Higher interest rates and resilient home prices mean most Canadians are getting less for their homes at the $1-million benchmark, according to a new Royal LePage report.

The analysis comes as would-be homebuyers continue to struggle with housing affordability, which market watchers say worsened again at the end of last year.

Royal LePage released a study Thursday morning that reviewed the average square footage, bathrooms and bedrooms available for homes listed around the $1-million price tag (give or take $50,000 or so) in major cities across Canada in December 2023.

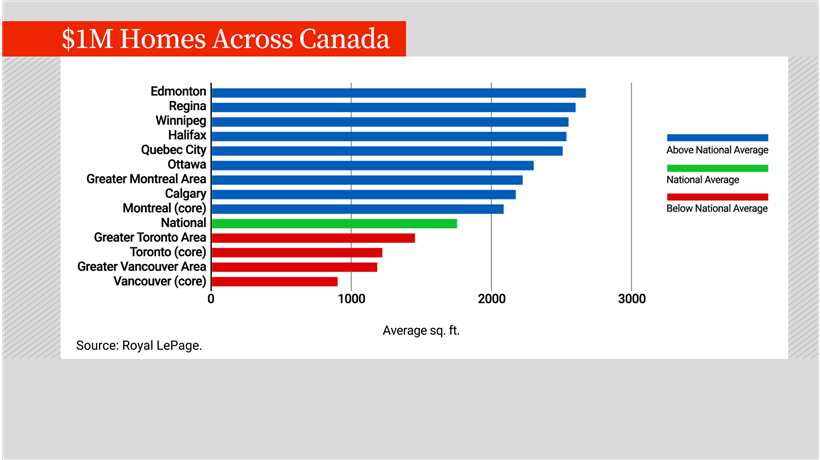

The national average for a million-dollar home comes with an average of 3.2 bedrooms, 2.6 bathrooms and 1,760 square feet of space, according to the national real estate brokerage.

That’s relatively consistent with a similar report from last year, but in most cities, the amount of space available in the typical $1-million home shrank year-over-year.

And across those cities, there was a steep variability between what homebuyers are getting for a million dollars.

“It is all about perspective,” Karen Yolevski, COO of Royal LePage, tells Global News. “Depending on where you are in Canada, where you may be looking for a home, $1 million can mean something dramatically different.”

If you had a million dollars…

Coming in at the bottom of the pile was the core of Vancouver, which offers an average 900 square feet of space at the million-dollar mark. That’s roughly a third of what a homebuyer can get in Edmonton for the same amount.

A million dollars can get a homebuyer in the core of Toronto a home with an average of 2.8 bedrooms, 1.9 baths and 1,218 square feet of space, though those figures rise a bit higher if the lens is expanded to include the wider Greater Toronto Area.

The Greater Toronto and Vancouver areas, as well as their respective cores, all fell below the national average for space in million-dollar properties. Montreal and Calgary boast 300-400 extra square feet over the national average, while Regina, Winnipeg Halifax, Ottawa and Quebec City were well above that bar.

Edmonton topped out among the major cities surveyed with an average of 2,675 square feet of space for a million-dollar home and was the only region to see its average size improve over last year’s report.

Million-dollar homes in some markets like Regina put the property firmly in the luxury category, the Royal LePage report notes, while Vancouver and Toronto buyers are more likely getting condominiums or bungalows for that amount.

Yolevski says that a million dollars can represent a “move up” home for markets like Calgary, but it’s closer to a starter home in Canada’s largest cities.

Though home prices have declined modestly or plateaued in most Canadian housing markets over the past year amid higher interest rates from the Bank of Canada, Yolevski says a million dollars is not what it used to be with prices in markets like Toronto essentially doubling over the past decade.

Get weekly money news

“One million dollars is essentially the median price, or even a bit of a starter price for homes in our big cities,” she says.

Royal LePage also provided a snapshot of homes around the $2-million price mark in its report.

For Toronto, $2 million means an average of more than 2,000 square feet of space; in cities like Ottawa or Montreal, that amount of money gets a buyer closer to 3,000 square feet. Yolevski says these homes likely look like the kinds of luxury properties that Canadians might have considered a million-dollar home over a decade ago.

“In some markets, the new ‘million dollars’ is $2 million,” she says.

Housing affordability worsens again in Q4

Also on Thursday, National Bank of Canada released its fourth quarter housing affordability index, which held little good news for renters and would-be homebuyers.

The index, which factors in home prices, mortgage rates and income levels in gauging how affordable homes in different Canadian markets are, degraded for the second quarter in a row to end 2023.

Every city saw the average mortgage payment as a proportion of income rise in the fourth quarter, according to National Bank, putting overall housing affordability almost back at its worst levels since the 1980s and nearing a recent peak in the second quarter of 2022.

That came as overall home prices ticked up 1.8 per cent quarter-to-quarter and mortgage rates rose amid expectations the Bank of Canada’s benchmark rate would stay higher for longer.

Mortgage rates remain elevated as the central bank holds its benchmark rate steady and has yet to signal that rate cuts are imminent. Economists expect the policy rate to ease this year as inflation cools with many penciling in June for the first cuts.

There’s little respite expected for renters, either, with National Bank noting its rental affordability index is at its worst-ever levels amid a tight rental vacancy rate across Canada. That report flagged a dearth of building permits in many Canadian cities issued at the end of 2023 as likely to keep supply strained in the rental market in the near future.

But a Ratehub.ca analysis released Wednesday shows signs of affordability improving in January as lower mortgage rates on offer and declining housing prices in some markets saw the income needed to afford a home drop in all major cities included in the report.

The annual income needed to buy the typical home in Vancouver dropped by nearly $10,000 month-to-month and fell nearly $7,800 in Toronto, Ratehub said, though both markets still required households to earn more than $200,000 to make homeownership accessible.

Ratehub co-CEO James Laird tells Global News that Canadians will need “top tier incomes” in their household to be able to afford the average home in the most expensive markets.

“The frustration is going to continue. It is not easy and will never be easy again to buy a home in Vancouver or Toronto,” he says.

Affordability still a challenge at the $1M price point

As part of the Royal LePage report, Leger surveyed more than 1,500 Canadians in late January about whether they thought $1 million was enough to buy the size of home they needed.

While 64 per cent of those polled indicated $1 million was sufficient, that tumbled to 42 per cent in British Columbia and 53 per cent in Ontario. Quebec topped out in this regard with 80 per cent indicating a million dollars was enough for their housing budget.

The average homebuyer indeed needs close to $1 million to afford the typical home in some of Canada’s most expensive housing markets, according to the Ratehub analysis.

The average home price in Toronto was just over $1 million in January 2023, roughly on par with December’s figures.

While most cities have not had much fluctuation year-over-year in the space-per-dollar in their millionaire markets, Yolevski notes that the carrying costs for those properties have changed as the Bank of Canada’s policy rate continued to rise in 2023.

Canadians buying million-dollar properties today are forced to pay more expensive mortgages in most cases than those who bought a year ago, she notes.

“So that million dollars is costing more per month now than it did a couple of years ago, when interest rates were much lower,” she says.

In addition to higher borrowing costs – and a tougher mortgage stress test, making it more difficult for prospective buyers to qualify for the loan – Yolevski notes there’s an additional hurdle for million-dollar properties.

Homes bought for more than $1 million in Canada do not qualify for mortgage insurance, which allows buyers to put down less than 20 per cent in a down payment on a home.

This means that in many cases Canadians are forced to put down $200,000 or more on a million-dollar starter home in markets like Toronto and Vancouver, Yolevski explains.

”Twenty per cent on $1 million is a large amount of money and can be a challenge for people, particularly first-time buyers looking to get on the property ladder for the first time, where they don’t have any equity in a pre-existing home already to contribute to that down payment,” she says.

Yolevski says the Royal LePage report shows that, outside Canada’s biggest housing markets, there’s more space for homebuyers who can qualify for the million-dollar price point and an easier path to homeownership for those short of that bar.

She says she expects the lingering remote and hybrid work opportunities from the pandemic, alongside the affordability crunch from higher interest rates and still elevated home prices, will push more Canadians to look outside their home provinces to the Maritimes and Alberta in particular to break into the housing market in 2024.

A Re/Max report released earlier this month pointed to home prices, elevated interest rates and taxation policies driving Canadians towards Alberta in a wave of interprovincial migration.

– with files from Global News’ Anne Gaviola

Comments

Want to discuss? Please read our Commenting Policy first.