As the COVID-19 pandemic drags on, Canadian small businesses have racked up a collective $135 billion in debt because of the health emergency, according to estimates by the Canadian Federation of Independent Business (CFIB).

The group, which lobbies for small entrepreneurs, says seven in 10 small business owners have had to borrow funds due to the pandemic, with the average debt load now nearly $170,000.

“The second wave and the restrictions that came with it are putting a massive wrench in an already slow recovery for small businesses,” Laura Jones, executive vice-president at the CFIB, said in a statement.

While many ventures experienced some reprieve during the summer, with sales picking up during the warmer months, Canada’s small business debt has since seen “a significant increase” since the CFIB’s previous estimate of $117 billion in July 2020.

And while just over half of businesses are now fully open, only 25 per cent report normal sales levels, a trend the report calls “concerning.”

In Vaughn, Ont., Elizabeth Clark says her business, Chair Decor, which supplies linens for venues and professional event planners, has been forced to take on more than $100,000 in debt due to lockdowns and restrictions linked to COVID-19.

The debt comes from the Canada Emergency Business Account (CEBA) program and a loan from the Business Development Bank of Canada, Clark says.

CEBA, which provides businesses with interest-free loans of up to $60,000, of which a maximum of $20,000 is eligible for forgiveness, has been the most-used government support program by far for small business, with nearly six in 10 entrepreneurs reporting that they are tapping in, according to the CFIB.

Clark, who has been running Chair Decor for five years, has also relied on the federal wage subsidy for a time, among other relief measures. But despite that, she has been forced to lay off all of her staff just before the holidays in December.

Even so, her business is still burning through between $12,000 and $15,000 a month as her warehouse sits empty, Clark says.

She hopes what she has borrowed so far will be enough to pay the bill until business comes back, but the massive debt load is bound to stunt her company’s recovery, she says.

In normal circumstances, small businesses usually take on debt to pay for inventory or equipment or to otherwise finance growth. With COVID-19-related debt, though, small businesses have been borrowing just to keep the lights on, she says.

“We have no idea how long it’s going to take us to pay off this debt. So then how are we going to account for future growth within our business when all our profits are literally going to be paying back this debt?”

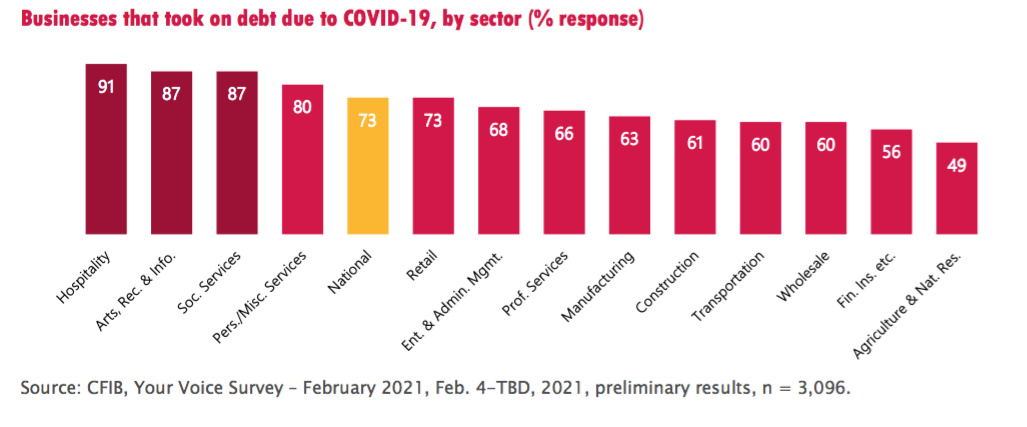

Small businesses in the hospitality, arts and recreation and social services sectors have been more likely to have taken on debt, as companies in these industries are usually public-facing, have a limited ability to accommodate for remote work and are unlikely to be considered essential, the CFIB report notes.

Overall, just over three-quarters of small businesses that have taken on debt expect it will take them over a year to repay it, with 11 per cent of this group saying they’re concerned that may not be able to repay at all.

Comments