If you’re shopping for a high-rise condo in Toronto at the moment and your agent has your best interests in mind, he or she may give you just one piece of advice: wait.

A new report from TD Economics published Monday takes a deeper look into the condo boom occurring in the country’s most populous city and backs up what some have been saying for some time.

Prices are headed for a correction.

By how much? TD’s call is for an eight per cent decline in prices by the end of 2015. The average condo price in the Greater Toronto Area sits at $353,665, according to the Toronto Real Estate Board.

A pullback of that magnitude could spell some meaningful downward revisions on prices on brand new units coming up for sale later this year or next.

READ MORE: Toronto’s condo construction towers over Big Apple’s

But a reduced price on a new condo is also a potential harbinger of a broader hit to the economy. Experts says a pronounced downturn in Toronto’s condo segment could have farther-reaching effects on the regional economy and beyond.

With tens of thousands of jobs in construction and financial services tied to the market, the Bank of Canada has specifically cited Toronto’s inflating condo sector as a potential source of concern.

‘Striking’ number of new units

Get weekly money news

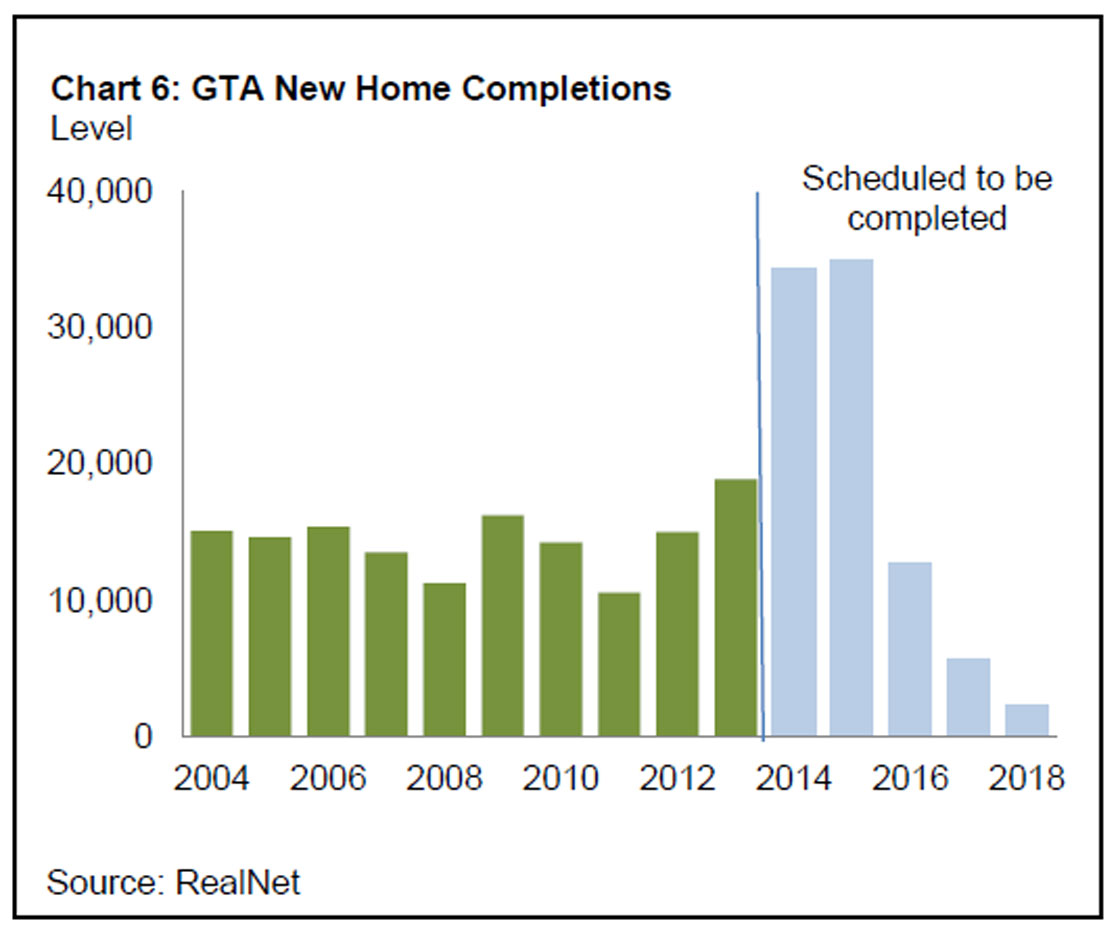

TD is basing the fresh assessment on the fact that a whopping 70,000 units are set to be completed this year and next – a number the bank calls “striking” — at a time when buyer demand for new units already appears to be “dwindling,” the bank said.

“While a majority of these units have been sold, roughly 9,000 of the units remain to be absorbed,” the report said.

But even among sold units, some suggest an unknown number of owners or investors are facing challenges when it comes time to securing a final loan to close the deal and take ownership.

There’s some emerging (if anecdotal) evidence that some buyers who put down a small deposit a few years ago on a yet-to-be built unit are now facing unforeseen problems securing a loan to cover the remaining balance now that lending conditions have tightened.

“They put their deposit down four or five years ago and then they’re ready to register the unit and get a mortgage and they’re walking into tough times,” a Toronto broker told industry website Mortgagebrokernews.ca last month.

Local dispute

Still, widely followed local condominium tracking service Urbanation disputes the number.

In a tweet, the market monitor said it expects a much more modest 19,000 units to be completed this year, and an “uptick” next.

It said the rate of scheduled completions is slower than TD estimates meaning many new units won’t be completed until later, something that would keep a lid on overall supply and maintain demand for those units on the market.

The 70,000 figure “will not happen,” Urbanation said.

The surge in new supply — if correct — is double the annual historical average, the TD report said (see chart). It has led to concerns that speculative investors are playing a leading role in the boom.

Investors vs owner occupants

“Among the concerns surrounding the high-rise market is that a significant amount of these units are held by investors,” economists Derek Burleton and Diana Petramala said in the report.

Surveys suggest that just over a quarter (26 per cent) of the pre-sold units set for completion this year and next are investor-owned, they said.

If the market heads for an unexpectedly sharper dive, investors can cut losses more easily than actual owner occupants would, while many may already be planning to list their properties immediately upon closing – two forces that could accelerate downward pressure on the market.

Still, while the bank report said it expects a “good portion” of the 70,000 new units to end up on the market, the number won’t be “to the point of exerting extreme downward pressure on prices.”

Comments