Home prices in Canada are set to rise this year, according to a new report.

In its latest forecast released Thursday, Royal LePage adjusted its price forecast for 2023 given stronger-than-expected demand and limited supply.

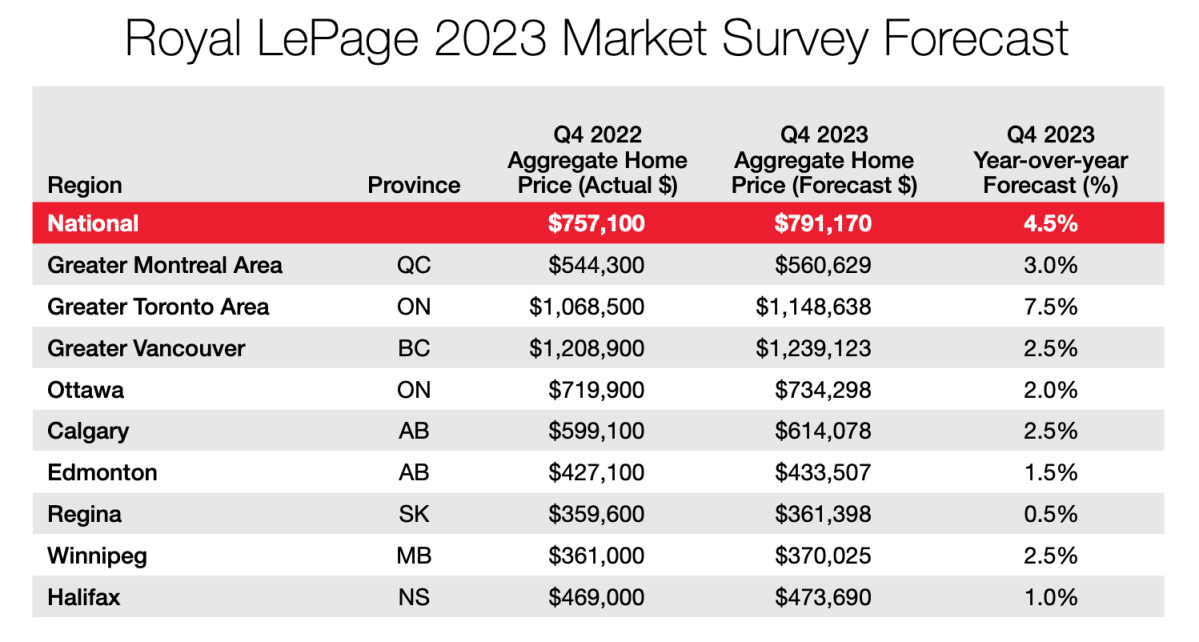

The brokerage now predicts that national home prices will rise 4.5 per cent year-over-year by the end of 2023 instead of dropping one per cent in 2023, as it had predicted in December.

Royal LePage CEO Phil Soper told Global News that high employment and low supply contributed to the change in the forecast.

The report says in Toronto, the aggregate home price is expected to rise 7.5 per cent to $1,148,638 in the fourth quarter of 2023 compared to the same quarter last year. In Vancouver, prices are expected to rise 2.5 per cent to $1,239,123, and in Montreal, three per cent to $560,629.

Nationally, the average price is forecast to rise to $791,170 from $757,100.

As the Bank of Canada announced Wednesday that interest rates will hold steady at 4.5 per cent, first-time buyers are now entering the market since rates seem to have achieved some stability, Soper said. But homeowners have been slow to put their properties for sale, causing an imbalance between supply and demand, which drives prices up.

Get breaking National news

“At this stage, people are just going ‘hip, hip, hooray’ that (interest rates) have reached a stable point and — critically — home prices aren’t going to be falling further,” Soper said.

A rise in home prices can cause higher demand, Soper explained, as buyers get FOMO (fear of missing out) and try to enter the market while the opportunity is there.

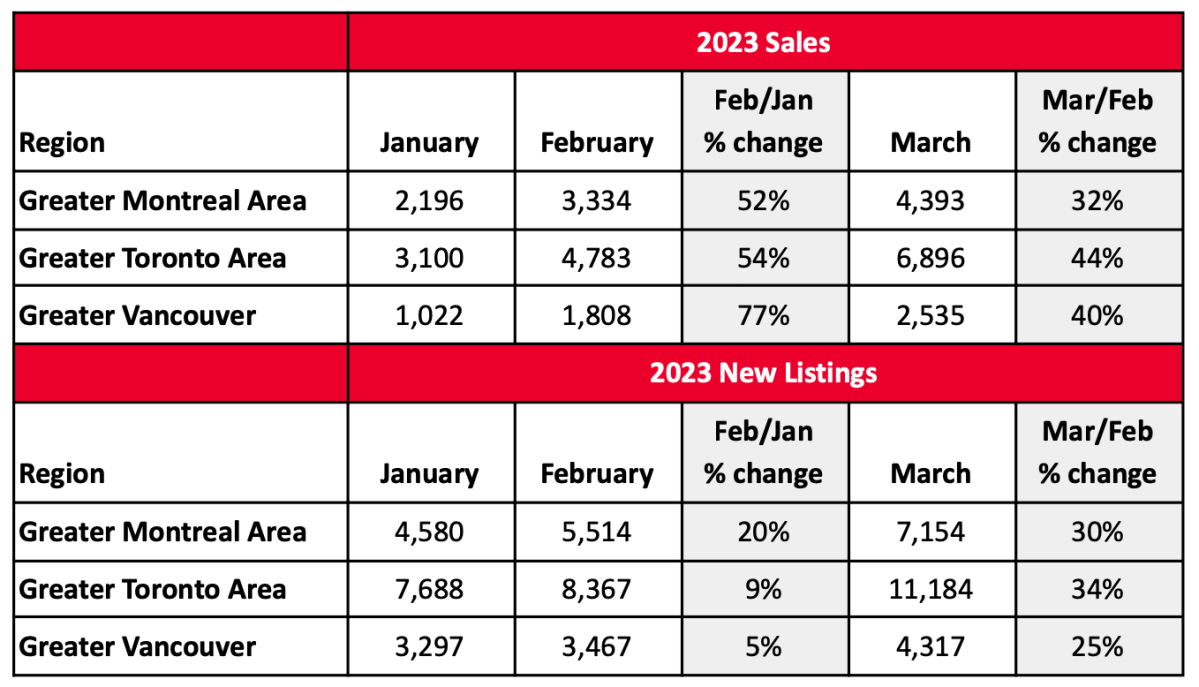

Sales and new listings have steadily been increasing month-to-month, according to the Royal LePage report.

Home prices in Toronto reached $1,108,606 in March compared with $1,096,519 the month before, according to Toronto Regional Real Estate Board data recently released. The numbers indicate prospective homebuyers are regaining the confidence to wade into the market despite borrowing costs climbing and are looking to take advantage of lower prices while they last.

Soper said the real estate market has returned to “sanity” from a year ago when buyers took advantage of low-interest rates and wanted a change of scenery amid COVID-19 restrictions. The high demand caused bidding wars and prices reaching above asking. Royal LePage’s report says that home prices have fallen 9.2 per cent year-over-year to $778,300 on average in Canada for the first quarter of 2023.

“It’s a much saner market for both real estate professionals and for consumers,” Soper said. “The market has entered a period of relative stability now.”

The central bank said in its Monetary Policy Report Wednesday it expects that housing activity to stabilize around the middle of the year.

“Growth in residential investment is anticipated to resume in the second half of 2023,” it read. “Strong demand from immigration should support housing activity over the projection horizon.”

Soper said the market is now trending toward being advantageous for sellers after going through a 12-month correctional period that ended around mid-March. He warns, though, that if supply remains low, prices could get out of hand in 2024, and encouraged more supply to be created.

- ‘A foreign policy based on short memory’: Carney continues push to diversify from the U.S.

- Oil surges to highest price since 2023 as Iran war chokes Strait of Hormuz

- Canada and Japan sign partnership deal on defence, energy, trade

- LeBlanc says U.S. meeting on CUSMA and trade ‘constructive and substantive’

Comments

Want to discuss? Please read our Commenting Policy first.