The annual rate of inflation in Canada cooled to 6.8 per cent in November amid falling prices at the gas station, but Statistics Canada’s latest report shows there’s little relief for consumers at the grocery store.

In its latest consumer price index (CPI) report released Wednesday, Statistics Canada said slower price growth for gasoline and furniture last month was offset by rapidly rising shelter costs and stubbornly high grocery prices.

Grocery prices climbed at a faster annual rate in November. The federal agency said prices rose 11.4 per cent annually, up from 11 per cent in October.

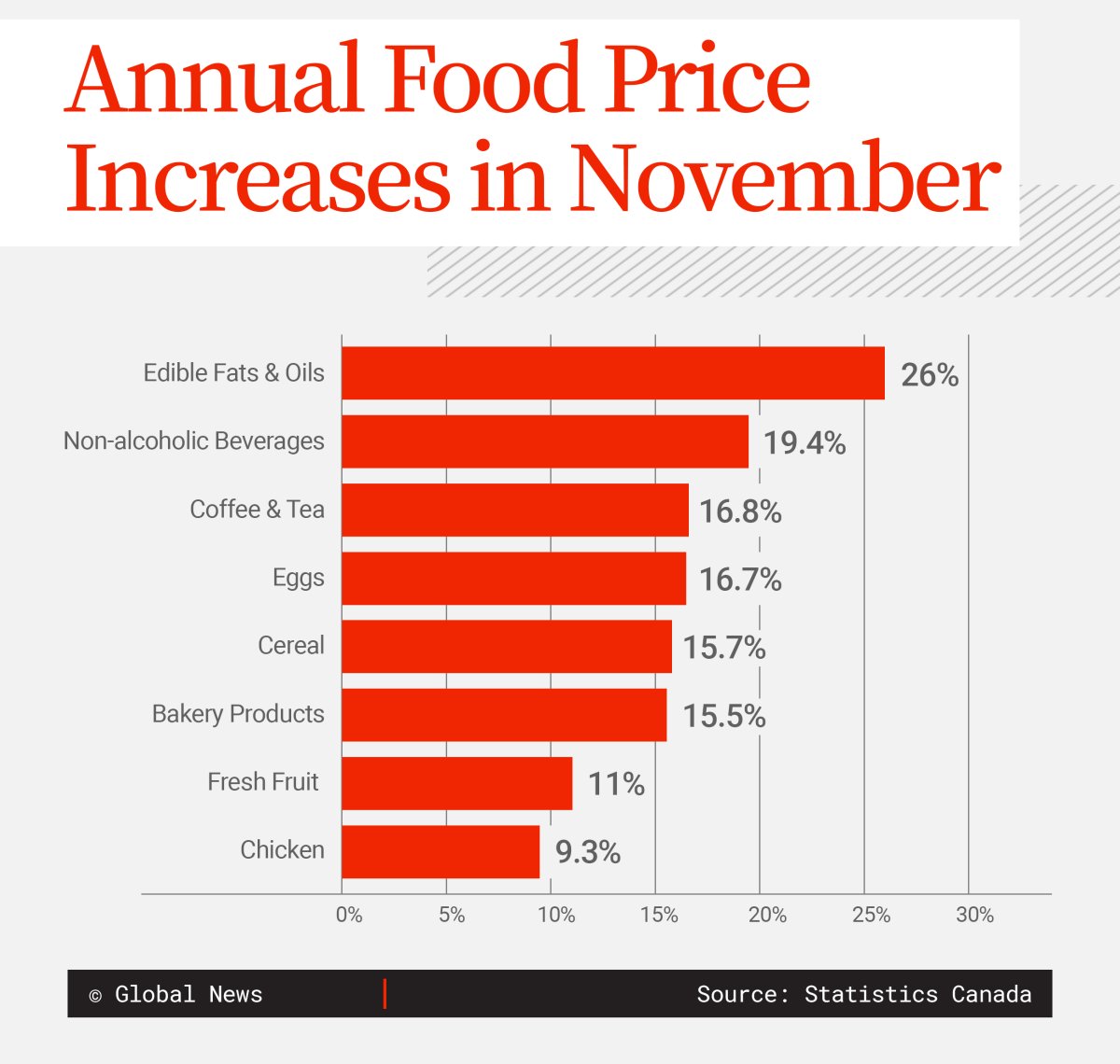

Among items seeing the biggest annual price growth were edible fats and oils (up 26 per cent), non-alcoholic beverages (up 19.4 per cent), coffee and tea (up 16.8 per cent) and eggs (up 16.7 per cent).

While overall meat prices were up 5.2 per cent, the cost chicken rose 9.3 per cent, with Statistics Canada pointing to reduced global supply amid outbreaks of avian influenza.

The agency said food prices remain “broad-based,” having now outpaced growth in the rest of the CPI basket for 12 consecutive months.

In a report released in mid-November exploring the causes of food inflation, Statistics Canada pointed to the simultaneous impact of supply chain disruptions and severe weather events across the globe as pushing prices higher in Canada.

Higher interest rates driving shelter costs up

The rise in shelter costs is attributed to higher mortgage interest costs and rising rent. Mortgage interest costs were 14.5 per cent higher in November on an annual basis, while rent was up 5.9 per cent.

Statistics Canada said upward pressure is being placed on rent prices as more Canadians are priced out of homeownership because of high interest rates.

Gasoline prices were down 3.6 per cent on a monthly basis.

Get weekly money news

Excluding food and energy, prices were up 5.4 per cent on a yearly basis.

- Jasper mayor says CN Rail relocation will be devastating: ‘Deeply disappointed’

- Retired Quebec teacher buys winning lottery ticket at last minute, wins $40M

- N.B. election: Higgs went to ‘very dark place’ with Liberal joke, opponent says

- GM, Volvo, Land Rover vehicles among those in big recall. What to know

In a client note, BMO chief economist Douglas Porter said core inflation edging up is a clear sign of persistent underlying inflation pressures.

“Turning the temperature down on inflation is proving to be an achingly slow process, and we suspect this may be a theme for 2023,” Porter said.

November’s consumer price index report compares with an annual inflation rate of 6.9 per cent in October and September. Inflation peaked in July at 8.1 per cent.

Economists expect Canadians facing higher shelter costs because of high interest rates to pull back on other spending. That process is expected to slow inflation.

The Bank of Canada has raised interest rates rapidly this year to cool decades-high inflation and slow spending in the economy.

Earlier this month, the central bank raised its key interest rate for the seventh consecutive time this year, bringing it to 4.25 per cent.

It also signalled it’s open to pressing pause on the rate hikes, depending on how the economy evolves.

Bank of Canada Governor Tiff Macklem reiterated in a video released on Twitter Wednesday that it will “take some time to get inflation” back to the two per cent target. The central bank’s policymakers do believe inflation will continue to come down and will hit three per cent by the end of next year and two per cent by 2024.

Porter is doubtful the Bank of Canada is ready to stop its aggressive rate hike cycle and expects it to hike rates again in January.

“This firm report does nothing to doubt that call,” he wrote.

— with files from The Canadian Press

Comments