A Chinese invasion of Taiwan risks triggering a global economic crisis if the semiconductor supply chain is disrupted, analysts warn.

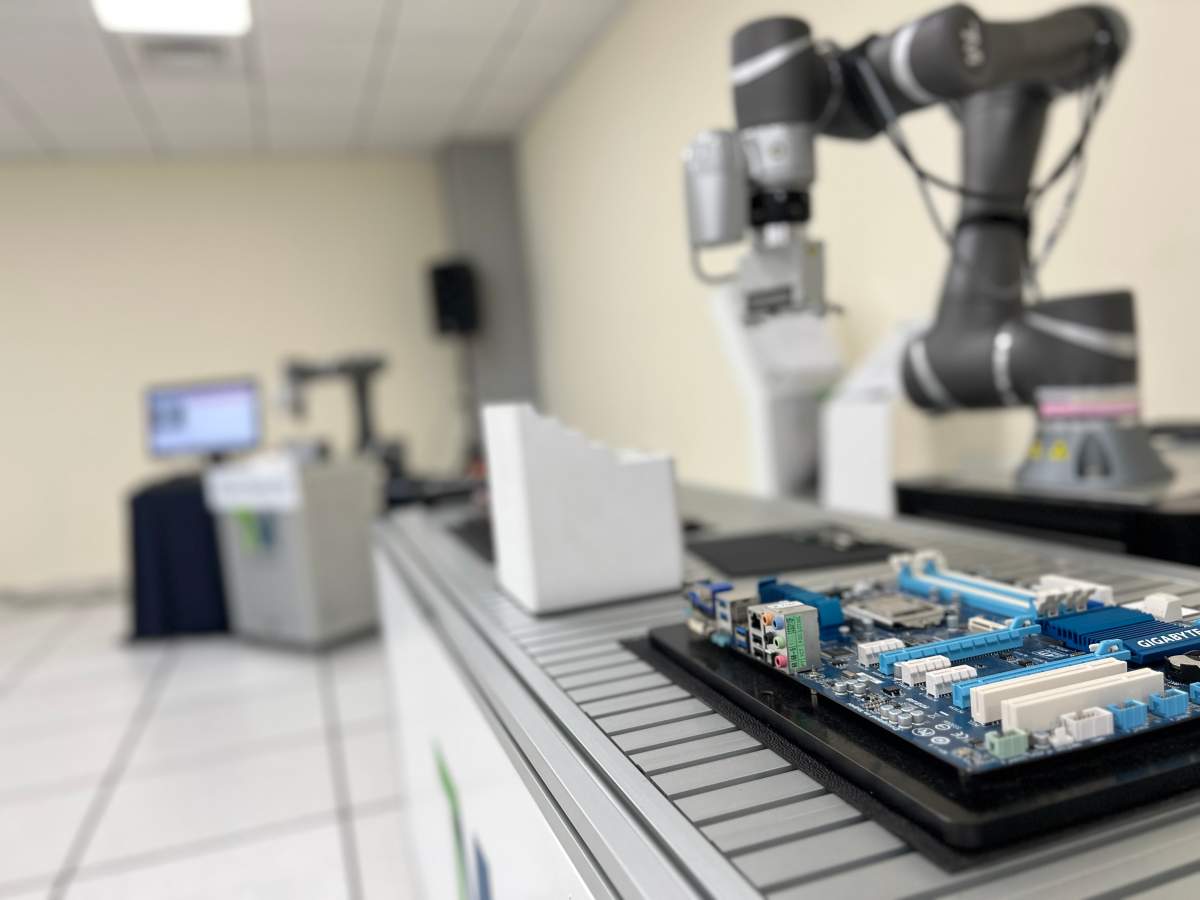

Taiwan produces the majority of the world’s semiconductor logic chips, which are considered the brain power behind modern electronics. The tiny microchips play an oversized role in our daily lives, used to produce everything from smartphones and refrigerators to MRI machines and fighter jets.

“The semiconductor now is like air for the human being,” said Wu Chih-I, a senior technology expert with the Taiwan Semiconductor Industry Association. “It’s everywhere. And not just for daily life, but also for the security and defence of every nation.”

“The semiconductor is so important that in the modern world, we cannot live without it,” added Andy Huang, an analyst with Taiwan’s Market Intelligence & Consulting Institute, which conducts industry research.

Huang’s office is located in Hsinchu Science Park, an hour’s drive southwest of Taipei. Known as “Taiwan’s Silicon Valley,” the sprawling 1,300 hectares industrial park is home to the biggest names in the semiconductor industry, including its leader TSMC.

The park was established in 1985 and, like Taiwan’s semiconductor sector, it’s experienced rapid growth. The park employs 150,000 people and is notorious for rush hour traffic. Its parking lots are packed with cars and scooters, which were built with the same semiconductors that are being produced inside the towering factories (or ‘foundries’).

From this science park and others on the self-governed island of 24 million people, Taiwan produces over 60 per cent of the world’s semiconductors and over 90 per cent of its most advanced chips.

“Around 50 years ago, the (Taiwanese) government identified this as future crucial, important technology for the entire world,” said Terry Tsao, president of industry association SEMI Taiwan.

Get breaking National news

“You could say it was a very visionary decision.”

Taiwan’s early gamble to invest in semiconductors has not only helped to power its economy — the industry is worth more than $200 billion — but it may also now protect it from invasion.

Opinion polls have consistently shown the vast majority of Taiwanese oppose joining China and want to remain a democracy. Faced with that fierce opposition, the Chinese Communist Party has vowed to take control of Taiwan by force if necessary. Its military now routinely holds war games rehearsing an attack on Taiwan, and according to U.S. intelligence, the Chinese president has ordered the People’s Liberation Army to be prepared for an invasion by 2027.

But some believe Beijing wouldn’t dare risk launching an attack that could compromise Taiwan’s semiconductor supply. China is the world’s largest consumer of semiconductors, but produces less than 20 per cent of its own. Most of its chips are made in Taiwan. That vital trade relationship has been dubbed Taiwan’s “Silicon Shield.”

China’s military forces, the largest in world, could essentially be kept at bay by a microchip the size of a fingernail.

“This has been a godsend for Taiwan,” said J. Michael Cole, a Canadian global security analyst based in Taipei.

“If there were armed conflict in the Taiwan Strait, either an attempted invasion or even a blockade, immediately you would see repercussions in the trillions of dollars for the global economy.”

The world got a small taste of a semiconductor shortage during the pandemic, when soaring demand for work-from-home electronics caused a supply crunch for smartphones and cars. Suddenly, consumers found themselves unable to purchase a $50,000 vehicle missing a 50-cent chip.

That demand is only expected to grow alongside emerging technologies such as electric-battery vehicles, which require more than twice as many semiconductors as internal-combustion-engines.

“The semiconductor supply chain is fragile,” said Huang. He and his team at Taiwan’s Market Intelligence & Consulting Institute recently examined more than 150 materials and equipment used in semiconductor production and found that about a third of those ingredients were only available for a single source.

“If any invasion happens, then probably all the traffic will be blocked. So any semiconductor import-exports will be ceased,” Huang explained. “The consequences will be very serious because the world cannot react that quickly.”

China and the United States are scrambling to boost their own domestic semiconductor supply, while undercutting the other. Chinese chipmaking suppliers and state-backed funds just announced plans to spend an estimated $10 billion to strengthen China’s domestic supply chain, as the U.S. moves to block Chinese access to the most advanced chips, as well as the equipment and talent needed to make them.

Both countries have a long way to go before they no longer depend on Taiwan, said Wu-Chih-I.

“It’s not that easy. No. It takes times,” he said. “We spend 40-50 years and billions of dollars to build up the infrastructure.

“It would take at least 10-20 years to build a whole infrastructure, the talent and everything to set up your semiconductor industry.”

For that reason, he expects, a Chinese invasion is unlikely and the “Silicon Shield” will hold.

- Iran’s president apologizes for strikes as missiles and drones pound cities

- Russia gave Iran information that can help strike US military: sources

- As Iran chokes Strait of Hormuz, U.S. vows $20B for maritime reinsurance

- Who is Markwayne Mullin? Meet the man set to replace Kristi Noem as DHS secretary

Comments

Want to discuss? Please read our Commenting Policy first.