The wife of a Palestinian terrorist cannot collect life insurance following her husband’s death because he lied about his past when he purchased the policy, the Ontario appeals court has ruled.

Fadia Khalil Mohammad sought $75,000 from Manulife when her husband, who had fled to Canada after hijacking a plane for the Popular Front for the Liberation of Palestine (PFLP), died of lung cancer.

The Ontario Superior Court of Justice ordered Manulife to pay up, but the decision was overturned in a Jan. 29 ruling that found her husband had fraudulently failed to disclose his terrorist past.

Manulife declined to comment.

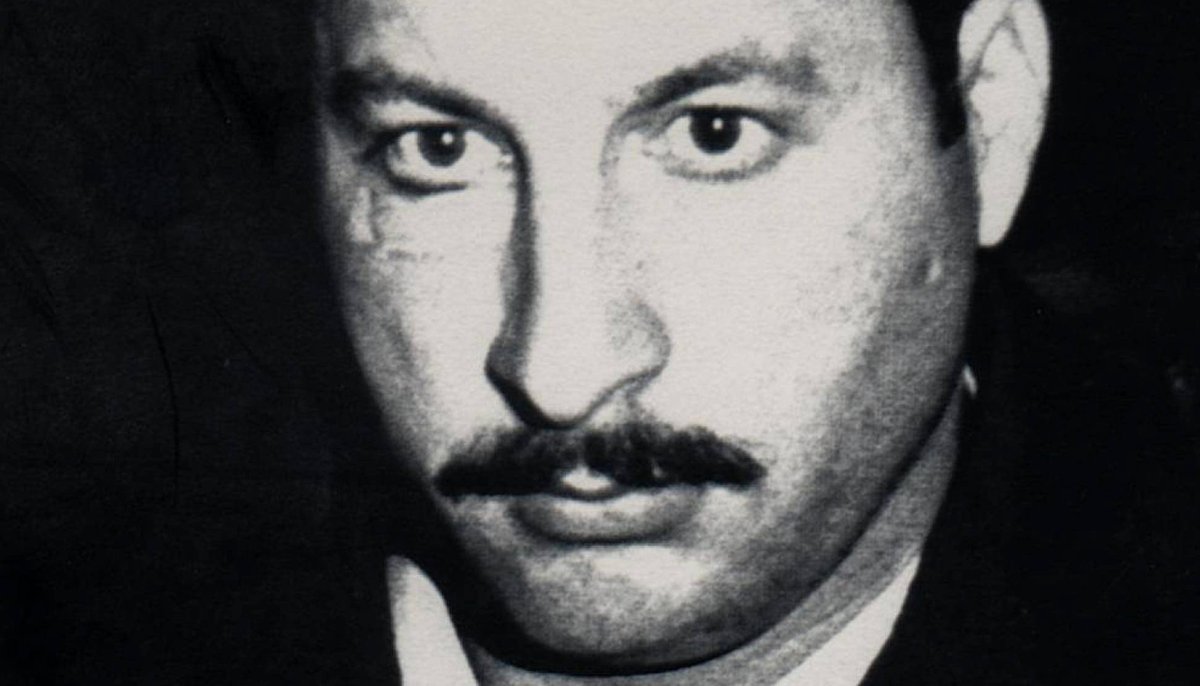

The case concerned Mahmoud Mohammad Issa Mohammad, known as Triple M, a PFLP member who hijacked an El Al passenger plane with grenades in Athens in 1968, killing one on board.

Although captured and convicted, he was freed in 1970 when the PFLP hijacked another plane and demanded his release. He moved to Lebanon before arriving in Canada in 1987.

That same year, he applied for life insurance — without mentioning that he had entered Canada under false pretences and was a convicted terrorist on the run. He was deported from Canada in 2013.

Following his 2015 death, Manulife refused to pay out his life insurance policy on the grounds he had “fraudulently misrepresented” his status in Canada, but the court ordered the company to pay.

The appeals court sided with Manulife, ruling his past was relevant to his application because it put him at risk of harm and that by withholding it he had committed fraud.

Stewart.Bell@globalnews.ca

Comments