Insolvency

-

Insolvencies to remain high in Canada as economy plays catch-up: expertsBusiness insolvencies will likely remain elevated throughout 2024, experts said, as the economy plays catch-up after historically low levels during the pandemic.MoneyMar 11

-

Insolvency filings surged in January amid higher interest rates, inflationThe federal regulator says there were 9,066 insolvencies for the first month of the year, up 33.7 per cent from 6,779 in January 2022.MoneyMar 1, 2023

-

-

Advertisement

-

British Columbians’ debt anxiety mounting amid inflation, interest rate hikes: surveysOne survey from MNP Ltd. found two in five British Columbians were $200 or less from insolvency.EconomyJan 16, 2023

![]()

-

-

Advertisement

-

Debt worries rise amid higher interest rates and persistent inflation: MNP reportA new report suggests Canadians' worries about debt are rising amid higher interest rates and persistent inflation.ConsumerJan 16, 2023

![]()

-

Rising interest rates, high household debt to spur ‘payment shock’ for CanadiansVariable-rate debt is getting more expensive to carry as the Bank of Canadas hikes its benchmark interest rate, which could lead to financial pain for heavily indebted households.MoneySep 7, 2022

![]()

-

-

What would you do with $5,000? Here’s what Canadians said amid high inflationMost Canadians are more concerned with saving and paying down debt amid rising interest rates and inflation than buying a big-ticket item, new polling shows.MoneyAug 22, 2022

![]()

-

-

DavidsTea takes step toward exiting insolvency after Quebec Superior Court approves planApprovals would mean the Montreal-based company would exit court protection from creditors in both countries later this summer.CanadaJun 16, 2021

![]()

-

Over half in Saskatchewan close to insolvency: reportA pair of reports are painting a not-so-pretty picture of personal finances in Saskatchewan.CanadaOct 18, 2020

![]()

-

-

Advertisement

-

Many Canadians will turn to debt when government benefits run out, survey suggestsThe survey found that among respondents currently receiving benefits due to the coronavirus pandemic, 45 per cent will take on more debt in the event that financial support ends.CanadaSep 16, 2020

![]()

-

-

Advertisement

-

Insolvency, bankruptcy rates up in Saskatchewan: MNP reportThe MNP Consumer Index Report indicates 45 per cent of people in Saskatchewan believe they can't cover their expenses in 2020 without going deeper into debtMoneyJan 27, 2020

![]()

Trending

-

![]() Here’s what to know about changes to capital gains taxes in Budget 202451,366 Read

Here’s what to know about changes to capital gains taxes in Budget 202451,366 Read -

![]() Toronto Pearson gold heist: Multiple people charged in historic $20M theft49,439 Read

Toronto Pearson gold heist: Multiple people charged in historic $20M theft49,439 Read -

![]() El Niño looks to be fading. What Canadians can expect in the months to come32,292 Read

El Niño looks to be fading. What Canadians can expect in the months to come32,292 Read -

![]() All 787 Dreamliners should be grounded, Boeing whistleblower says28,401 Read

All 787 Dreamliners should be grounded, Boeing whistleblower says28,401 Read -

![]() Gas prices in Ontario, Quebec to jump to highest level in 2 years: analyst12,242 Read

Gas prices in Ontario, Quebec to jump to highest level in 2 years: analyst12,242 Read -

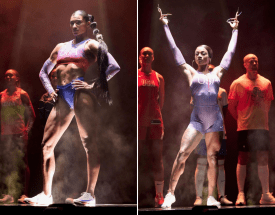

![]() ‘Body on display’: U.S. Olympians debate skimpy women’s uniform11,071 Read

‘Body on display’: U.S. Olympians debate skimpy women’s uniform11,071 Read -

Top Videos

-

![]() Budget 2024 introduces capital gains tax changes that will impact 0.13 per cent of Canadians

Budget 2024 introduces capital gains tax changes that will impact 0.13 per cent of Canadians -

![]() Pearson gold heist: arrests made but very little gold recovered

Pearson gold heist: arrests made but very little gold recovered -

![]() El Niño may be over — what weather could Canadians see in the coming months?

El Niño may be over — what weather could Canadians see in the coming months? -

![]() Boeing whistleblower says entire 787 Dreamliner fleet should be grounded

Boeing whistleblower says entire 787 Dreamliner fleet should be grounded -

![]() Gas prices across Ontario set to soar

Gas prices across Ontario set to soar -