The importance of financial literacy skills was touted at an event in Edmonton on Thursday.

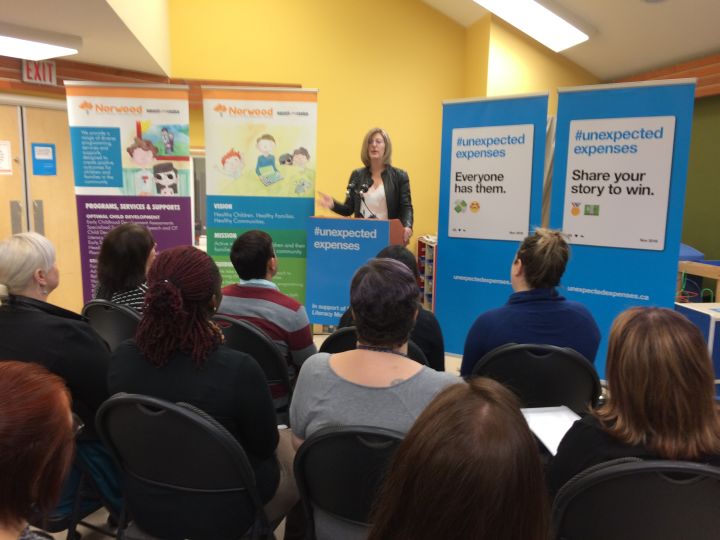

Service Minister Stephanie McLean, along with representatives from the City of Edmonton, community organization Momentum and community hub Norwood Child and Family Resource Centre, urged Albertans to prepare for unexpected financial events.

READ MORE: Surviving the slump: how to find ‘survival work’ to pay your bills

McLean said those skills are even more important now as the province struggles with an economic downturn and thousands of workers have been laid off, predominantly from the oil sector.

RELATED: Hundreds out of work as Enbridge cuts 5% of staff across operations

“It’s a reminder that we need to plan for our futures. We need to plan for those ups and downs, those booms and busts,” McLean said.

“It’s a message to Albertans that we’re all in this together. We are going to rally together. We’re going to get through this.”

Blair Barton was laid off from his job in the hospitality sector in 2013 after a neck injury left him unable to work.

Barton admits that he did not have financial literacy skills prior to that, which left him in a tight position.

RELATED: Nearly one third of Calgary’s office space could be empty by 2018: real estate firm

“When you don’t have a source of income and you still have the bills, it becomes a bit of a problem,” he said.

“Waiting for unemployment to come in, whatever other revenue you might be waiting for – it becomes tenuous at best.”

Barton said he took a crash course in financial literacy after a bad experience with payday loans and said he is in a much position now.

“Due to discipline – that’s one of the biggest things I’ve learned about life. Having a good relationship with money is, it’s a tool and you need to respect it. By doing that, you respect yourself and discipline is what helps you get to that point.”

RELATED: ‘It’s been awesome’: Alberta man laid off amid economic downturn

The public awareness campaign Unexpected Expenses is encouraging people to share their experiences of unexpected expenses as a way to reduce the stigma of financial problems. Participants can share their stories at unexpectedexpenses.ca and have the chance to win a $500 emergency savings account. One account will be awarded each day of November.

November is Financial Literacy Month.

Comments