Consumer Debt

-

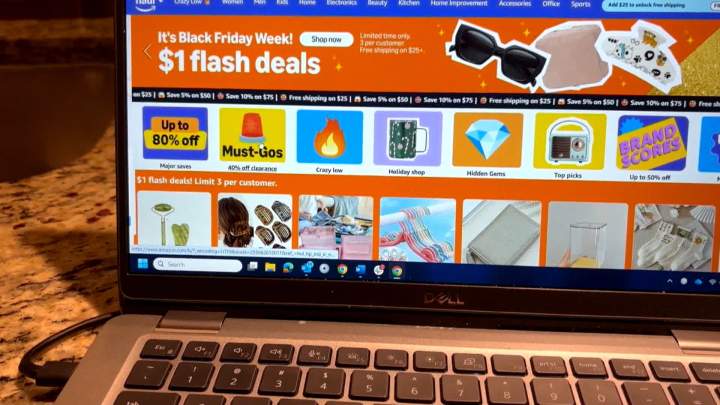

Buy now, pay later plans may seem attractive but come at a cost, warn expertsBuy now, pay later purchase plans are becoming a lot more common, but experts warn, while they may help provide some temporary happiness, they come at a cost.EconomyDec 16, 2025

-

As Bank of Canada decision looms, Canadians worry they can’t afford more hikesAs more Canadians worry about their ability to handle future rate hikes, others are finding they're having an easier time handling higher interest costs, a new survey found.MoneyOct 18, 2023

-

-

Advertisement

-

Canada’s banks brace for possible wave of loan defaults. Why that mattersCanada's big six banks all reported this week that they're putting more money aside for possible loan defaults. Here's what to know about the outlook for Canadian credit.MoneyMar 4, 2023

![]()

-

-

Advertisement

-

Debt worries rise amid higher interest rates and persistent inflation: MNP reportA new report suggests Canadians' worries about debt are rising amid higher interest rates and persistent inflation.ConsumerJan 16, 2023

![]()

-

Consumer insolvencies in Canada hit highest number since COVID pandemic beganDuring the pandemic, consumer and business insolvency numbers dropped as emergency aid helped buoy individuals and firms alike.MoneyJan 5, 2023

![]()

-

-

Canadian consumer debt climbs 7.3% to $2.36 trillion in third quarter: EquifaxEquifax Canada says an increase in borrowers helped push total consumer debt to $2.36 trillion in the third quarter, even as mortgage volumes decline.ConsumerDec 6, 2022

![]()

-

-

Rising inflation, interest rates push 1 in 4 British Columbians to cut back on essentials: pollAnd almost half (46 per cent) said they'd slashed spending on non-essentials like travelling, dining out and entertainment.EconomyJul 11, 2022

![]()

-

More than half of B.C. residents feel the squeeze of interest rate hikes, survey findsSince the last financial quarter, the debt index found British Columbians had the largest decrease in disposable income across the country.EconomyApr 18, 2022

![]()

-

-

Advertisement

-

Consumer debt continued to rise in Q4 but new mortgages declined: EquifaxThe number of new mortgages declined 8.1 per cent year over year in the last three months of , according to Equifax.ConsumerMar 7, 2022

![]()

-

-

Advertisement

-

Roughly half of Canadians financially insecure as debt confidence hits record low: reportThe latest MNP Consumer Debt Index found the twin stressors of holiday spending bills coming due and the resurgent COVID-19 pandemic has Canadians feeling squeezed.MoneyJan 17, 2022

![]()

Trending

-

![]() Tumbler Ridge B.C. school shooting: 9 dead, 27 injured275,144 Read

Tumbler Ridge B.C. school shooting: 9 dead, 27 injured275,144 Read -

![]() B.C. school shooting ‘one of the worst mass shootings’ in Canada, minister says106,662 Read

B.C. school shooting ‘one of the worst mass shootings’ in Canada, minister says106,662 Read -

![]() Olympic medallist wins bronze, confesses on live tv to cheating on girlfriend26,025 Read

Olympic medallist wins bronze, confesses on live tv to cheating on girlfriend26,025 Read -

![]() Parents condemn $176 fines for hostel staff after daughters died from tainted alcohol21,952 Read

Parents condemn $176 fines for hostel staff after daughters died from tainted alcohol21,952 Read -

![]() A list of some school shootings that happened in Canada before Tumbler Ridge13,057 Read

A list of some school shootings that happened in Canada before Tumbler Ridge13,057 Read -

![]() WestJet won’t fly to 10 U.S. cities this summer amid ‘notable’ travel decline11,826 Read

WestJet won’t fly to 10 U.S. cities this summer amid ‘notable’ travel decline11,826 Read -

Top Videos

-

![]() B.C. premier and minister of public safety on Tumbler Ridge school shooting1,295 Viewed

B.C. premier and minister of public safety on Tumbler Ridge school shooting1,295 Viewed -

![]() 12-year-old’s death raises questions251 Viewed

12-year-old’s death raises questions251 Viewed -

![]() Multiple people dead in Tumbler Ridge school shooting137 Viewed

Multiple people dead in Tumbler Ridge school shooting137 Viewed -

![]() RCMP speaks on Tumbler Ridge B.C. shooting135 Viewed

RCMP speaks on Tumbler Ridge B.C. shooting135 Viewed -

![]() B.C. school shooting: At least 9 killed, 25 injured in Tumbler Ridge

B.C. school shooting: At least 9 killed, 25 injured in Tumbler Ridge -