the last decade. In many ways, we caught up and surpassed some of the other provinces,” John Hopkins, CEO of the Regina and District Chamber of Commerce, said.

“Is there still work to be done here? Absolutely. We need to continue to focus on growth.”

With files from David Baxter

Comments