The Insurance Bureau of Canada (IBC) calls it an “auto theft crisis.”

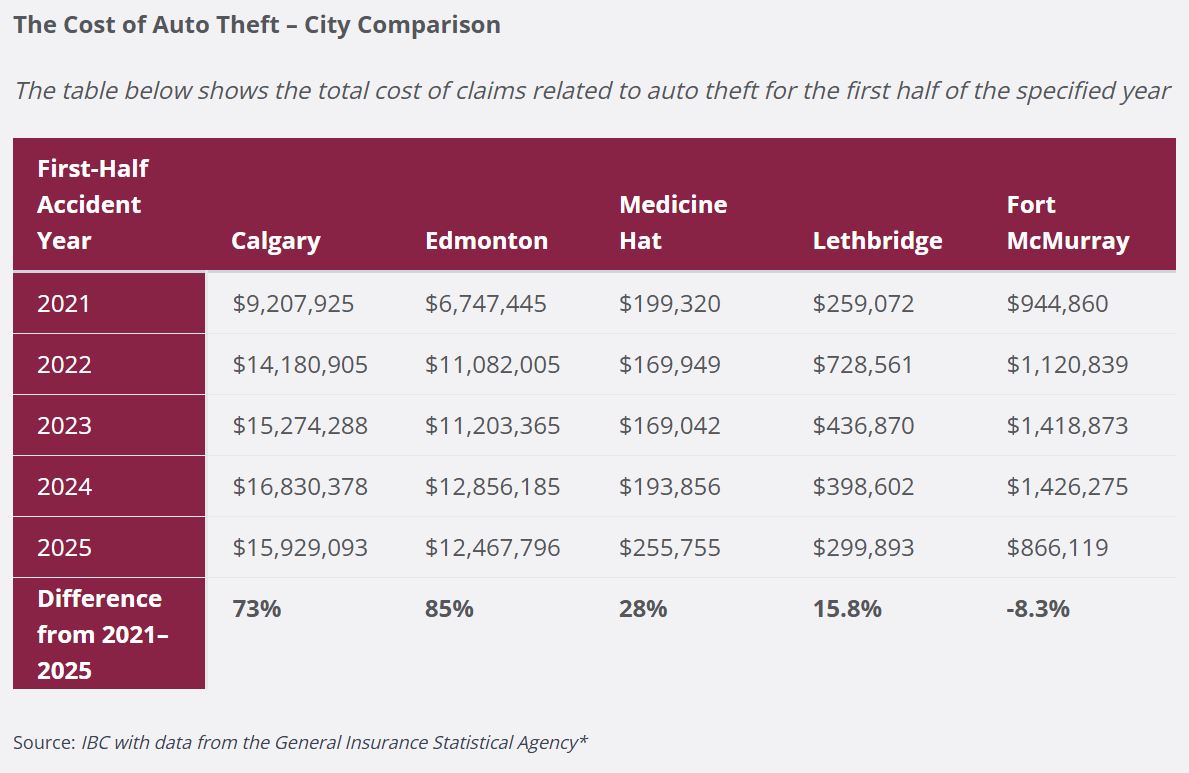

The cost of claims from stolen vehicles has risen 85 per cent in Edmonton and 73 per cent in Calgary over the past four years (2021-2025), the IBC said, referring to Alberta’s two biggest cities as “the province’s epicentre for auto theft.”

“It really is a wake up call to all orders of government to make sure that we’re all doing all we can to address this trend and address the impact that auto crime has, both financially and the human toll and stress and concern it can create as well,” said Aaron Sutherland, vice-president of the IBC for Western Canada.

By comparison, auto theft insurance claims during the same time period have risen by 28 per cent in Medicine Hat, almost 16 per cent in Lethbridge and dropped by more than eight per cent in Fort McMurray.

“Auto theft disrupts the lives of everyone and creates fear in communities across the province, with city centres being hit the hardest,” Sutherland said.

Vehicles being stolen to be sent around the world is part of the issue, Alberta RCMP said last summer. The IBC said that continues to be an ongoing problem.

“Criminal networks continue operating in our communities and are growing more brazen in their actions to steal vehicles, often shipping them overseas to fund other illicit activities,” Sutherland said.

Last year, he told Global News as provinces like Ontario and Quebec made changes to cut down on auto theft, criminal patterns in Alberta changed as organized crime migrated west in search of easy targets.

However, Sutherland says federal, provincial and municipal governments, in partnership with law enforcement agencies, have now begun to make some progress on efforts to target auto theft.

Among the measures being taken: Canada Border Services, the RCMP and other enforcement agencies are investing in new technology to help detect and search shipping containers for stolen vehicles, as well as strengthening intelligence-sharing with international law enforcement partners to identify and apprehend people involved in the stolen-vehicle supply chain.

Last fall, the federal government also announced changes to the Criminal Code of Canada, with new offences and tougher penalties targeting auto theft, as well as the possession of electronic devices used to steal vehicles.

Get daily National news

Alberta RCMP says most stolen vehicles are not being taken via violent means such as carjacking. Instead, the criminals are stealing keys, spoofing fobs or using other electronic technology to get into and start the vehicle.

The introduction of keyless and remote start technology in newer vehicles has been exploited by criminals.

In 2024, insurance fraud and auto crime organization Équité Association identified three main ways criminals can use technology to steal vehicles.

One is through the “relay attack,” in which the thieves use readily available and cheap tools to intercept the radio frequency signal between the vehicle and the key fob and start the vehicle.

Another is called “reprogramming theft.” In this case, the criminals break into the vehicle and plug into the onboard diagnostic port, which every car is legally mandated to have. It monitors emissions, mileage, speed and other data about your car and allows a mechanic to check for any problems. Criminals plug into that same port and are able to reprogram the key fob.

Meanwhile, in a “CAN bus” or “CAN injection” attack, perpetrators try to access the car’s Controller Area Network. This can include spoofing and introducing bogus messages to trick the car’s security system into unlocking the vehicle.

The IBC is now calling on the Alberta government to provide resources for a coordinated inter-agency law enforcement team focusing on auto theft.

The province has not yet made a decision about that.

In a statement to Global News on Tuesday, Finance Minister Nate Horner said, “The IBC’s report highlights that auto theft and rising lawyer fees are driving up premiums for Albertans, and we are reviewing their recommendations as part of our work to address cost pressures.”

The IBC claims the Alberta government’s plan to switch to no-fault insurance, starting on Jan. 1, 2027, will help reduce the insurance industry’s increasing legal costs.

Under the new system, in most cases, victims of vehicle collisions will no longer have the right to sue for damages. Instead, insurers will pay victims standardized compensation amounts for different injuries.

— With files from Saba Aziz, Global News

Comments

Comments closed.

Due to the sensitive and/or legal subject matter of some of the content on globalnews.ca, we reserve the ability to disable comments from time to time.

Please see our Commenting Policy for more.