The annual rate of inflation ticked down in February amid relief on grocery and cellphone bills, Statistics Canada said Tuesday.

Even though economists warn that inflation might still have a “bumpy” path back to the Bank of Canada’s two per cent target, the latest price figures are solidifying bets for when interest rate cuts could start.

Overall inflation was 2.8 per cent year-over-year in February, down from 2.9 per cent in January, the StatCan said. The easing surprised most economists, who had expected an uptick in inflation for the month.

“We’ve had two months in a row of inflation coming in under expectation,” says RSM economist Tu Nguyen. “It’s a reason to celebrate.”

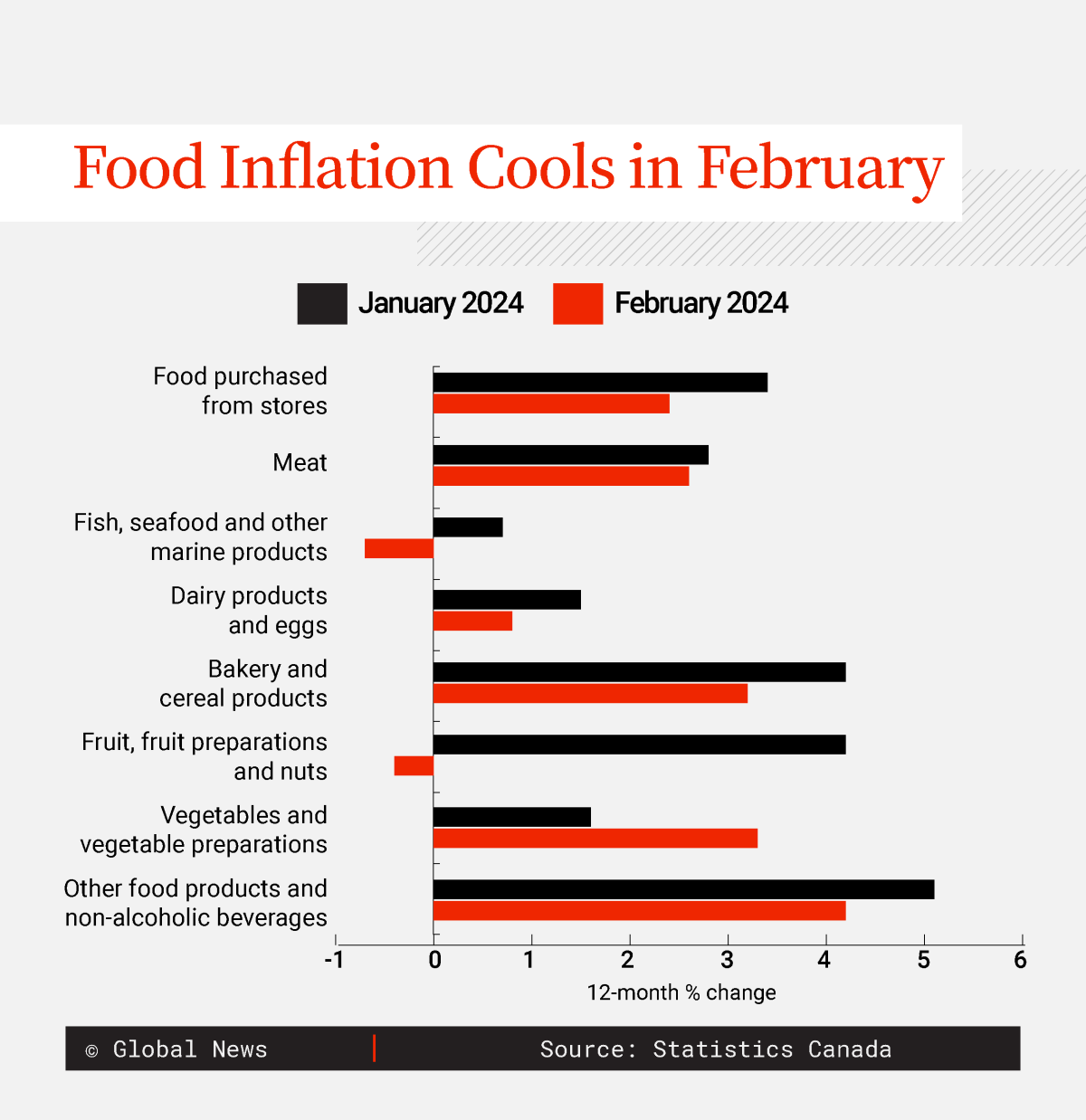

Prices at the grocery store were one of the biggest contributors to the step down, rising 2.4 per cent in February, down from 3.4 per cent in the previous month. This marks the first month since October 2021 that grocery inflation came in below the overall inflation rate, StatCan noted.

The cooling inflation was “broad-based” across aisles at the grocery store, according to the agency. Prices for fresh fruit, processed meat and fish declined year-over-year in February, while other components including bakery and dairy products saw prices grow but at a slower pace than January.

StatCan also noted however that last month’s food inflation figures were helped by base-year comparisons to February 2023, when supply constraints and inclement weather drove prices sharply higher.

But Nguyen says that the grocery store is one of the frontlines for inflation in the minds of consumers. Easing here could help to moderate inflation expectations, one of the key metrics the Bank of Canada watches in gauging how long it needs to keep the cost of borrowing elevated to cool spending in the economy.

“When consumers go to the grocery stores, they see that grocery prices are not going up as quickly anymore, they see discounts and deals back in store,” she tells Global News.

“That, in turn, has helped inflation stay in moderation and helps make the Bank of Canada’s job a little bit easier.”

Cheaper wireless services also contributed to the decline in overall inflation, StatCan said, as providers were offering cheaper phone and internet plans.

Shelter and gas prices still putting pressure on households

Housing costs meanwhile continue to put pressure on household budgets. Shelter prices rose 6.5 per cent year-over-year last month, up from 6.2 per cent in January.

“Shelter is the thorn in the Bank of Canada’s side, and this is a thorn that’s not going away because we have structural imbalances in Canadian housing,” says James Orlando, director of economics at TD Bank.

Get weekly money news

Orlando tells Global News that, stripping away the impact of rent hikes and higher mortgage costs, inflation is basically at the Bank of Canada’s two per cent target. Since these pressures in the housing market are largely outside the central bank’s control – tied primarily to rapid population growth and a fundamental lack of supply of homes – he argues that the Bank of Canada will likely have to ease monetary policy before shelter inflation gets back to target.

“In my mind, the Bank of Canada’s job is done when it comes to being able to put that downward impact on the Canadian economy to bring inflation under control,” he says.

Prices for gasoline were 0.8 per cent higher year-over-year in February, StatCan said. Prices were also up from January, according to the agency, amid higher global crude prices tied to expected production slowdowns.

Patrick de Haan, head of petroleum analysis at GasBuddy, told Global News on Monday that consumers can expect pressure at the pumps to continue until around the Victoria Day long weekend in May.

Warmer weather drives up the demand for gas, he said, and stations are also switching over to the more expensive summer blends of fuel.

De Haan doesn’t expect gas prices to hit record highs this summer, but said motorists in most provinces can expect to pay in the “mid to upper $1 per litre” range. In British Columbia, that could exceed $2 a litre, he added.

Governor Tiff Macklem warned after the Bank of Canada’s latest rate hold on March 6 that while the central bank expects inflation to hold around three per cent through the first half of the year, gas prices will add “volatility” to the easing path and shelter pressures will persist.

“In other words, the path back to our two per cent target will be slow, and progress is likely to be uneven,” he said.

Orlando says there might be “starts and stops” on the way to price stability, but the restrictive interest rate levels and easing in global supply chains mean “everything is in place for inflation to keep going down in the coming months.”

Forecasters can’t rule out additional shocks to the global supply chain driving up inflation in the months ahead. But Nguyen agrees with Orlando’s take that the Bank of Canada’s two-year-old rate hike cycle is showing proof of working to tame inflation.

“If things go as we expect, then it will be only a few more months of high interest rate before consumers and businesses will see some relief,” she says.

Is an April rate cut in the cards?

The Bank of Canada is watching for signs that inflation will cool all the way back down to its two per cent target before it considers cutting its benchmark interest rate.

The central bank’s preferred core measures of inflation, which strip out the more volatile components of the consumer price index like gas, also ticked down in February but remain just above three per cent. Orlando says the Bank of Canada will likely want to see signs that these core inflation figures are also dipping below three per cent before feeling confident that price pressures are fully under control.

The February report is the final inflation print the Bank of Canada will get before its next rate decision on April 10.

Money markets increased their bets for a first 25 basis point rate cut in June to more than 75 per cent, from 50 per cent before the inflation data, according to Reuters. The bets for an April rate cut increased to over 28 per cent from 18 per cent before the numbers were released.

Many economists weighing in on the surprisingly soft inflation figures on Tuesday said that the easing in price pressures likely isn’t enough to warrant an interest rate cut in April.

But CIBC senior economist Katherine Judge said in a note to clients on Tuesday that the February figures were “unambiguously good news” and are “clearly encouraging” for the Bank of Canada. She said the central bank will look for more loosening in the labour market before “pulling the trigger” on an interest rate cut in June.

BMO chief economist Doug Porter said in a note that an April rate cut is in the cards if the Bank of Canada’s upcoming business outlook surveys show signs of more progress.

But he said the April central bank decision should see policymakers “open the door” to rate cuts, with easing actually beginning in June.

- Stock markets plummet as oil nears $90 amid Iran war, U.S. job losses

- ‘A foreign policy based on short memory’: Carney continues push to diversify from the U.S.

- Americans view each other as morally bad, poll says. Canada is the opposite

- Canada and Japan sign partnership deal on defence, energy, trade

In the wake of reassuring inflation data, Orlando says the Bank of Canada’s governing council will need to at least have a discussion about rate cuts at the upcoming meeting.

But he disagrees with other economists who are predicting a “dovish” tone from the Bank of Canada that raises expectations for imminent interest rate cuts.

That’s because the Bank of Canada doesn’t necessarily need to actually cut interest rates for the cost of borrowing to start falling for Canadians. The bond market, which informs the interest rates Canadians pay on products like mortgages, sets its prices based on expectations for where the central bank’s policy rate is heading next, so clear signals that cuts are coming will be enough to send rates lower on some loans.

Orlando says the timing on this is critical heading into April due to the typically busy spring housing market. If the Bank of Canada is plain about its rate cut timeline and rates fall on fixed-rate mortgages, that could bring more buyers into the market and spur an uptick in sales and prices that Orlando says the central bank wants to avoid as it finalizes the inflation fight.

“I don’t think the Bank of Canada’s even going to signal that they are ready to cut … because the moment they say we’re thinking about cutting, interest rates are going to start falling,” he says.

“They’re going to keep their cards very close to their chest until they’re ready to make that call.”

– with files from Global News’ Uday Rana, Anne Gaviola and Reuters

Comments

Want to discuss? Please read our Commenting Policy first.