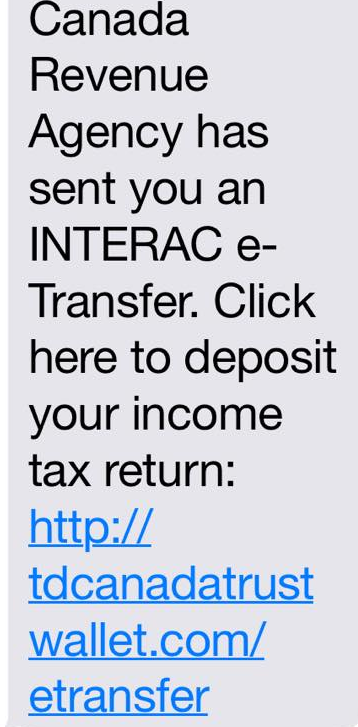

VANCOUVER — The Canada Revenue Agency (CRA) is warning the public of a recent scam involving email money transfers. It wants to remind the public the CRA will only send payments by direct deposit or by cheque, never by email money transfer.

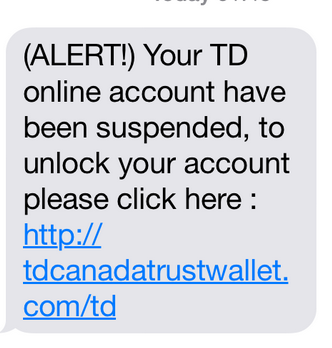

The CRA says occasionally, taxpayers may receive, either by telephone, mail, or email, a communication that claims to be from the CRA but is not. In all these cases, the communication requests personal information, such as a social insurance, credit card, bank account, and passport numbers, from the taxpayer.

READ MORE: Top 10 scams to watch out for this Fraud Prevention Month

Sometimes the message reads that the personal information is needed so that the taxpayer can receive a refund or benefit payment. They have also been referred to a website, like the CRA’s website, where the person is asked to verify their identity by entering personal information. Taxpayers should never respond to these communications.

The CRA does not do the following:

- The CRA will not request personal information of any kind from a taxpayer by email.

- The CRA will not divulge taxpayer information to another person unless formal authorization is provided by the taxpayer.

- The CRA will not leave any personal information on an answering machine.

READ MORE: 5 things you need to know about your 2014 tax return

When in doubt, ask yourself the following:

- Am I expecting additional money from the CRA?

- Does this sound too good to be true?

- Is the requester asking for information I would not include with my tax return?

- Is the requester asking for information I know the CRA already has on file for me?

- How did the requester get my email address?

- Am I confident I know who is asking for the information?

Comments