An interrelated connection between house prices and rising rents continues to hamper Hamilton’s rental vacancy rate which Canada’s housing agency predicts will remain below historical averages until at least the end of the year.

The Canada Mortgage and Housing Corporation (CMHC) spring housing market outlook predicts rental demand and supply will grow at comparable rates, but average rents for two-bedroom apartments are also expected to grow faster than inflation and worsening affordability.

“So that flow of renters that would move out of their rental unit to buy, has stopped significantly in recent years,” senior economics analyst Anthony Passarelli told 900 CHML’s Hamilton Today.

“What that does, it has a lot of negative ramifications for the rental market in terms of units not opening up (for the) high rental demand.”

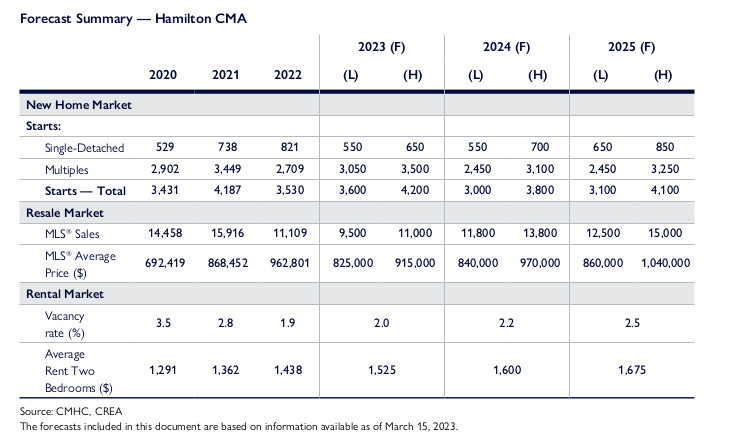

The CMHC forecast suggests the overall vacancy rate for rentals will hit 2.0 per cent for Hamilton in 2023, an increase of 0.1 per cent from 2022, and likely rise to 2.5 per cent by 2025.

However, prices are expected to move in the same direction, up, with the average two-bedroom to hit $1,525 this year.

Reports from property aggregators Rentals.ca and Zumper.com suggest that number is even higher on the open market now, between $2,100 and $2,200 based on available dwellings listed in March.

The forecast for new home starts in 2023, single-detached and multiple residential units, is expected to surpass 2022’s numbers by about 70 developments moving from just over 3,500 to 3,600 by year-end.

That number will shrink by several hundred starts in 2024 and 2025.

Get daily National news

Passarelli anticipates most of that development will be intended for the rental market in anticipation of strong demand stemming from high international migration and low homeownership affordability.

“Hamilton’s going to continue to see strong population growth, people moving in from other regions such as the GTA,” Passarelli believes.

“We don’t foresee any of those things changing, so there just needs to be more supply out there and potentially maybe even incentives for people to list their homes for sale.”

Home prices are expected to continue to drop in 2023 with the average price in the resale market between $825,000 and $915,000 but rebound in the next two years potentially hitting between $860,000 and $1.04 million by 2025.

Comments