OTTAWA – The Conservative government has introduced legislation to enact its family tax-and-benefit package – a multibillion-dollar suite of measures that includes the controversial income-splitting plan.

The so-called “family tax cut” is worth as much as $2,000 a year to eligible families with kids under 18 – but several studies have found only small fraction of households can benefit from it.

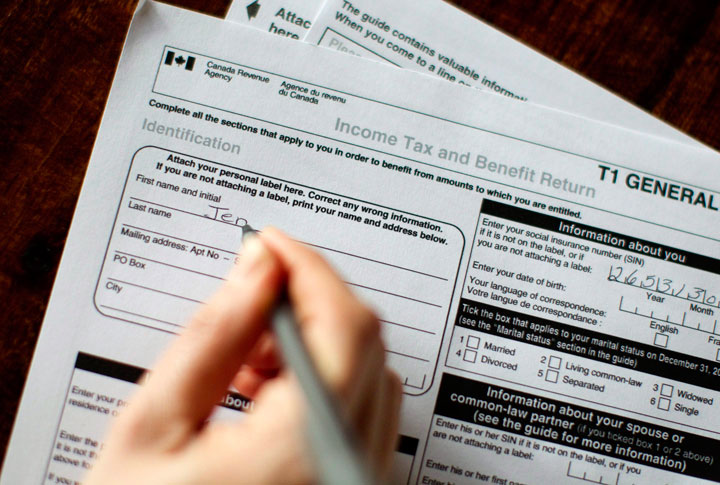

WATCH BELOW: How the Family Tax Cut works and who benefits from it

The government’s bundle of family-friendly measures also contains a bolstered universal child care benefit and higher limits on the existing child-care expense deduction.

These enhancements mean monthly government cheques will start arriving at the homes of qualifying families in July – three months before Canadians are scheduled to go to the polls.

Critics have called the income-splitting plan unfair, while opposition parties have promised to scrap it if they win the election.

When specifically asked about income splitting, the Conservatives typically avoid discussing it. They point out that the overall plan will provide benefits for all families with kids.

Comments