Douglas Raynor’s heating bill last month was about $165 – roughly $40 more than the Alberta resident paid in December.

Normally, that wouldn’t raise too much concern from the pensioner. As the winter wears on and tempratures get colder, usage typically goes up.

Except this February, Raynor was in Arizona for more than half the time.

“We turned the thermostat down to 15,” said Raynor, who lives in Okotoks, 30 minutes south of Calgary. “So I got back expecting a really low bill, but the statement said $164.74.

“There was a big jump. I’m having trouble figuring it out. I get there’s a lot of demand because of the weather, but isn’t there a surplus of natural gas in North America?”

Not exactly.

Alberta has been walloped by the same ceaseless arctic chill that’s gripped most of the country (with the exception of B.C.’s Lower Mainland) during this interminable winter.

Not surprisingly, the price of the natural gas used to heat homes has soared while the frigid weather has seen households take a healthy bite out of a North American fuel glut.

Higher prices

It’s also unfortunately paved the way for higher heating costs to come, barring another rush by drillers to pull more gas from the ground, experts say.

- Posters promoting ‘Steal From Loblaws Day’ are circulating. How did we get here?

- Video shows Ontario police sharing Trudeau’s location with protester, investigation launched

- Canadian food banks are on the brink: ‘This is not a sustainable situation’

- Solar eclipse eye damage: More than 160 cases reported in Ontario, Quebec

“Consumers will be spending the equivalent of an extra $200 or $300 a year,” says Ian MacLellan, vice-president of Energyshop.com, a website that tracks energy prices.

Only about a quarter of homes are on fixed-rate plans, MacLellan says, the rest of us allow the bill to float based on usage.

Because Raynor lives in Alberta, where the main natural-gas provider, Direct Energy, adjusts prices each month, he’s watched rates rise more quickly.

In March, the spot price for natural gas has shot even higher, Direct Energy says, as cold temperatures shut down production entirely at some wells.

“These ‘Freeze-offs’, when it’s so cold that well operations could actually freeze, contributed to a reduction in supply in Alberta,” Jeff Lanthier, a spokesman for Direct Energy said.

READ MORE: Cranking on the furnace? Some tips to avoid burning cash

Usage is also up sharply. Average temperatures in Alberta have been six degrees colder this winter than longer-term norms.

The deep freeze has amounted to 4.2 gigajoules (GJ) of additional gas used per household, Direct Energy says – a big jump considering homes consume about 100 GJs annually, according to Energyshop.

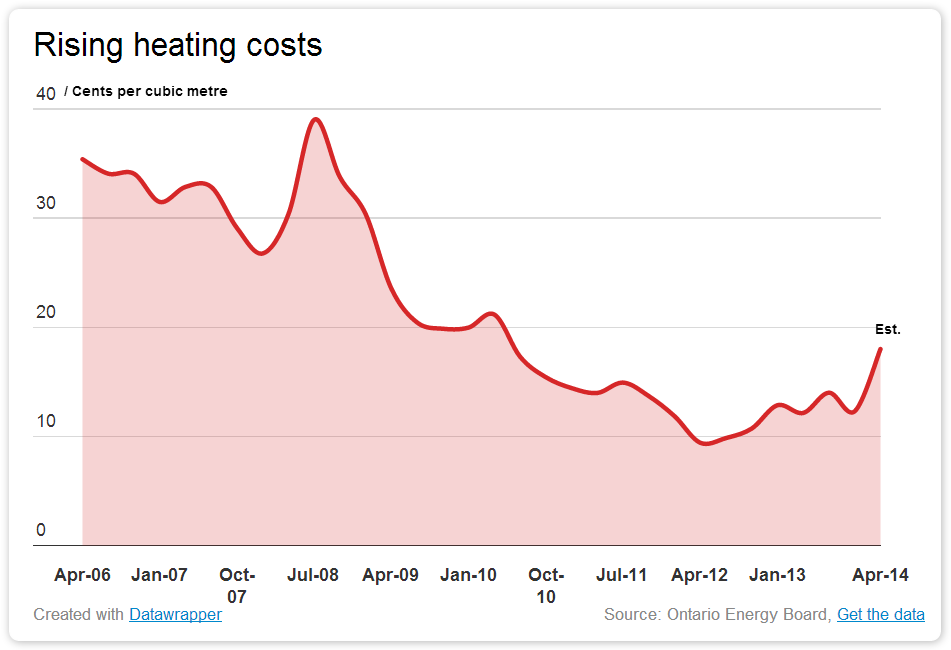

As a result, regulated March gas rates in the province are at 2008 levels again (see chart).

But supply is stretched across the continent, experts say. And if bill increases haven’t been felt yet by some, like in Ontario, they are coming.

Regulated prices in that province (as well Quebec) are set once every three months. And in a province where gas heats most homes, customers should be braced for a spike scheduled for the beginning of next month.

“April 1, prices are going to jump significantly,” MacLellan said.

Ontario residents currently pay about 12 cents a cubic metre of natural gas, a steep discount to the going rate half a decade ago before the shale boom swelled gas supplies.

“We do expect the gas supply price portion of the bill to increase but do not have the amount confirmed at this time,” said Chris Meyer, a spokesperson for Enbridge, which alongside Union Gas, is the biggest supplier of gas in the province.

MacLellan said he estimates the rate adjustment will see the cost of a cubic metre jump to 18 cents – a 50 per cent increase.

The actual amount of gas you use makes up about half the average bill, while the remainder is comprised of delivery charges and other regulated fees collected by the gas company.

Clearing a glut

Still, Raynor is worried energy companies are using the unusually cold weather to gouge consumers.

But experts back up what the spot price and the gas companies are telling us – supply is tightening.

“So far, I haven’t seen a reason to say that there’s anything other than a supply shortfall relative to demand, which is just driving prices up,” said Michal Moore, professor of energy economics at the University of Calgary’s School of Public Policy.

Energy supplies in general have been tested by the brutally cold weather, Prof. Moore said.

Natural gas prices have climbed gradually after touching their lowest levels in decades during the spring of 2012, when the rise in fracking helped create a record glut in stored reserves.

The glut has slowly but surely been clearing, lifting the price along with it. This year’s polar vortices have helped the process along considerably.

According to the U.S. Energy Information Administration, there was a meagre 2.423 billion cubic feet of the natural gas in underground storage in mid-January – levels not seen since January, 2005.

In Canada, Enbridge says it buys gas and stores it in advance, which has saved customers money this winter.

“Unfortunately, the winter has been so cold and gone on so long that we’ve used up a lot of the lower cost natural gas we had in storage,” Meyer said.

Enbridge has had to buy more gas than usual on the open market, where prices are rising.

“Natural gas is still abundant – it just costs more now,” Meyer said.

On the whole, a string of warmer winters and low natural gas prices have saved Canadians much in the form of cheap heating bills.

“Over the last four years, heating bills have plummeted,” Energyshop’s MacLellan said. But now, prices “seem to have hit bottom and bounced.

“Consumers have to see it before they believe it.”

Comments