The federal government’s spending priorities are shifting dramatically in the next fiscal year as federal programs put in place during or after the pandemic wind down and the government looks to trim costs across a variety of departments.

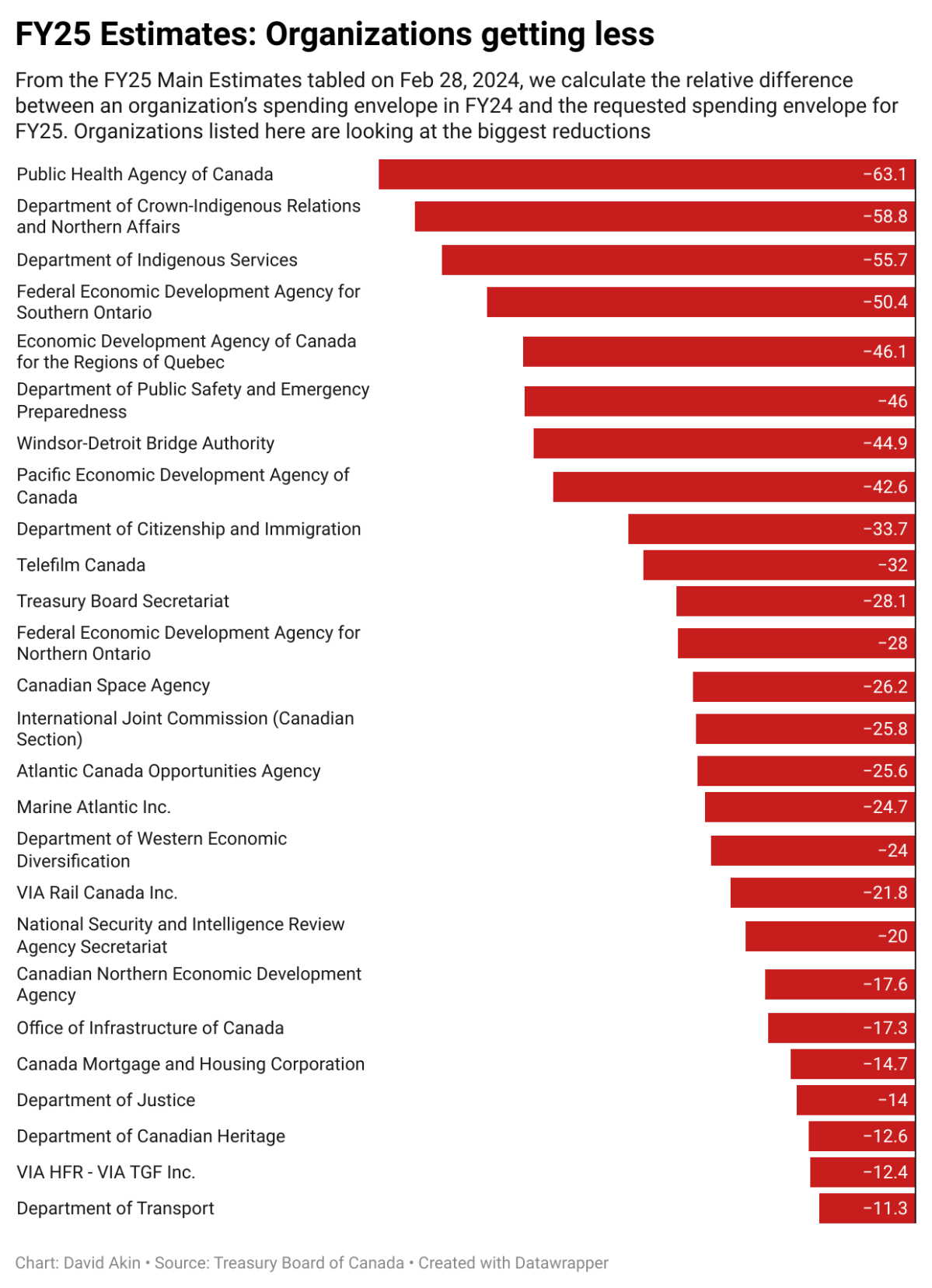

The budgetary shift out of pandemic mode is most evident at the Public Health Agency of Canada (PHAC), which is asking parliamentary approval to spend 63 per cent less next year than it is expected to spend in the fiscal year that ends on March 31. PHAC’s spending reduction is the largest relative reduction in planned spending among all government organizations.

PHAC is expected to spend more than $5 billion this year but has asked Parliament for authority to spend just $1.9 billion next year — a $3.6 billion drop. PHAC says in its departmental plan that it no longer needs to spend as much as it has in the last two years on COVID vaccines and COVID mental health support programs, although it is now returning spending on items like influenza vaccines to pre-pandemic levels.

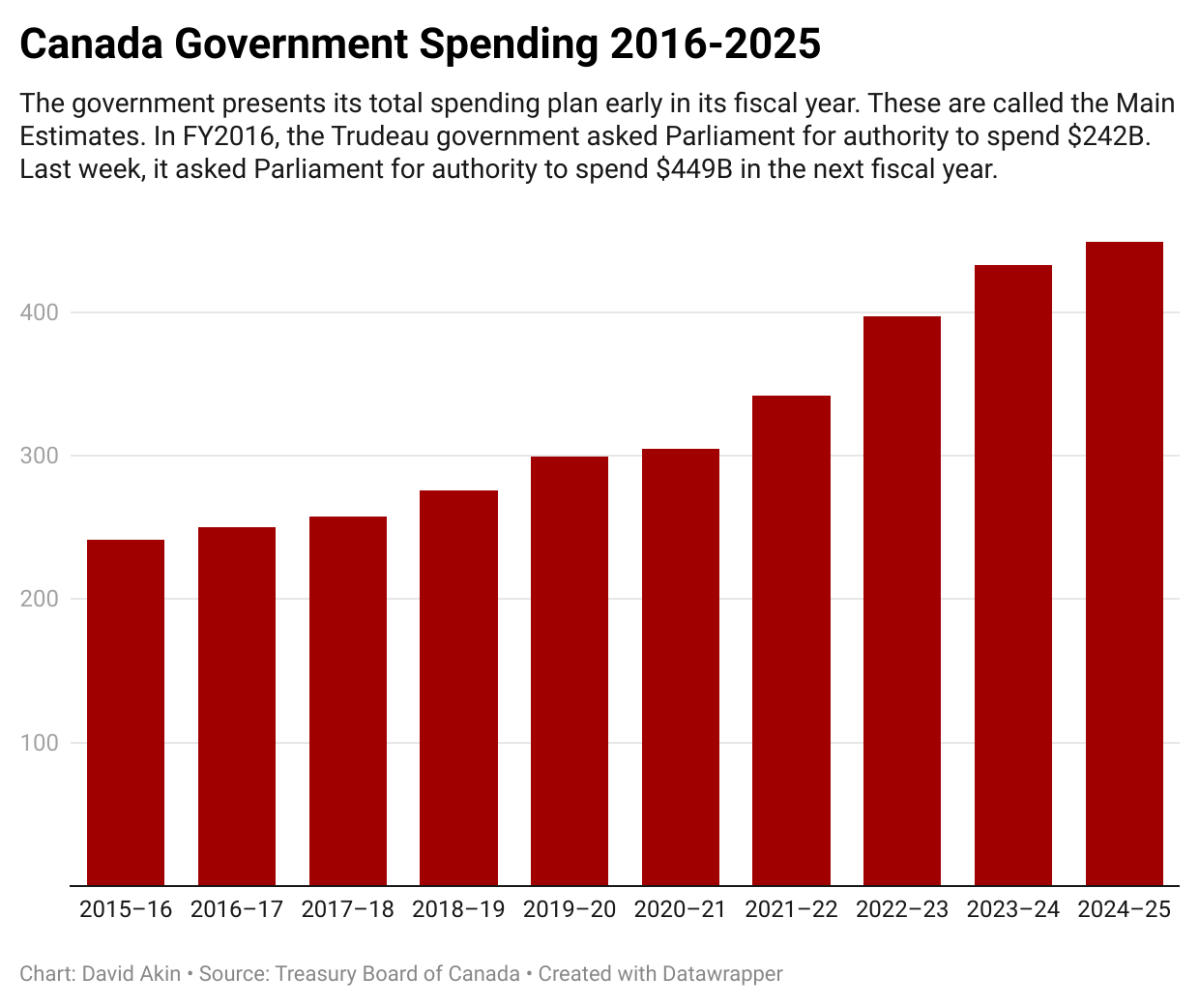

But despite the shift away from expensive pandemic programs, overall spending in 2024-2025 is anticipated to jump at least 16 per cent to $449-billion. When the Trudeau government took office in 2015, overall government spending in that fiscal year was just $242-billion.

Similarly, the government’s seven regional development agencies also expect to need less money in the next fiscal year as they unwind programs set up during the pandemic to support struggling businesses such as the tourism sector. The economic development agency for southern Ontario, for example, has asked Parliament for 50 per cent less next year than it received this year while the Atlantic Canada Opportunities Agency is asking for about 25 per cent less.

Get daily National news

The government’s spending plan for 2024-2025 is contained in a document known as the Main Estimates, tabled last week in the House of Commons. The Parliamentary Budget Office released its analysis of those Estimates on Thursday. Parliamentarians will vote on these Estimates later in the spring.

The rise in proposed government spending next year is driven by increases in unavoidable expenses — referred to as statutory authorities — including a 12 per cent jump in the costs of servicing the debt. Debt servicing costs are expected to climb to $46.5 billion next year and will make up more than 10 per cent of all government spending.

The other significant statutory spending items include $81.1 billion expected to be paid out in benefits for the elderly – a jump of 7.5 per cent — and $52.1 billion to be paid to the provinces for the Canada Health Transfer — a 5.4 per cent year-over-year increase.

The PBO says it is the first time the cost of elderly benefits has hit the $80-billion mark. Old Age Security is the single most expensive government program, accounting for one of every seven dollars spent, the PBO said. The costs of OAS, CPP and other benefits for the elderly should eclipse $100-billion within four years. “This is driven by a combination of a larger number of seniors and inflation,” the PBO said.

But while those unavoidable expenses are increasing, the government is trying to reduce the amount of budgetary or discretionary spending. In fact, the government has asked Parliament, through the Main Estimates, to approve $43.4 billion less than it is set to spend in the current fiscal year. That said, the spending requests are sure to increase through the fiscal year, particularly after Finance Minister Chrystia Freeland tables the budget on April 16.

The Main Estimates are revised three times during the fiscal year and the first revision is expected after the budget is tabled. As a result, the Main Estimates are often seen as a baseline for spending in the year and will only be revised upward as the year unfolds. The Main Estimates do not include any items the government might propose in the budget document.

The lower discretionary spending proposed so far is a partial reflection of the Trudeau government’s desire to control costs as it seeks to continue to reduce annual deficits and the overall debt-to-GDP ratio. The PBO attributes $4.1 billion in lowered anticipated costs next year to the government’s spending restraint, restraint to be achieved by, for example, reducing expenses on consultants and travel costs.

But some of the biggest year-over-year spending reductions will come at the departments responsible for advancing the government’s agenda with the country’s Indigenous people. Combined, the departments of Crown-Indigenous Relations and Indigenous Services are asking for parliamentary approval to spend $32 billion in 2024-2025. That would be less than half — or $42 billion less — than the two departments are set to spend in the current fiscal year.

Indigenous Services, in its 2024-2025 departmental plan, said it does not expect to require as much money next year because of lower costs of providing child and family health and welfare services to Indigenous communities. Expenses in the current year were also abnormally higher because of spending associated with COVID as well as payments related to out-of-court settlements. Additionally, the one-time payout of $23.3 billion for the First Nations child welfare settlement was charged to the IS budget. for the $23.3 billion towards the First Nations child welfare settlement.

Crown-Indigenous Relations, in its departmental plan, said it incurred billions in one-time extraordinary costs in the current fiscal year associated with land claim and other settlements including $5 billion for the Restoule Settlement Agreement involving several First Nations in northern Ontario and $2.9 billion for the Gottfriedson Band Class Settlement Agreement, an agreement involving day scholars at residential scholars.

Comments