Auto Loans

-

Prices are starting to fall at car dealerships. Is it time to buy?Sticker prices at dealerships have started to come down and affordability is improving, experts say. But some are still advising buyers to pause.ConsumerJul 8

-

Your car-loan payment may be way too high. Here’s what’s happeningHow negative equity on your car can trap you in a cycle of debt.MoneyOct 26, 2019

-

-

Advertisement

-

Deals, convenience drive popularity of dealership financing for vehicle buyersWhen it comes to buying a car, Canadians can't get enough of the zero per cent loan, no-down-payment and cashback options offered by their car dealers.ConsumerMay 9, 2019

![]()

-

-

Advertisement

-

Here’s what happens to your car loan if interest rates riseWatch for longer loan terms, not just higher monthly payments.MoneyJul 11, 2017

![]()

-

Loonie jumps as Bank of Canada sends more signals that interest rates may riseThe loonie shot up following fresh signals from the Bank of Canada that it is giving more thought to raising interest rates, while Toronto's main stock index continued its second day of declines.MoneyJun 13, 2017

![]()

-

-

Experts believe interest rate hike may be coming after ‘hawkish’ Bank of Canada speechCarolyn Wilkins said the gains are something Canada hasn't seen since before the oil-price collapse nearly three years ago.ConsumerJun 12, 2017

![]()

-

-

Rising interest rates could cost the average Canadian $130 a month more in debt repaymentsRBC report highlights the implications of a rate hike for household debtMoneyJun 7, 2017

![]()

-

TransUnion report: Auto loan delinquencies rise in Alberta, Sask.The slowdown in the oilpatch is impacting auto loan delinquency rates according to a TransUnion report, with rates on the rise in Alberta and Saskatchewan.CanadaFeb 17, 2016

![]()

-

-

Advertisement

-

The pros and cons of leasing versus financing your next carThe shiny chrome and new car smell can be tempting lures for anyone who needs to replace their car. If you're heart is set on it, should you borrow or lease?CanadaFeb 12, 2016

![]()

-

-

Advertisement

-

Canadians still love that new car smell, despite economic ‘doom and gloom’Vehicle sales are on pace to smash last year's record high, despite economic warnings signs flashing red. 'Canadian car buyers don’t seem to be paying attention.'CanadaFeb 4, 2016

![]()

Trending

-

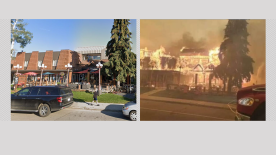

![]() Jasper wildfire: Before-and-after photos show destruction of town123,364 Read

Jasper wildfire: Before-and-after photos show destruction of town123,364 Read -

![]() Jasper wildfire: Up to 50% of townsite may have been destroyed67,775 Read

Jasper wildfire: Up to 50% of townsite may have been destroyed67,775 Read -

![]() Jasper wildfire: Video and pictures show destruction within townsite36,924 Read

Jasper wildfire: Video and pictures show destruction within townsite36,924 Read -

![]() Scotiabank resolves ‘technical issue’ that left customers without paycheques30,812 Read

Scotiabank resolves ‘technical issue’ that left customers without paycheques30,812 Read -

![]() Why is convicted child rapist Steven van de Velde allowed in Olympics?29,801 Read

Why is convicted child rapist Steven van de Velde allowed in Olympics?29,801 Read -

![]() Tour of Jasper wildfire devastation reveals destroyed homes and hotels29,428 Read

Tour of Jasper wildfire devastation reveals destroyed homes and hotels29,428 Read -

Top Videos

-

![]() Raw video of wildfire damage in Jasper, Alta.1,110 Viewed

Raw video of wildfire damage in Jasper, Alta.1,110 Viewed -

![]() Jasper wildfire: 30-50% of structures damaged313 Viewed

Jasper wildfire: 30-50% of structures damaged313 Viewed -

![]() Mayor of Jasper loses home in devastating mountain park wildfire: ‘I see memories of life taken’83 Viewed

Mayor of Jasper loses home in devastating mountain park wildfire: ‘I see memories of life taken’83 Viewed -

![]() 3 killed in collision northeast of Calgary80 Viewed

3 killed in collision northeast of Calgary80 Viewed -

![]() 2 B.C. sailors found dead in Nova Scotia79 Viewed

2 B.C. sailors found dead in Nova Scotia79 Viewed -

![]() BC Tree Fruits ceasing operations56 Viewed

BC Tree Fruits ceasing operations56 Viewed -