Extending amortizations for Canadians struggling with mortgage payments is a common way for lenders to offer some relief amid higher interest rates — but experts and regulators are warning the strategy can come with unseen costs and risks for consumers.

Canadian homeowners with variable-rate mortgages on fixed payment schedules can, instead of paying more when the Bank of Canada’s policy rate rises, instead see their amortization — the length of time over which they have to pay back the loan – extended.

In Canada, initial amortizations are capped at 25 years for insured mortgages, but can run to 30 years or more in cases where a buyer puts down at least 20 per cent for a down payment. Once a bank has the mortgage on its books, however, it can choose to extend these amortizations further on a temporary basis until the mortgage comes up for renewal.

Homeowners who have hit their trigger rate — the point at which a consumer’s payments are not sufficient to cover the interest on the loan — will fall into negative amortization, where the time to pay back the loan continues to grow. Eventually, these owners must make changes to get back on track, either with a lump sum payment, larger monthly contributions or lengthening the amortization.

Desjardins analyst Royce Mendes estimates that more than 20 per cent of the mortgage portfolio of the big six Canadian banks had a repayment period greater than 30 years in the first quarter, up from roughly two per cent one year ago.

Extending amortizations are also open to other consumers to lower their monthly payments, including those with fixed-rate mortgages coming up for renewal and considering refinancing, says Penelope Graham, director of content at rate comparator website Ratehub.ca.

“That immediate monthly payment relief is what is going to make the difference in terms of whether or not they can hang onto their mortgage in this volatile rising interest rate environment,” she says.

That strategy tends to offer near-term relief for Canadians homeowners who are struggling amid rapid rises in the Bank of Canada’s benchmark rate over the past year; in fact, the Financial Consumer Agency of Canada (FCAC) on Wednesday issued new guidelines to standardize the practice among federally regulated financial institutions.

Mortgages cost more with longer amortizations

Significant to Graham in the FCAC guidelines was a direction to financial institutions to make sure that if amortizations are to be extended, it’s done for the “shortest period possible” and that lenders take into consideration the risks to consumers who need to revert to the original amortization period at renewal.

Extending amortizations should be looked at as only a stop-gap measure to provide mortgage relief, Graham says, because the extra costs added to mortgages when amortizations are extended can “add up rapidly.”

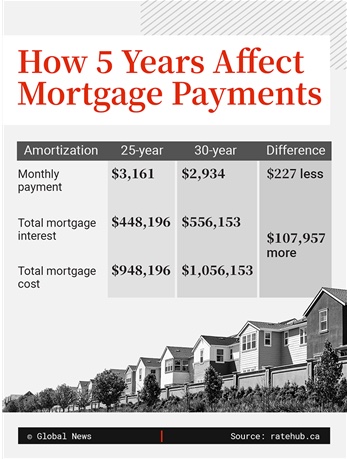

Ratehub recently undertook an analysis to show why keeping amortizations in check is critical for consumers.

Taking the sample of a $500,000 mortgage taken out at today’s typical five-year variable rates of 5.8 per cent, Ratehub showed how shifting a 25-year amortization to 30 years can save roughly $227 monthly for the consumer. However, at the same time, letting interest accumulate on the loan for an extra five years would push the overall payments on the mortgage up by more than $100,000.

“The biggest risk for borrowers is that when you extend your amortization, you exponentially increase what you’re going to owe on your mortgage, because the longer your amortization, the more interest you’re paying over a greater period of time,” Graham explains.

Lenders that allow variable mortgage amortizations on their books to stretch past 35 years never end up holding consumers to those schedules because the amortization must snap back to their original timeframes at the end of the current term.

Ratehub’s analysis also explored the hypothetical, however, of what consumers would pay on the same mortgage if 60-, 70-, 80- or even 90-year mortgages were fair game.

The total interest paid on the mortgage would balloon from just under $450,000 on a 25-year amortization to nearly $1.3 million over 60 years and more than $2.1 million for a 90-year amortization, for example.

Lengthy amortizations can be riskier

Extending amortizations far past their original timeframe and driving down monthly payments, only for consumers to face a jarring jump in payments when they renew their mortgages, shows the risks of an over-reliance on extending amortizations, Graham says.

“It’s essentially kicking the payment-pain-can down the road,” she says. “Many of these borrowers are going to experience that interest rate shock and payment shock when they come up for renewal.”

The limits for amortizations are set by the Office of the Superintendent of Financial Institutions (OSFI), which is currently reviewing mortgage rules for lenders.

OSFI told Reuters in June that it has urged banks to tackle the risks from amortization extensions and resolve negative amortization at the “earliest opportunity.”

To that end, Graham warns that consumers hoping for a boost to the allowable amortizations might be disappointed.

Increasing the maximum allowable amortization in Canada might help more consumers jump into the housing market amid more manageable monthly payments, Graham says.

But measures that lower the barriers in the Canadian housing market also ratchet up risk in the system, she adds, and OSFI would likely be wary of removing safeguards from the financial system at a time when many homeowners are already facing the heat of higher rates.

“It really is a two-sided issue because we know we have a housing crisis in Canada. We know affordability is historically at its worst levels. And that’s a real issue for consumers,” Graham says.

“But then on the other side, you have people who’ve gotten into the market and now they’re really being squeezed. And the regulator is trying to find a balance between those two.”

— with files from Reuters

- 3 women diagnosed with HIV after ‘vampire facials’ at unlicensed U.S. spa

- Posters promoting ‘Steal From Loblaws Day’ are circulating. How did we get here?

- As Canada’s tax deadline nears, what happens if you don’t file your return?

- N.S. mom calls for better ultrasound access after private clinic reveals twins

Comments