Canada’s national downtown office vacancy rate hit a record high of 19.4 per cent to end 2023, according to data from commercial real estate and investment firm CBRE.

For context, a “healthy” office vacancy rate would fall between 10 and 12 per cent.

While responses to the coronavirus pandemic, which saw more people move to remote work, certainly play a role in the figures, it’s far from the only contributor, CBRE says.

Four main reasons for the climbing vacancy rate

On the whole, the COVID-19-induced work-from-home shift has had a major impact on the office market, with Maria Benavente, vice-president and real estate-focused portfolio manager at Dynamic Funds, claiming 10 to 15 per cent of demand has been “permanently destroyed.”

But Marc Meehan, managing director of research for CBRE Canada, says remote work isn’t even the largest contributor to the third-quarter downtown office vacancy rate.

“New supply is definitely the biggest one,” he said.

He then pointed to remote work as well as “fears around a recession or concerns around a potential recession and what growth might look like” but the fourth factor, he says, has to do with the tech sector.

- Premier Moe responds to Trudeau’s ‘good luck with that’ comment

- Drumheller hoping to break record for ‘largest gathering of people dressed as dinosaurs’

- As Canada’s tax deadline nears, what happens if you don’t file your return?

- Posters promoting ‘Steal From Loblaws Day’ are circulating. How did we get here?

“In Toronto and Vancouver especially, but also in Waterloo, Ottawa and Montreal — and even a little bit in Calgary — we saw a lot of demand during the pandemic from U.S.-based tech companies. These are companies that would otherwise have opened head offices in the San Francisco Bay area, in Seattle, in New York and Washington, D.C.,” he explained.

“During the pandemic, we saw a really significant influx of those companies that would otherwise have been traditionally located in the U.S., coming to Canada for affordable labour.”

Meehan explained that Canada has high-skilled tech workers coming out of our Canadian universities and can also bring in skilled workers “with our accommodated immigration programs that have accelerated entries,” making Canada an attractive place for tech companies.

However, not long after, tech valuations began dropping, “and as part of that, largely they halted on hiring and expanding operations.”

“That was a very significant source of demand for Canadian cities that turned off about a year or two ago.”

‘Net absorption’ largely up

While the overall office vacancy rate for Canada is at a record high 19.4 per cent for the final quarter of 2023, the situation is largely improving in most of Canada when looking at net absorption.

Net absorption serves as a measure of what the demand for office space is: “are tenants generally shrinking and returning office space to the market, or are they taking more space and growing?”

Meehan pointed to Calgary as an example of a city with a very high vacancy rate that has seen a significant rebound.

While Calgary’s downtown vacancy rate for the last quarter of 2023 was a whopping 30.2 per cent, it’s important to note that the city has been struggling with a negative net absorption since the 2014 energy crisis.

Throughout 2023, however, Calgary saw a positive net absorption of 667 square feet, which works out to about three medium-sized office buildings.

Calgary also has a “very successful office conversion program,” which involves offering incentives to transform less functional office buildings into residential units.

Outside of Calgary, Meehan says CBRE saw improvements in Vancouver, Edmonton, Ottawa and Halifax, but massive new supply in Toronto made a huge impact on national figures.

In just the last quarter of 2023, Toronto saw 624,550 square feet of new office space for a total of 1.1 million square feet in new office space that year.

“Based on global trends, office utilization and demand are picking up. That is helping improve office fundamentals in most Canadian cities,” CBRE Canada chair Paul Morassutti said in a release.

“Toronto will also benefit from the overall trends once new construction comes to an end since it is new supply that’s had the biggest impact on the city’s vacancy.”

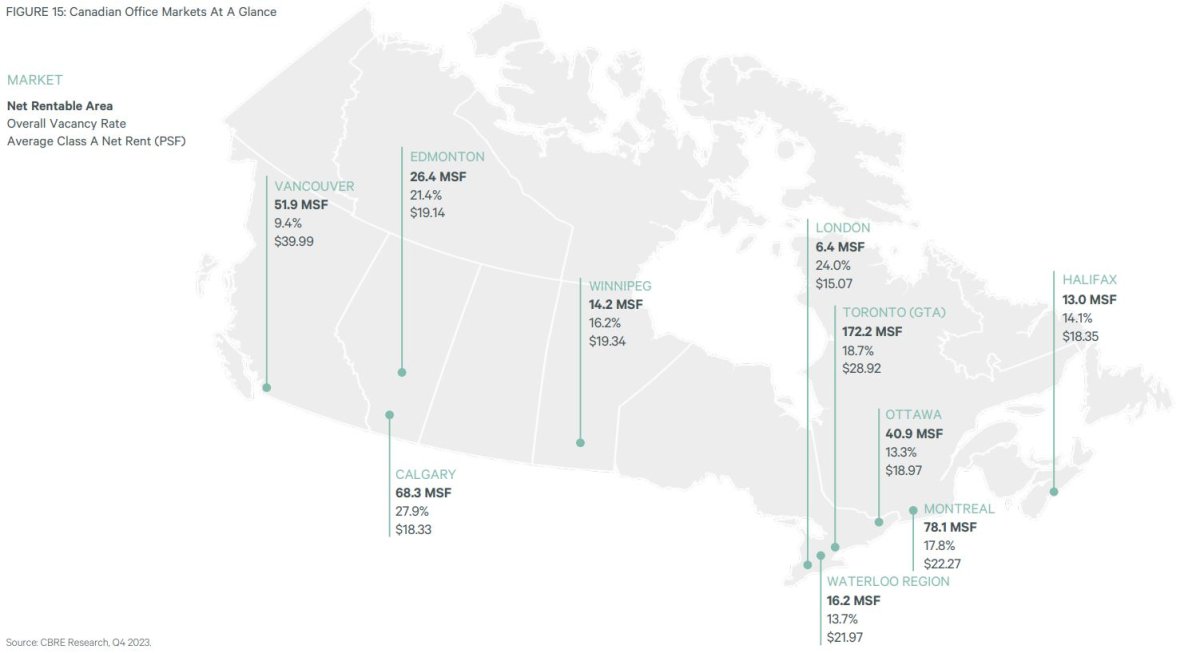

The climate coast to coast

Generally speaking, the demand for office space improved in B.C., Alberta and Atlantic Canada while demand “softened in the fourth quarter” in most of Ontario and Quebec.

On a more local level, Meehan said Vancouver had a year of positive net absorption. While the vacancy rate actually climbed a little bit downtown it is still the “office market with the best conditions in North America” at an overall vacancy rate of 11 per cent downtown.

Calgary and Edmonton “have slowly but steadily been improving over the balance of the year” as the energy sector improves.

Meehan described Toronto’s recovery as “two steps forward, one step back.” He also noted that the growth in new supply is leading to decisions around “what is the right amount of space that (businesses) need.”

“And so they are moving out of lower-quality space into higher-quality buildings. That has made it very difficult for Class B, or lower-quality space with a weaker amenity offering, where that level of demand for those types of buildings has really kind of come off a cliff.”

Montreal has been largely stable, he says, but vacancy rates are still “quite elevated” around 18 per cent, a far cry from the 11 per cent for the downtown three years ago.

“The good thing about their under-construction pipeline is that it’s nearly fully leased.”

Montreal has also seen “quite a bit of activity in smaller spaces,” or offices less than 5,000 square feet taken up by smaller companies.

The CBRE report states that, while on a smaller scale, Halifax has posted seven consecutive quarters of positive net absorption with demand for co-working space remaining strong.

— with a file from The Canadian Press’s Michelle Zadikian.

Comments